Europe & Africa Market Update 21 May 2025

Prices in most European and African bunker locations have increased, and prompt bunker supply is tight in Gibraltar.

Changes on the day to 09.00 GMT today:

- VLSFO prices up in Durban ($8/mt) and Rotterdam ($4/mt), and down in Gibraltar ($1/mt)

- LSMGO prices up in Gibraltar ($6/mt) and Rotterdam ($5/mt)

- HSFO prices up in Rotterdam ($6/mt), Gibraltar and Durban ($5/mt)

- Rotterdam B30-VLSFO premium over VLSFO unchanged at $229/mt

Bunker prices across all grades have increased some in Rotterdam in the past day. Prompt bunker availability is tight in Rotterdam and in the wider ARA hub, a source said. Lead times of 7-8 days are advised for all grades in the region.

Gibraltar’s HSFO and LSMGO prices have risen, while its VLSFO price has edged down. The port’s VLSFO price premium over Rotterdam has narrowed by $5/mt, to $54/mt now. Bunker supply is currently tight for prompt deliveries in Gibraltar, with recommended lead times of 8-9 days for all grades, a trader said.

Meanwhile, supply of all conventional fuel grades is normal off Malta and lead times of up to five days are recommended for VLSFO and HSFO. LSMGO requires 3-4 days, a trader said.

