Singapore fuel oil stocks drawn amid net import slump

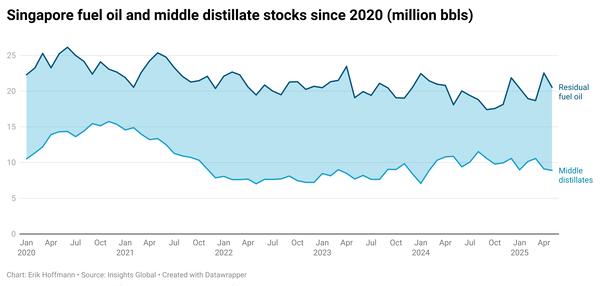

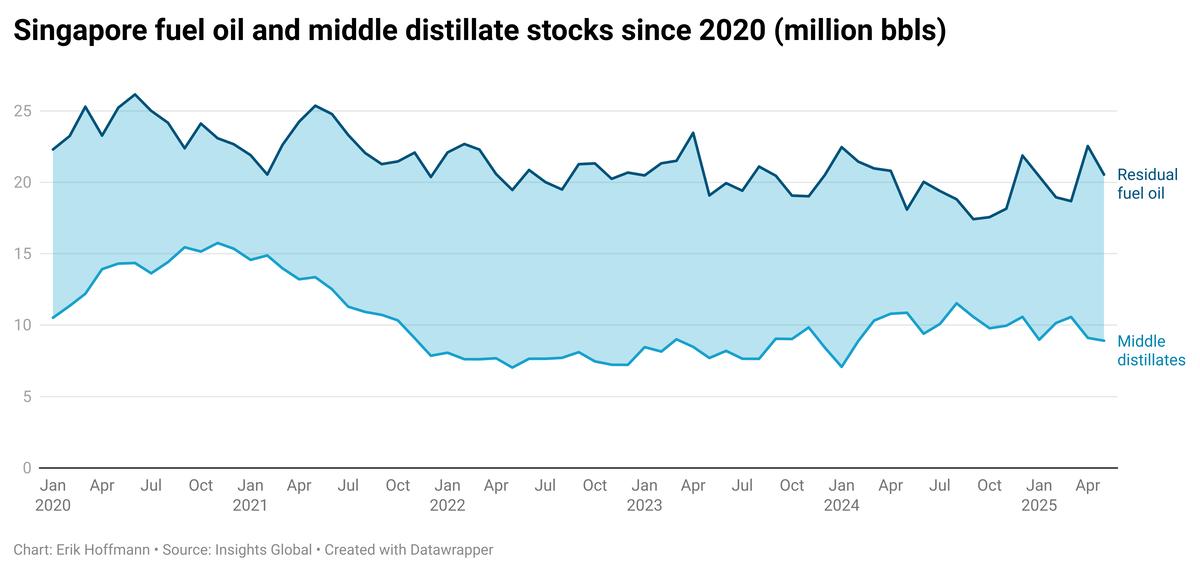

Singapore’s residual fuel oil stocks have averaged 2 million bbls lower in May so far than across April, according to Enterprise Singapore data.

Changes in monthly average Singapore stocks from April to May:

- Residual fuel oil stocks down 2 million bbls to 20.54 million bbls

- Middle distillate stocks down 200,000 bbls to 8.91 million bbls

Some 2 million bbls of fuel oil have been drawn out of storage in Singapore this month compared to April’s average. Fuel oil inventories have dropped below the five-year average of 21.27 million bbls.

