Europe & Africa Market Update 22 May 2025

Bunker benchmarks in European and African ports have declined with Brent, and Gibraltar faces congestion.

IMAGE: Oil refinery and storage tanks in Rotterdam. Getty Images

IMAGE: Oil refinery and storage tanks in Rotterdam. Getty Images

Changes on the day to 09.00 GMT today:

- VLSFO prices down in Gibraltar ($18/mt) and Rotterdam ($15/mt)

- LSMGO prices down in Gibraltar ($26/mt) and Rotterdam ($21/mt)

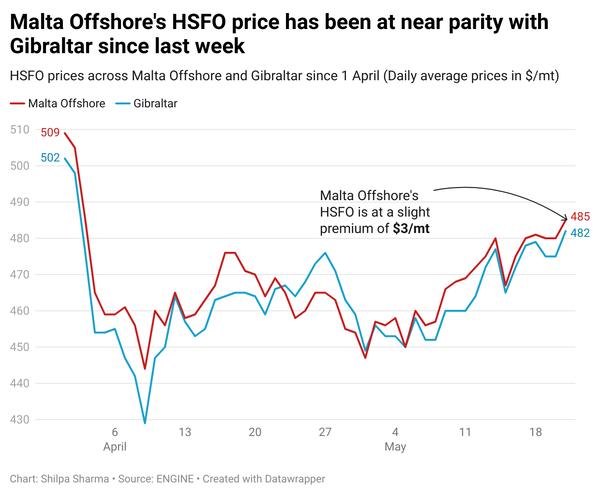

- HSFO prices down in Durban ($18/mt), Gibraltar ($17/mt) and Rotterdam ($12/mt)

- Rotterdam B30-VLSFO premium over VLSFO down by $12/mt to $217/mt

Prices of conventional fuels in Rotterdam, Gibraltar and Durban have dropped significantly in the past session.

There are 11 vessels awaiting bunkers in Gibraltar, according to port agent MH Bland. The congestion is a result of limited barge availability and a lack of space for vessels to bunker. Two suppliers are running 4-8 hour behind in their bunker schedules.

Suppliers in Algeciras are delayed by 2-16 hours.

Across the Strait in Ceuta, there are no bunker delays and 12 vessels are set to arrive for bunkers today, says shipping agent Jose Salama & Co.

Brent

The front-month ICE Brent contract has declined by $2.08/bbl on the day, to trade at $64.12/bbl at 09.00 GMT.

Upward pressure:

Brent has found support as supply concerns in the Middle East resurfaced after a CNN report stated that Israel was preparing for a major airstrike on Iranian nuclear facilities.

The risk of a wider conflict in the Middle East could affect oil supplies from other regional producers.

“Crude oil rallied in early trading amid heightened geopolitical risk,” ANZ Bank’s senior commodity strategist Daniel Hynes noted.

The news has raised concerns that negotiations between the US and Iran over Tehran's nuclear program may falter, according to market analysts.

“While the likelihood of a strike appears low, it has snapped the market out of a calm that developed as some hostilities in the region appeared to cool slightly,” Hynes said.

Downward pressure:

Brent’s price has declined after the US Energy Information Administration (EIA) reported a surprise gain in US crude stocks.

Commercial US crude oil inventories increased by 1.3 million bbls to touch 443 million bbls for the week ending 16 May, according to data from the EIA.

The build in crude stocks was “was much higher than expected,” Hynes said. A buildup in inventories typically signals weaker oil demand, which can put downward pressure on Brent's price.

By Samantha Shaji and Aparupa Mazumder

Please get in touch with comments or additional info to news@engine.online

Contact our Experts

With 50+ traders in 12 offices around the world, our team is available 24/7 to support you in your energy procurement needs.