Fuel Switch Snapshot: B100 gains more price edge on VLSFO

Rotterdam’s B100-VLSFO spread widens

LBM at even wider discounts to fossil LNG

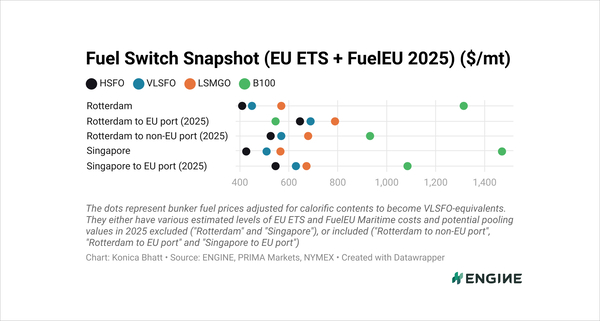

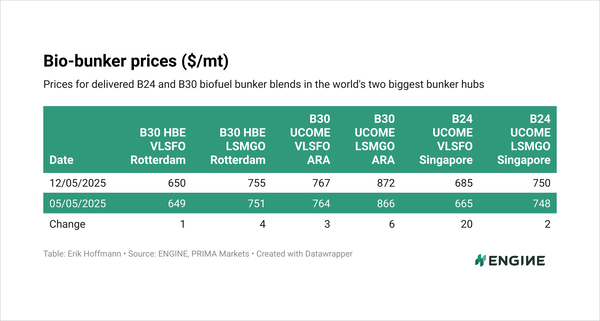

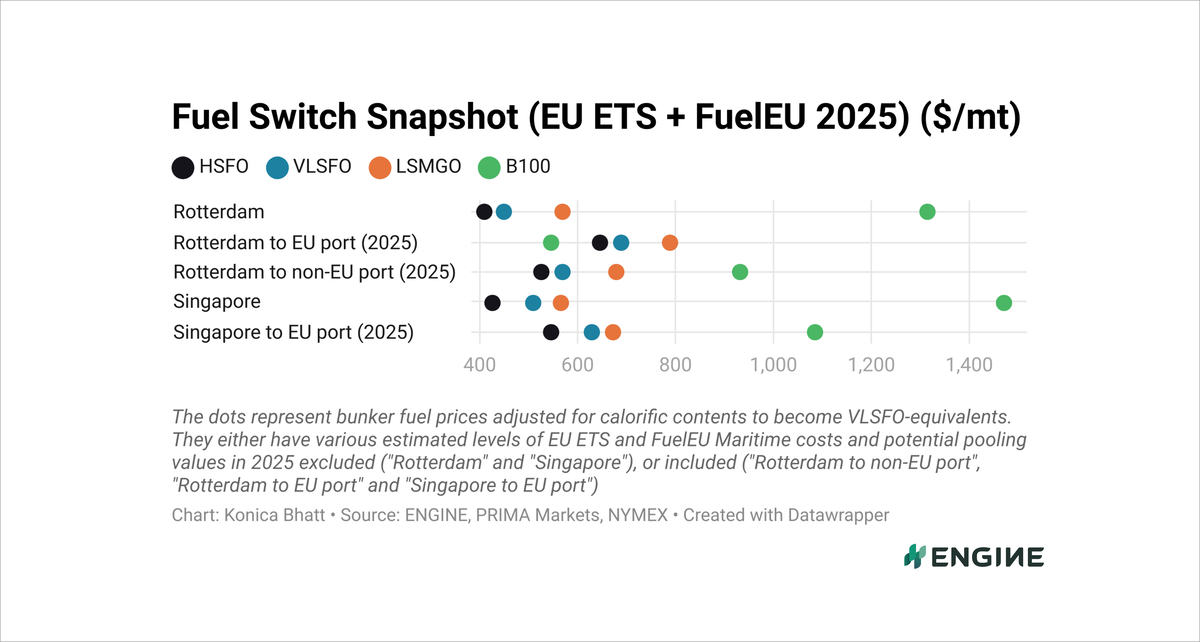

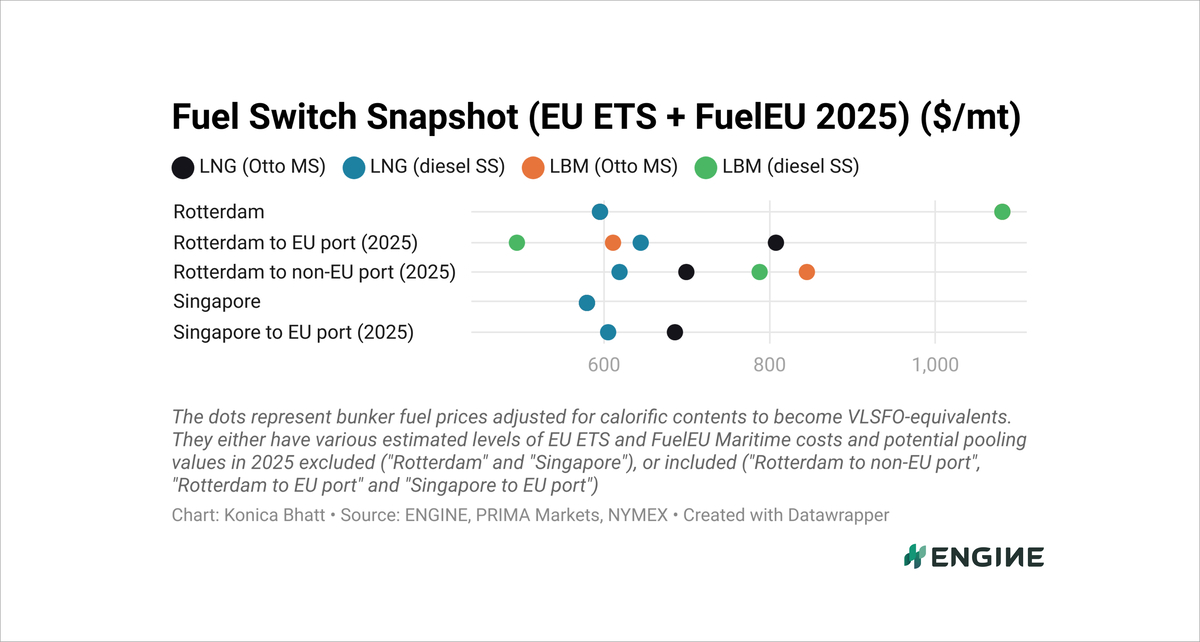

All bunker prices mentioned below have been adjusted for calorific contents to make them VLSFO-equivalent. They have estimated EU-EU voyage compliance costs included for Rotterdam, and non-EU-EU compliance costs included for Singapore. These account for EU ETS costs and FuelEU Maritime penalties, and our estimated compliance surplus values for FuelEU pooling. Rotterdam's B100 and LBM prices also factor in Dutch HBE rebates for advanced liquid and gaseous biofuels sold in the Netherlands.

A slightly bigger weekly gain for VLSFO ($29/mt) than for B100 ($25/mt) in Rotterdam has widened the spread between the two. B100 is now $142/mt cheaper than VLSFO, an increase of $4/mt from the previous week’s discount.

B100’s discount to LSMGO has widened by $7/mt to $240/mt.

LNG remains the costliest fuel in the Dutch port when consumed in Otto medium-speed (Otto MS) engines on voyages between two EU ports. It is priced $195/mt above liquefied biomethane (LBM) when they are both consumed in Otto MS engines.

For dual-fuel shipowners, LNG is currently priced $118/mt above VLSFO in Rotterdam.

However, LNG flips to a discount to VLSFO when used in diesel slow-speed (diesel SS) engines, which have the lowest default methane slip rating of 0.2%. With reduced methane slip, EU regulatory compliance costs make LNG $45/mt cheaper than VLSFO.

