Fuel Switch Snapshot: LNG premiums shrink in Rotterdam

Rotterdam LNG nearly closes gap with LSMGO

B100–VLSFO spread narrows further

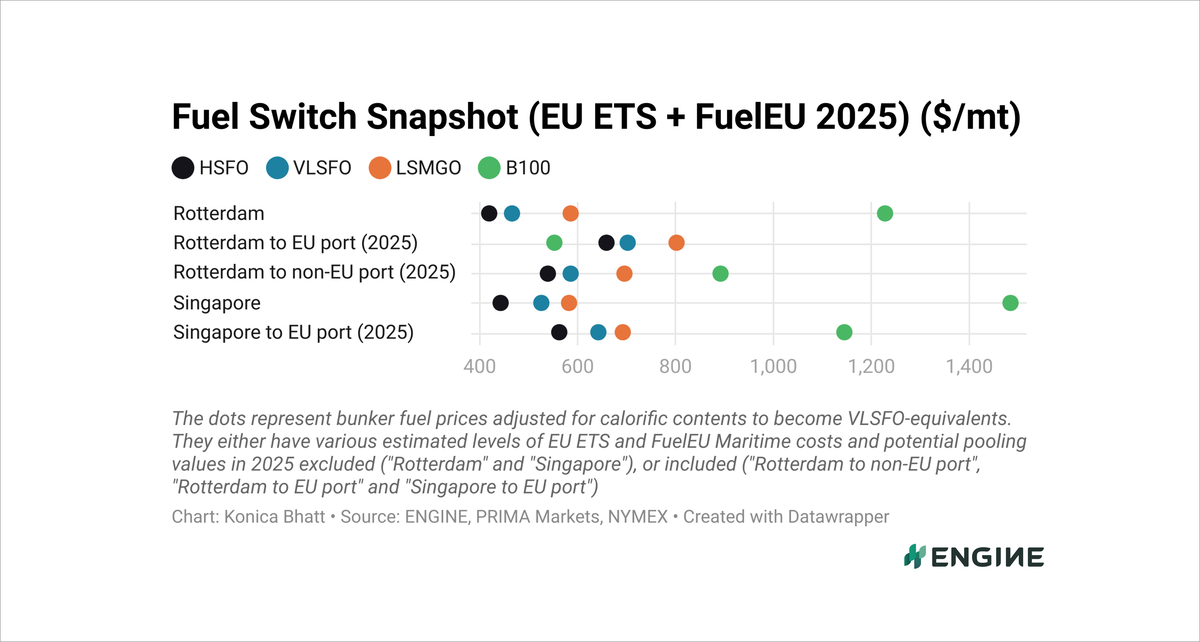

All bunker prices mentioned below have been adjusted for calorific contents to make them VLSFO-equivalent. They have estimated EU-EU voyage compliance costs included for Rotterdam, and non-EU-EU compliance costs included for Singapore. These account for EU ETS costs and FuelEU Maritime penalties, and our estimated compliance surplus values for FuelEU pooling. Rotterdam's B100 and LBM prices also factor in Dutch HBE rebates for advanced liquid and gaseous biofuels sold in the Netherlands.

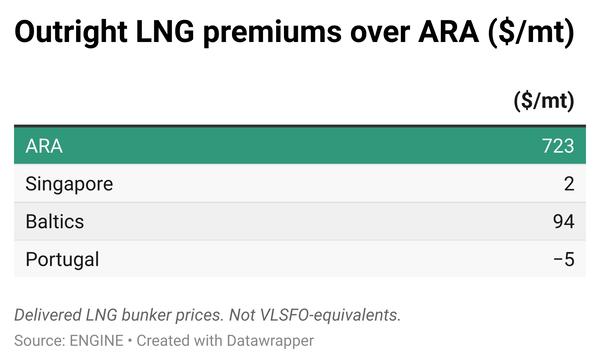

LNG price premiums over conventional fuels have narrowed in Rotterdam over the past week.

LNG is currently $105/mt more expensive than VLSFO, a $13/mt drop on the week. Its premium over LSMGO now stands at $6/mt, down from $19/mt the week before.

LNG continues to maintain its premiums over LBM, ranging between $148-194/mt depending on the engine type and associated methane slip.

Meanwhile, Rotterdam’s B100 discount to VLSFO has widened by $10/mt, to $152/mt. B100’s discount to LSMGO has also increased, reaching $251/mt from $240/mt last week.

