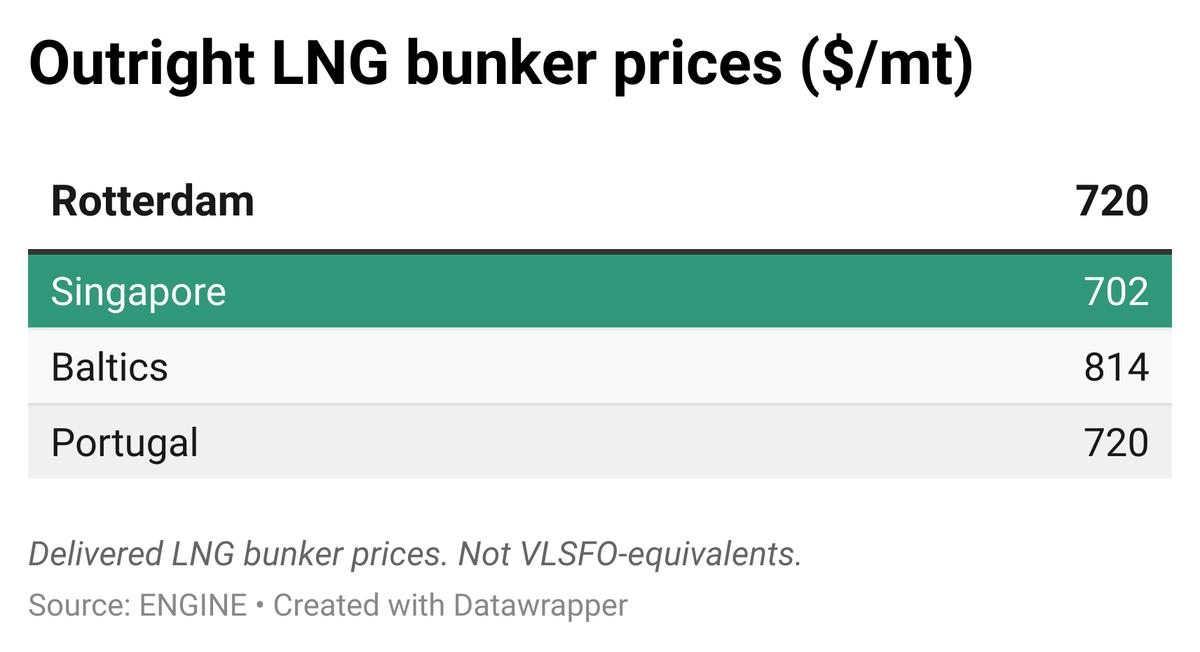

LNG Bunker Snapshot: Cargo competition drives up LNG prices

LNG bunker prices have risen across Rotterdam and Singapore as underlying gas indexes have been lifted by Europan and Asian vying for LNG cargoes.

Weekly changes in LNG bunker prices:

- Rotterdam up by $28/mt to $720/mt

- Singapore up by $6/mt to $702/mt

Rotterdam

Stiffer competition between European and Asian LNG importers and a larger bunker delivery premium have pushed Rotterdam’s LNG bunker price 4% higher on the week.

The ARA bunker delivery premium on top of the front-month ICE Dutch TTF gas futures price has gone up by $0.12/MMBtu ($6/mt) on the week, to $2.50/MMBtu ($130/mt), according to ENGINE’s assessment.

The underlying TTF gas price has traded higher as European utility companies are stocking up before the summer season, and as EU inventories more broadly are being refilled to hit the targeted 80-90% of capacity before the peak winter season.

Underground EU gas inventories are now over 42% full, up from 40% a week ago. But that is still a far cry from the 65% at this time last year, according to Gas Infrastructure Europe data.

European importers are facing stronger competition for LNG cargoes from Asian importing countries.

Global gas demand has also gotten a shot in the arm from tentative steps to de-escalate the US’ trade war with China. A further de-escalation could improve the outlook for industries reliant on this trade, which could produce more goods and consume more gas as energy inputs to their factories as a result.

Longer-term, the EU has proposed to phase out all spot purchases of Russian gas and LNG by the end of the year, and all imports – spot and contract – by the end of 2027.

Singapore

Singapore’s LNG bunker price has climbed 1% higher on the week with support from rising Platts Japan/Korea Marker values, and counter downward pressure from a smaller bunker delivery premium.

The port’s bunker delivery premium has shrunk by $0.08/MMBtu ($4/mt) on the week, to $2.04/MMBtu ($106/mt).

JKM has gained through the past week, but not by as much as TTF. As for TTF, key support for JKM has come from stronger competition between Europe and Asia for LNG cargoes, said Japan Organization for Metals and Energy Security (JOGMEC).

But JKM (up $11/mt) has only risen by half as much as TTF ($22/mt) on the week. This comes amid weak end-user demand in Asia, JOGMEC said.

Chinese LNG demand has also been tepid.

“China's LNG imports are down by 25% year-to-date, which freed up some volumes, including to Europe. a recovery in China's gas demand growth could intensify the competition with Europe (although this seems unlikely at the moment),” argued Greg Molnar, gas analyst at the International Energy Agency (IEA).

Other LNG bunker news

Seaspan Energy has completed the first LNG bunkering of a cruise ship in the Port of Vancouver, supplying Silversea’s Silver Nova ahead of its departure for Alaska. Seaspan operates three LNG bunker vessels on the West Coast of North America. It has previously supplied LNG to container ships, car carriers and bulk carriers calling at Vancouver.

Italian shipowner Grandi Navi Veloci (GNV) has ordered four new LNG-capable ferries. At 71,300 gross tonnes, they will be the largest ferries operating in the Mediterranean, said GNV, which primarily operates ferry routes across the western Mediterranean.

By Erik Hoffmann

Please get in touch with comments or additional info to news@engine.online

Contact our Experts

With 50+ traders in 12 offices around the world, our team is available 24/7 to support you in your energy procurement needs.