Despite this, LNG still carries a $149/mt premium over LBM when used in diesel SS engines.

Liquid fuels

Rotterdam’s VLSFO price has surged $29/mt higher in the past week. The price rise is mostly driven by an increase in the front-month ICE Brent Futures benchmark and a tightening supply of the fuel in the ARA region.

Rotterdam’s B100 benchmark has seen a similar increase, rising by $25/mt over the same period.

Singapore’s VLSFO price has also climbed, up by $38/mt week-on-week. Bunker availability in the port remains tight, with lead times extended significantly, to around 9–17 days now.

Liquid gases

Rotterdam’s VLSFO-equivalent LNG bunker price with EU-EU voyages costs included has increased by $31/mt in the past week. Stiffer competition between European and Asian LNG importers and a larger bunker delivery premium have pushed Rotterdam’s LNG bunker price up.

Singapore’s LNG bunker price has climbed 1% higher on the week with support from rising Platts Japan/Korea Marker values, and counter downward pressure from a smaller bunker delivery premium.

Global gas demand has gotten a shot in the arm from tentative steps to de-escalate the US’ trade war with China. A further de-escalation could improve the outlook for industries reliant on this trade, which could produce more goods and consume more gas as energy inputs to their factories as a result.

By Konica Bhatt

Please get in touch with comments or additional info to news@engine.online

Contact our Experts

With 50+ traders in 12 offices around the world, our team is available 24/7 to support you in your energy procurement needs.