LNG Bunker Snapshot: Singapore’s LNG discount to Rotterdam erased

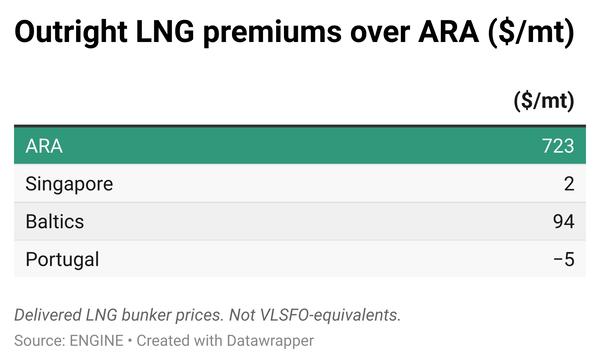

Rotterdam’s LNG bunker price has held broadly steady and been overtaken slightly by a rising price in Singapore.

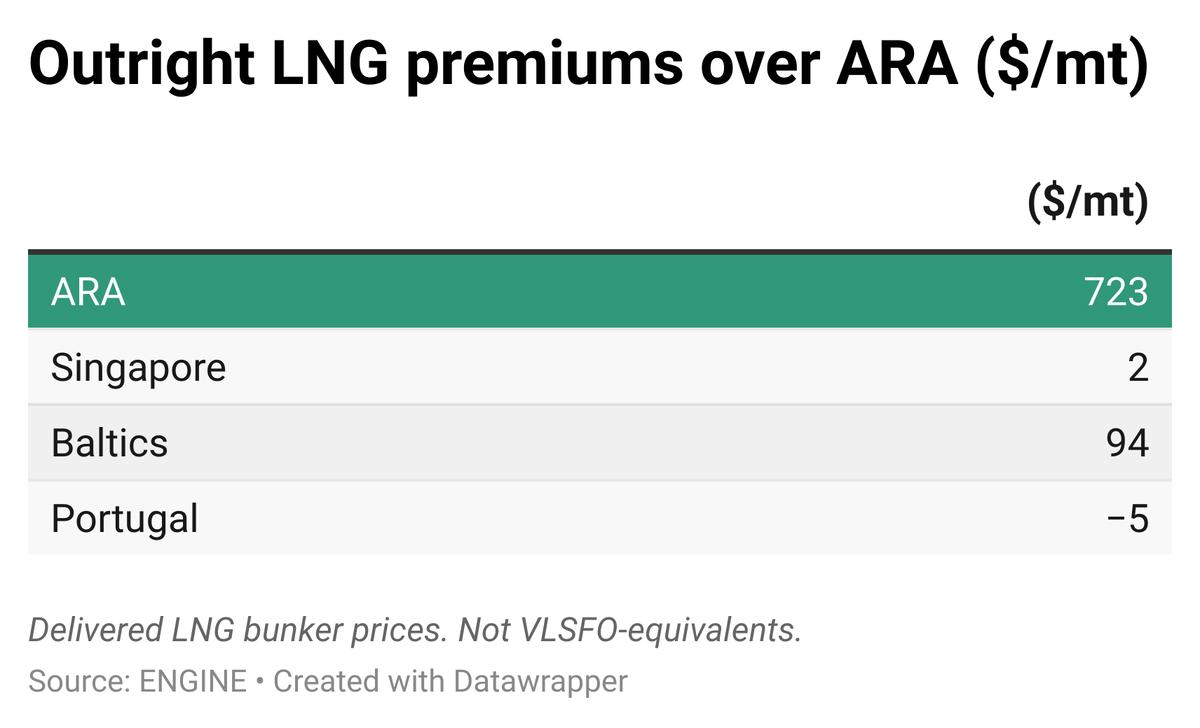

Changes in weekly LNG bunker prices:

- Rotterdam up by $3/mt to $723/mt

- Singapore up by $23/mt to $725/mt

Rotterdam

Rotterdam’s LNG bunker price has remained largely unchanged from last week amid a stable front-month Dutch TTF Natural Gas contract, a key benchmark for European gas prices.

Steady gas supply from Norway has added some downward pressure on TTF, according to the Japan Organization for Metals and Energy Security (JOGMEC). This pressure has been offset as the market is “waiting to see how things develop regarding peace talks between Russia and Ukraine and the possibility of a ban on Russian gas imports.”

“The market now sees mixed signals, with stable supply, uncertainty about the upcoming Russia-Ukraine peace talks, and growing inventory levels during the current shoulder season,” Energi Danmark noted.

A shoulder month refers to the transitional period between peak and off-peak seasons, and typically come with milder weather and reduced energy demand.

As of 17 May, EU underground gas storage was at 44%, up from 42% the previous week, but still 33% lower than a year earlier, according to data from Gas Infrastructure Europe.

Singapore

Singapore’s LNG bunker price has increased for the second week in a row, reaching $725/mt. This rise is tied to a 4% increase in the front-month NYMEX Japan/Korea Marker (JKM), which climbed by $0.46/MMBtu over the same period, bringing the contract to $11.90/MMBtu ($619/mt). Asian LNG bunker prices typically follow the JKM trend broadly.

The JKM rise has been driven by “peace negotiations between Ukraine and Russia, economic recovery due to the easing of tariffs between the U.S. and China, and expectations of increased purchasing power due to summer demand,” according to JOGMEC.

Singapore’s previous $18/mt discount to Rotterdam has disappeared over the past week, with prices now nearly at parity.

As of 11 May, LNG inventories for power generation stood at 1.94 million mt, reflecting a 50,000 mt decline from the previous week, according to Japan’s Ministry of Economy, Trade and Industry (METI).

Meanwhile, Singapore’s LNG bunker sales rose for the second consecutive month, increasing from 39,000 mt in March to 42,000 mt in April. The average stem size grew by 141 mt to reach 1,400 mt. Total LNG bunker sales from January to April totalled nearly 144,000 mt, up from 112,000 mt during the same period last year.

Other LNG bunker news

Spanish shipping company Baleària announced that it has bunkered three of its vessels with LNG on the same day in Barcelona.

LNG bunker supplier Gasum will use liquefied biomethane (LBM) on one of its chartered vessels to generate a FuelEU Maritime compliance surplus that it will sell on in a pooling scheme. Gasum said it LBM has net-negative well-to-tank greenhouse gas emissions.

Gasum has also announced that its new biogas plant in Sweden’s Götene is up and running. The plant is one of the largest in Sweden and can produce around 120 gigawatt hours/year (GWh) of liquefied biogas. The gas must be upgraded into biomethane by removing CO2, before it can be liquefied to LBM and used as a bunker fuel.

Also in Sweden, a chemical tanker operated by Terntank received domestically produced LBM from supplier St1 and its venture St1 Biokraft in the Port of Gothenburg. LBM can be a low-emission drop-in fuel with LNG as they have the same chemical composition.

By Tuhin Roy

Please get in touch with comments or additional info to news@engine.online

Contact our Experts

With 50+ traders in 12 offices around the world, our team is available 24/7 to support you in your energy procurement needs.