The Week in Alt Fuels: B30 goes mainstream in Asia

B30 biofuel deliveries are picking up across key Asian ports and a number of suppliers could take advantage of the IMO’s regulatory tweak.

IMAGE: SK Incheon supplying a B30 blend in Incheon port. SK Incheon

IMAGE: SK Incheon supplying a B30 blend in Incheon port. SK Incheon

The IMO’s Marine Environment Protection Committee (MEPC) recently approved a draft amendment allowing bunker vessels certified as oil tankers to transport biofuel blends of up to B30, comprising a 30% bio-component and 70% conventional fuel.

The previous threshold was capped at 25% biofuel. Blends exceeding B30 must still be transported by IMO Type II chemical tankers.

This change has opened the door for bunker suppliers using regular bunker tankers to carry blends with higher bio percentages without needing additional investments in chemical tankers.

The Maritime and Port Authority of Singapore (MPA) was first out of the blocks.

It has allowed Singapore-flagged bunker tankers to deliver B30 since March, in line with the IMO’s revised carriage rules. The port also incentivises adoption through concessions on port dues for ocean-going vessels using biofuels: a full waiver for B100, 30% off for B50–B99, and 20% off for B24–B49 blends.

Suppliers in certain other Asian ports have announced B30 bunker operations in the wake of the MPA's announcement, which could help the market transition to B30 as a more standardised biofuel grade.

In Hong Kong, Chimbusco Pan Nation has started physical deliveries of B30 blends.

In South Korea, GS Caltex has already been supplying B30-HSFO in Busan for years, but another supplier, SK Incheon Petrochem, has now entered the B30 market. SK Incheon completed its first B30 delivery in Incheon Port last month, using a blend of 30% biofuel from JC Chemical with 70% straight run fuel oil (SRFO). It plans to expand supply across ports along the country’s West Sea region.

Chimbusco, GS Caltex and SK Incheon might have used chemical tankers to supply B30, which would make the changed IMO rule less relevant. But the IMO now at least allows for oil as well as chemical tankers to carry and deliver B30, leaving it up to these companies which delivery vessels in their fleets they want to use.

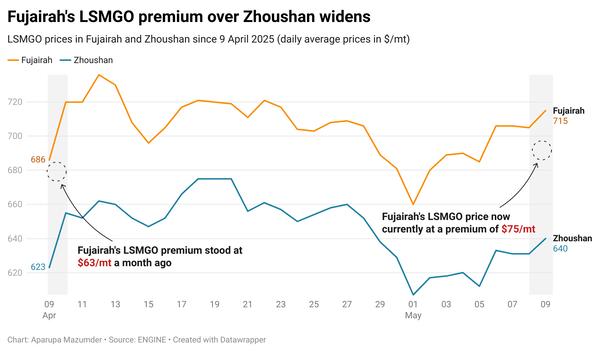

Hong Kong or South Korea's authorities have not officially announced anything on B30. Neither have other major Asian bunker locations such as Fujairah and Zhoushan. But in the past week, ENGINE has gathered indicative prices for B30-VLSFO and B30-HSFO blends in smaller UAE ports, suggesting readiness from at least one supplier.

Shipping companies are also starting to expect B30 to become available from more suppliers.

Singapore-based Swire Shipping, for example, has started running three of its vessels on B24 biofuels supplied by BP and plans to transition to B30 blends. These ships operate between Southeast Asia and the Pacific Islands.

Beyond Asia, the revised IMO regulations could also pave the way for B30 to become a mainstay in other biofuel bunker ports like Gibraltar or in Panama, where some suppliers are already delivering B30 blends using IMO Type II chemical tankers.

And B30 is already the go-to blend percentage for suppliers in the ARA and other bunker locations where river barges operate, like Lisbon, the Houston area and upriver Argentinian ports. These river barges have been exempt from the IMO's 25% biofuel cap.

In other news this week, Spanish LNG bunker supplier Molgas delivered an unspecified quantity of bio-LNG to a dual-fuel container ship operated by Norwegian car carrier firm UECC in the Spanish port of Sagunto.

Hong Kong-based shipping firm Orient Overseas Container Line (OOCL) placed a HK$24,024 million ($3.08 billion) order for 14 methanol-capable container vessels in China. All these vessels are expected to be delivered between 2028 and 2029.

By Konica Bhatt

Please get in touch with comments or additional info to news@engine.online

Contact our Experts

With 50+ traders in 12 offices around the world, our team is available 24/7 to support you in your energy procurement needs.