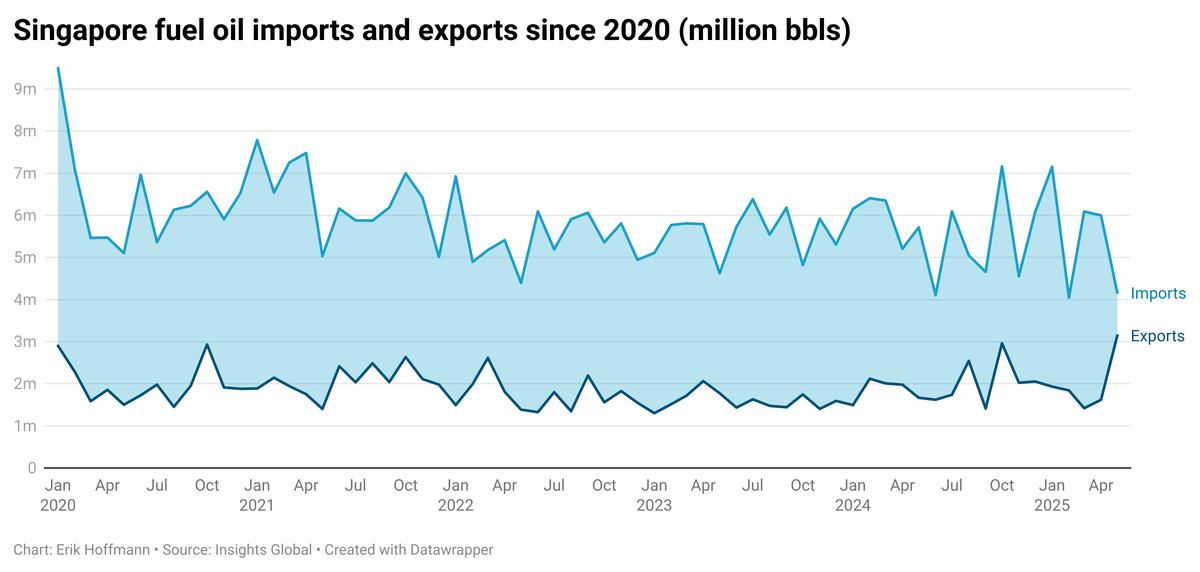

Shrinking net imports could have contributed to the stock draw. Net imports are down to just over 1 million bbls – the lowest they have been since at least 2020, when ENGINE started reporting these figures.

The net balance is based on weekly average import and export figures from Enterprise Singapore, so the fact that we are only one week into May should not matter. But one week of May data compared to a whole month of April data is a small sample size, and net imports could very well grow as we move further into May.

Singapore has mostly imported fuel oil from the US (23%), Thailand (17%) and Brazil (15%) this month, according to Vortexa data. Exports have been bound for China (61%), Malaysia (7%) and French Overseas Territories (5%).

The port’s middle distillate stocks – which include gasoil – have dropped to a 15-month low. The majority of imports have come from Russia (37%), Thailand (18%) and Malaysia (16%), while exports have gone to Malaysia (21%), Indonesia (15%) and Australia (13%), Vortexa data shows.

Changes in Singapore fuel oil trade from April to May (so far):

- Fuel oil imports down 1.84 million bbls to 4.16 million bbls

- Fuel oil exports up 1.53 million bbls to 3.15 million bbls

- Fuel oil net imports down 3.36 million bbls to 1.02 million bbls

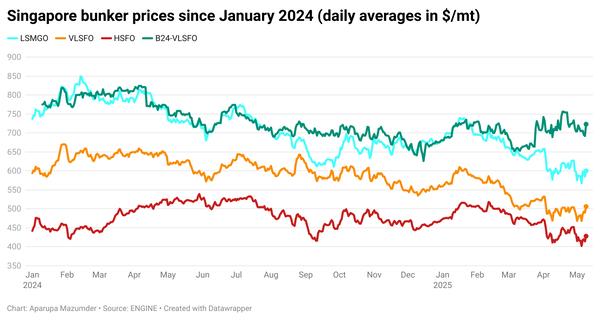

Bunker availability in Singapore is a bit tight, with VLSFO lead times of around 9-17 days advised now. HSFO lead times have increased and are at around 7-13 days. LSMGO availability varies between suppliers. Recommended lead times have changed from 6-8 days last week, to 3-10 days now.

By Erik Hoffmann

Please get in touch with comments or additional info to news@engine.online

Contact our Experts

With 50+ traders in 12 offices around the world, our team is available 24/7 to support you in your energy procurement needs.