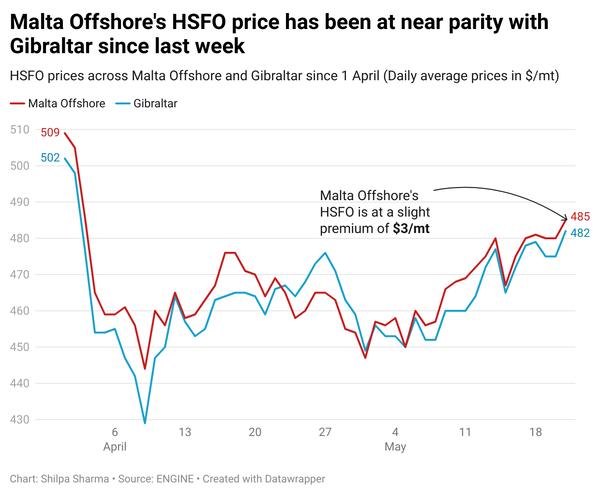

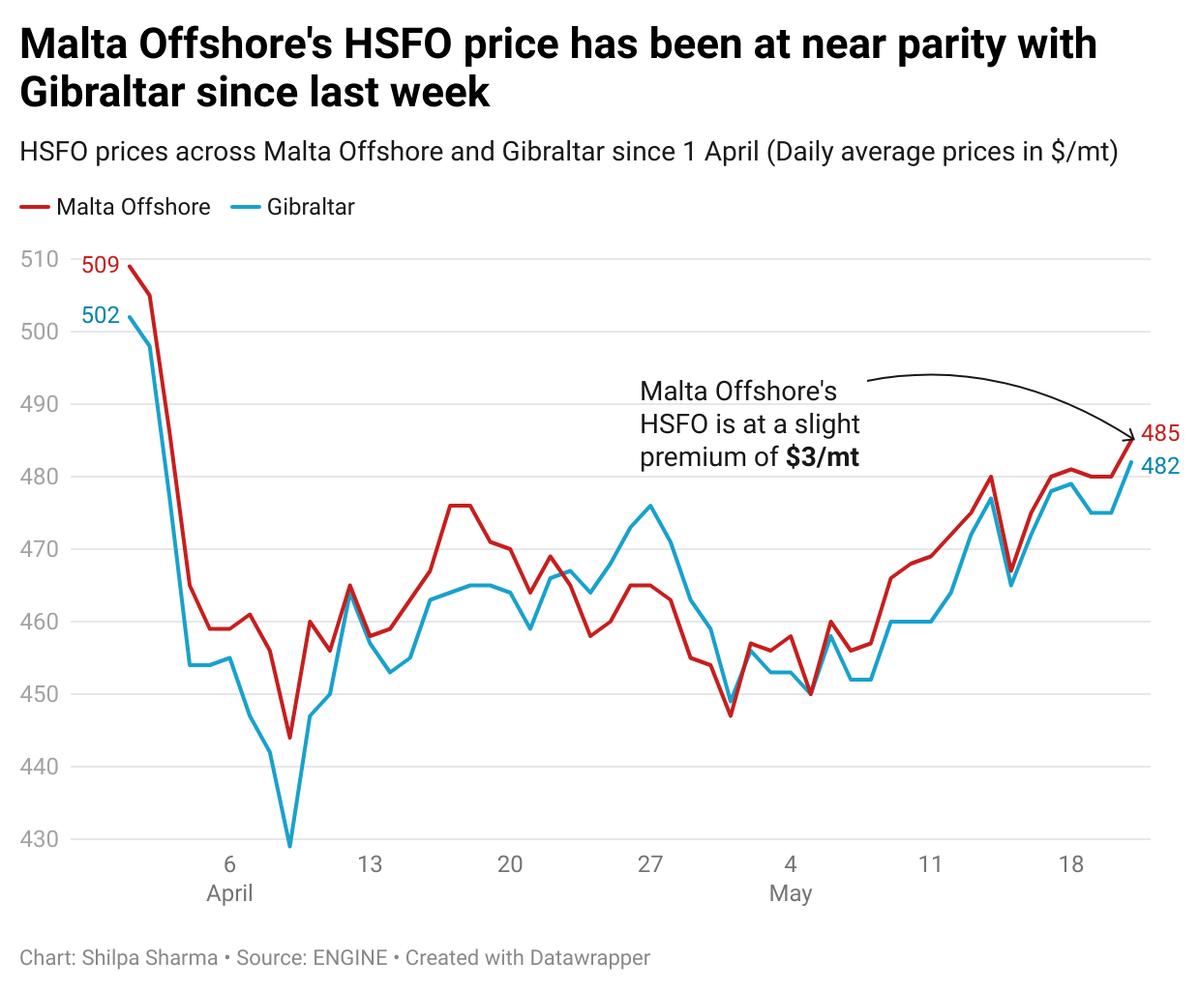

Malta Offshore's HSFO price has been at near parity with Gibraltar's benchmark since last week.

Brent

The front-month ICE Brent contract has pushed $0.74/bbl higher on the day, to trade at $66.20/bbl at 09.00 GMT.

Upward pressure:

Brent has gained following reports that Israel could soon be targeting Iran’s nuclear facilities. US intelligence suggests that Israel is actively preparing to strike Iran, according to a CNN report citing officials familiar with the matter.

“The news, based on US intelligence, may signal a significant escalation, prompting the oil market to price in a larger geopolitical risk premium for the region,” two analysts from ING Bank note.

Iran, an OPEC+ member, currently produces around 3.3 million b/d of oil, according to OPEC's latest oil market report.

“Such an escalation would not only put Iranian supply at risk, but also in large parts of the broader region,” the ING Bank analysts argue.

Downward pressure:

Brent has felt some downward pressure after the American Institute of Petroleum (API) reported another rise in US crude stocks, which could signal weaker oil demand. Commercial US crude oil inventories rose by about 2.5 million bbls in the week ending 16 May, according to API estimates.

The change in crude stocks was not as constructive as changes in gasoline and distillate inventories, ING Bank analysts said.

Official US government crude stocks data from the US Energy Information Administration (EIA) is due for release later today.

By Shilpa Sharma and Aparupa Mazumder

Please get in touch with comments or additional info to news@engine.online

Contact our Experts

With 50+ traders in 12 offices around the world, our team is available 24/7 to support you in your energy procurement needs.