East of Suez Market Update 19 May 2025

Most prices in East of Suez ports have mirrored Brent’s upswing, and VLSFO and LSMGO availability is good across several Taiwanese ports.

Changes on the day from Friday, to 17.00 SGT (09.00 GMT) today:

- VLSFO prices up in Zhoushan ($11/mt), Fujairah ($6/mt) and Singapore ($5/mt)

- LSMGO prices up in Zhoushan and Fujairah ($2/mt), and down in Singapore ($11/mt)

- HSFO prices up in Zhoushan ($2/mt) and Singapore ($1/mt), and unchanged in Fujairah

- B24-VLSFO at a $190/mt premium over VLSFO in Singapore

VLSFO benchmarks in the three major Asian bunker ports have increased by $5–11/mt, with Zhoushan seeing the steepest rise. As a result, Zhoushan’s slight VLSFO discount to Fujairah has disappeared, and its discount to Singapore has narrowed to $13/mt.

In Zhoushan, VLSFO lead times remain steady at around 4–7 days due to low demand. LSMGO lead times have shortened from roughly seven days last week to about 3–5 days, while HSFO lead times have also dropped from around seven days to 3–5 days.

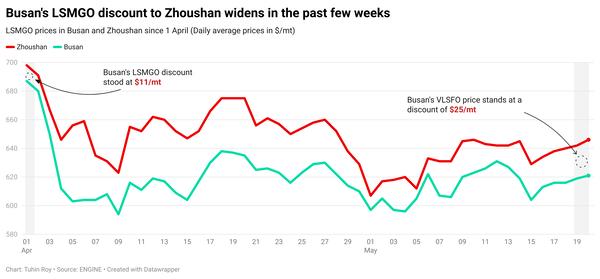

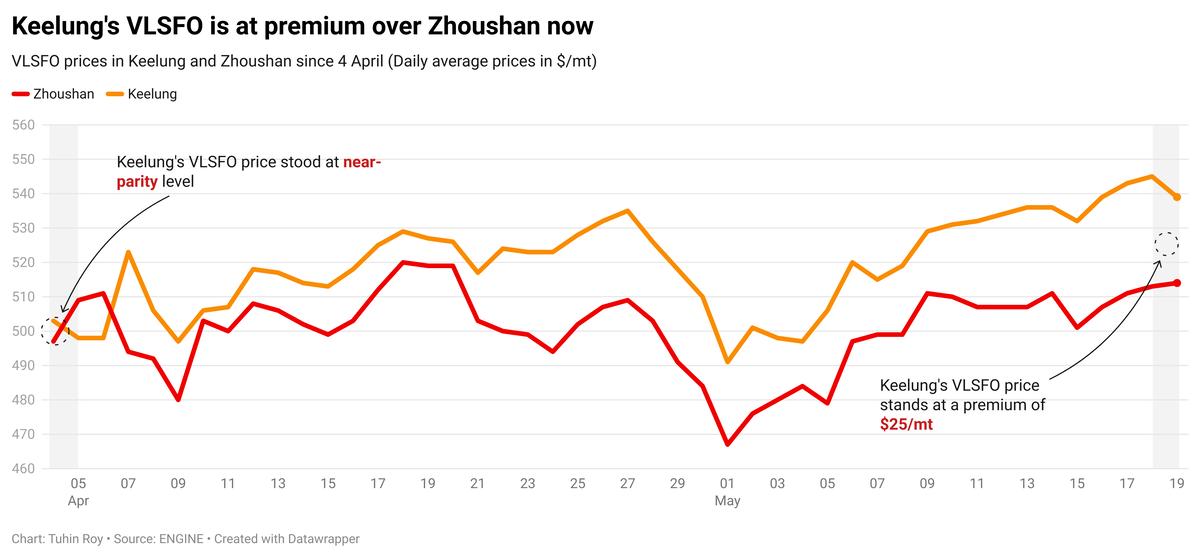

Meanwhile, in Taiwan, Keelung’s VLSFO price stands at a $25/mt premium over Zhoushan.

In Taichung, lead times for both VLSFO and LSMGO are approximately three days. Hualien, Kaohsiung and Keelung continue to maintain stable supplies of both grades, with lead times unchanged at around two days.

Brent

The front-month ICE Brent contract has gained $0.74/bbl on the day from Friday, to trade at $64.99/bbl at 17.00 SGT (09.00 GMT).

Upward pressure:

Brent crude’s price gained over the weekend after Iran downplayed the likelihood of a near-term nuclear deal with the US.

On Friday, Iran’s Foreign Minister, Seyed Abbas Araghchi, said that Tehran had not received any formal proposal from the US. “Iran has not received any written proposal from the United States, whether directly or indirectly,” he said on social media platform X (formerly Twitter).

The country’s Supreme Leader, Ayatollah Ali Khamenei, lashed out at US President Donald Trump, accusing him of dishonesty and power abuse, Bloomberg reported.

If finalised, the deal could see the US lifting sanctions on Iranian oil. “Crude oil rebounded as Iran cast doubt on an imminent nuclear deal with the US,” ANZ Bank senior commodity strategist Daniel Hynes remarked.

“Iran’s President Pezeshkian said that Tehran won’t abandon its pursuit of civilian nuclear energy under any circumstance,” he added.

Downward pressure:

Oil felt some downward pressure as market investors shifted focus to a highly anticipated call scheduled between US President Trump and his Russian counterpart, Vladimir Putin, to discuss the war between Russia and Ukraine.

“The market will be on the lookout for any signs of potential de-escalation,” two analysts from ING Bank said.

By Tuhin Roy and Aparupa Mazumder

Please get in touch with comments or additional info to news@engine.online

Contact our Experts

With 50+ traders in 12 offices around the world, our team is available 24/7 to support you in your energy procurement needs.