East of Suez Market Update 20 May 2025

Most prices in East of Suez ports have moved up, and availability is good across all grades amid weak demand in Zhoushan.

Changes on the day to 17.00 SGT (09.00 GMT) today:

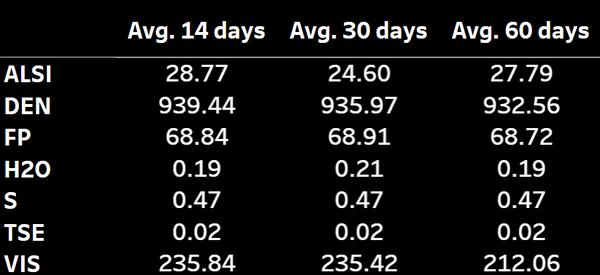

- VLSFO prices up in Zhoushan ($6/mt), and down in Singapore ($8/mt) and Fujairah ($1/mt)

- LSMGO prices up in Zhoushan ($11/mt), Fujairah ($7/mt) and Singapore ($5/mt)

- HSFO prices up in Zhoushan ($9/mt), Fujairah ($5/mt) and Singapore ($4/mt)

- B24-VLSFO at a $205/mt premium over VLSFO in Singapore

Zhoushan’s VLSFO price has increased by $6/mt over the past day, while prices in Singapore and Fujairah have declined. As a result, Zhoushan’s previous VLSFO discount to Singapore has been erased, bringing prices to near parity. Zhoushan’s VLSFO now stands at a $7/mt premium over Fujairah.

Meanwhile, Zhoushan’s LSMGO price has risen by $11/mt - the steepest increase among the three major Asian bunker ports. It now stands at a $35/mt premium over Singapore, while at a $76/mt discount to Fujairah.

In Zhoushan, VLSFO lead times remain stable at around 4–7 days due to low demand. LSMGO and HSFO lead times have shortened from approximately seven days last week to about 3–5 days now.

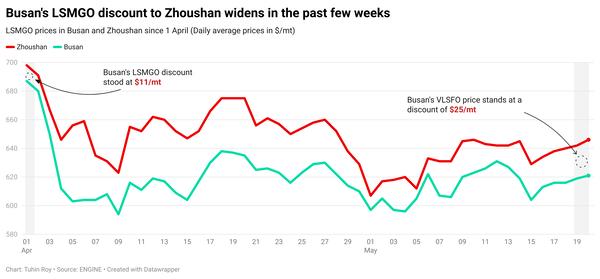

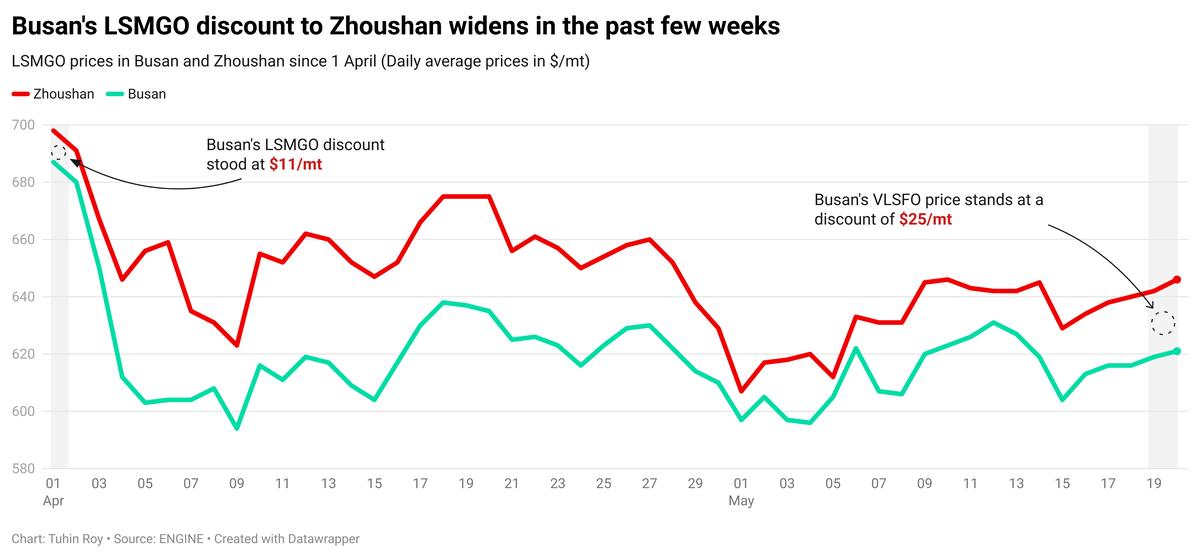

Fuel availability has improved across all grades in several South Korean ports amid subdued demand. Lead times are now recommended at around 2–3 days, significantly lower than the 4–11 days seen last week.

However, bunker operations may face disruptions in Ulsan, Onsan and Busan between 22–26 May due to high waves and strong winds. Yeosu is also likely to see interruptions between 24–26 May.

Brent

The front-month ICE Brent contract has moved up by $0.47/bbl on the day, to trade at $65.46/bbl at 17.00 SGT (09.00 GMT).

Upward pressure:

Brent’s price has moved higher amid signs that the US-Iran nuclear negotiations may be faltering.

Washington has said that any deal with Tehran must include an agreement that suspends Iranian uranium enrichment. "We have one very, very clear red line, and that is enrichment. We cannot allow even 1% of an enrichment capability," Reuters cited US special envoy Steve Witkoff saying.

“Iranian nuclear talks appear to be hitting some stumbling blocks,” two analysts from ING Bank noted.

If the two countries had moved closer to striking a nuclear deal, it would raise prospects for the US to lift sanctions on Iranian oil supplies. “However, the latest developments demonstrate that reaching a deal won’t be easy,” the two ING Bank analysts added.

Downward pressure:

Oil came under pressure as weaker economic outlooks for the US and China – the world’s two largest oil consumers – weighed on demand sentiment.

Credit ratings agency Moody’s has downgraded US sovereign credit rating from "AAA" to "Aa1", citing concerns about the country’s growing $36 trillion debt pile, Reuters reports.

This news could further delay the US Federal Reserve (Fed) from cutting interest rates this year. Higher interest rates in the US could, in turn, dampen demand for dollar-denominated commodities like oil, making it costlier against other currencies.

Brent has been under some downward pressure after the latest Chinese economic data showed a slump in industrial output and retail sales, raising demand growth concerns for the world's top oil importer.

“Weaker demand [in China] coincides with rising US-China trade tensions following Liberation Day,” the ING Bank analysts said.

By Tuhin Roy and Aparupa Mazumder

Please get in touch with comments or additional info to news@engine.online

Contact our Experts

With 50+ traders in 12 offices around the world, our team is available 24/7 to support you in your energy procurement needs.