East of Suez Market Update 6 May 2025

Bunker fuel prices in East of Suez ports have moved in mixed directions, and prompt VLSFO availability has improved in Zhoushan.

IMAGE: Aerial view of Zhoushan City, Zhejiang Province. Getty Images

IMAGE: Aerial view of Zhoushan City, Zhejiang Province. Getty Images

Changes on the day, to 17.00 SGT (09.00 GMT) today:

- VLSFO prices up in Zhoushan ($16/mt), Fujairah ($12/mt) and Singapore ($5/mt)

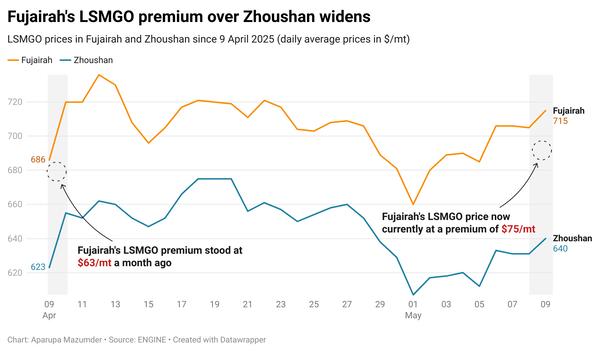

- LSMGO prices up in Zhoushan ($25/mt) and Fujairah ($16/mt), and down in Singapore ($13/mt)

- HSFO prices up in Zhoushan ($12/mt), and down in Singapore ($7/mt) and Fujairah ($6/mt)

- B24-VLSFO at a $227/mt premium over VLSFO in Singapore

VLSFO benchmarks have gained in three major Asian bunker ports, with Zhoushan recording the steepest rise. Zhoushan’s VLSFO price is trading at premiums of $9/mt over Singapore and $13/mt over Fujairah.

Zhoushan's VLSFO lead times remain steady at 5–7 days. LSMGO lead times have dropped from 5–7 days last week to just 1–3 days now. HSFO supply has improved significantly, with several suppliers now advising lead times of 3–5 days, compared to around eight days last week.

A lower-priced 50-150 mt LSMGO stem fixed at $575/mt in Singapore for prompt delivery today has contribued to push its benchmark lower. HSFO lead times have shortened from 7–11 days to 6–9 days, while VLSFO typically needs 7-10 days of lead time, compared to last week’s recommendation of 6-18 days.

In Hong Kong, lead times for all fuel grades continue to hold steady at approximately seven days, showing no change from recent weeks.

Brent

The front-month ICE Brent contract has moved $1.74/bbl higher on the day, to trade at $61.72/bbl at 17.00 SGT (09.00 GMT) today.

Upward pressure:

Oil demand in the US, the world’s largest oil consumer, has shown some resilience in the past week, amid the ongoing US-China tariff saga. This has provided some support to oil prices.

Brent crude’s price felt some upward pressure after commercial US crude oil inventories declined by 2.7 million bbls to touch 440 million bbls for the week ending on 25 April, according to data from the US Energy Information Administration (EIA).

A drop in US crude inventories could signal strengthening oil demand and offer some support to Brent’s price, analysts say. Market participants are now eyeing the latest EIA data, due for release tomorrow.

Traders are also closely watching the upcoming US Federal Reserve's Open Market Committee (FOMC) meeting, where policymakers are expected to discuss potential interest rate cuts in the coming months. A reduction in rates could weaken the US dollar, making dollar-denominated commodities like oil more attractive for holders of other currencies.

“Heading into the FOMC, traders were on a risk diet, not a buffet,” SPI Asset Management managing partner Stephen Innes said.

Downward pressure:

Brent crude’s price gains were capped as markets reacted to a larger-than-expected increase in output from OPEC+ producers.

The Saudi Arabia-led oil producers group surprised the market in April by tripling its planned output hike to 411,000 b/d for May, and on Saturday it agreed to extend that increase through June.

This is the second month in a row that they plan to expedite the unwinding of their joint 2.2 million b/d output cuts. “That means over 37% of the 2.2mb/d in production gains will have come in the space of two months,” ANZ Bank senior commodity strategist Daniel Hynes remarked.

Subsequently, global investment bank Morgan Stanley cut its oil price forecasts for the remainder of the year. The bank now sees ICE Brent to trade around $62.50/bbl in the third and fourth quarters of this year, down by $5/bbl from its previous forecast, Bloomberg reports.

By Aparupa Mazumder

Please get in touch with comments or additional info to news@engine.online

Contact our Experts

With 50+ traders in 12 offices around the world, our team is available 24/7 to support you in your energy procurement needs.