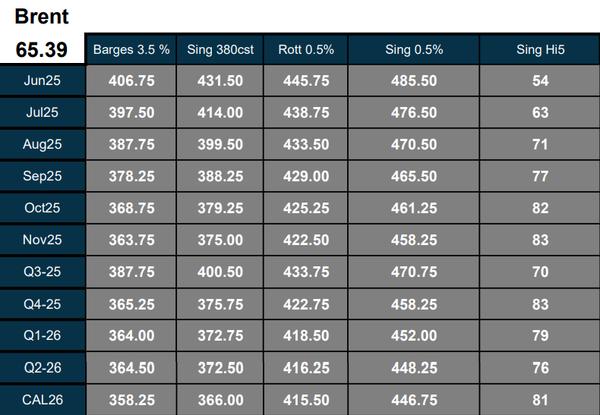

Liquid fuels

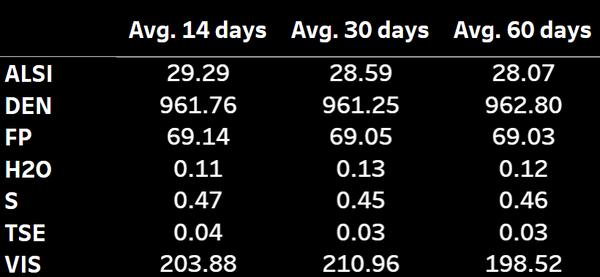

Rotterdam’s VLSFO price has gained $14/mt in the past week. Prompt bunker fuel availability of the grade has tightened in the wider ARA region, with lead times now recommended at 7-8 days.

Rotterdam’s B100 benchmark has remained largely stable, with a $4/mt gain. A $7/mt drop Prima Market's assessed HBE rebate has added some upward pressure on B100. But a $21/mt fall in Prima's POMEME CIF ARA barge price has offset further upside.

A biofuel bunker supplier has seen demand grow for B100 and B30 lately. Its barge schedules has been filling up with contract and new demand, especially for shipping companies looking to comply with FuelEU Maritime and reduce their EU ETS exposure. While stems could be fixed with only a few days of lead time previously, two weeks of lead time is recommended now.

Singapore’s VLSFO price has increased by $14/mt over the week. Bunker availability has improved in the port amid subdued demand and VLSFO lead times have shortened from 9–17 days last week to 6–13 days.

Biofuel bunker demand has come off a bit in Singapore, where the market is now dominated by a few key players, a local source says.

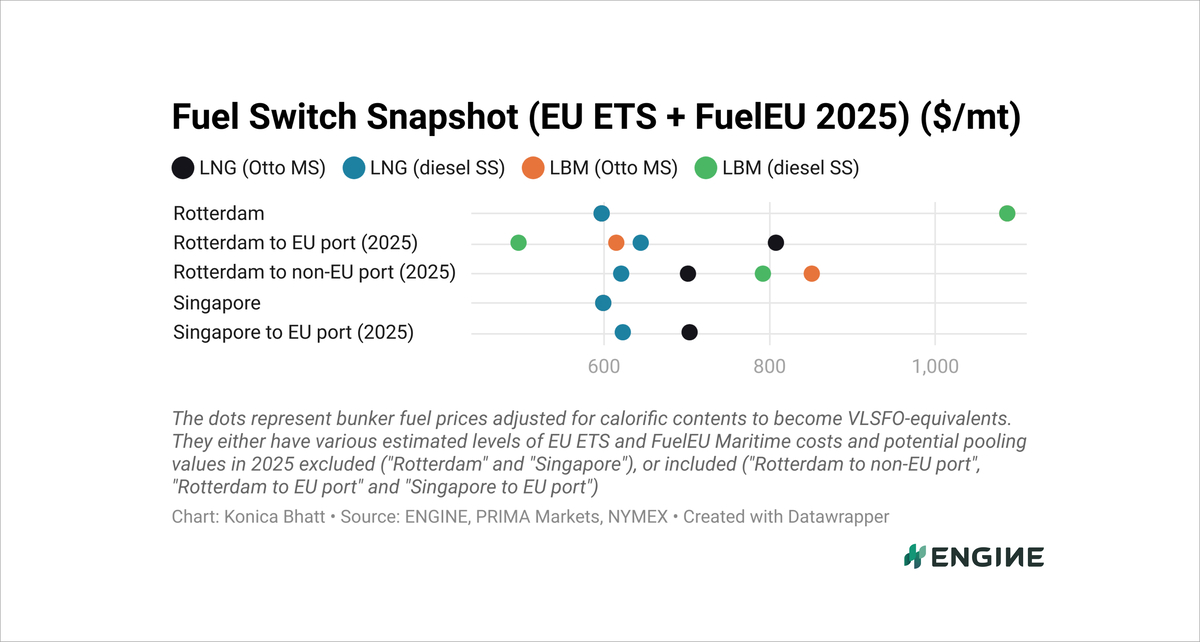

Liquid gases

Rotterdam’s LNG bunker price has remained nearly flat, edging up by just $1/mt over the past week amid a stable front-month Dutch TTF Natural Gas contract.

Steady Norwegian gas supplies have put downward pressure on the Dutch TTF, according to the Japan Organization for Metals and Energy Security (JOGMEC). This has been offset by market uncertainty around the ongoing Russia-Ukraine peace talks.

LBM prices in Rotterdam have increased by $1–3/mt, depending on a vessel's engine type and methane emissions.

Singapore’s LNG bunker benchmark has gained $18/mt over the same period, mostly due to a 4% increase in the underlying front-month NYMEX Japan/Korea Marker (JKM).

By Konica Bhatt

Please get in touch with comments or additional info to news@engine.online

Contact our Experts

With 50+ traders in 12 offices around the world, our team is available 24/7 to support you in your energy procurement needs.