East of Suez Fuel Availability Outlook 29 Apr 2025

Bunker availability improves in Singapore

Prompt VLSFO supply tight across several Japanese ports

Several South Korean ports brace for weather disruptions

IMAGE: Illuminated Kaohsiung city and harbor at night, Taiwan. Getty Images

IMAGE: Illuminated Kaohsiung city and harbor at night, Taiwan. Getty Images

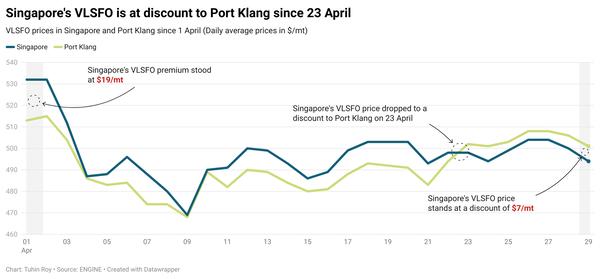

Singapore and Malaysia

Bunker availability in Singapore has improved. VLSFO lead times have shortened from 6–18 days last week to 7–10 days now, while HSFO lead times have decreased from 7–11 days to 6–9 days. LSMGO remains readily available, with recommended lead times reduced from 6–8 days to 4–7 days.

According to Enterprise Singapore, residual fuel oil stocks in the port have averaged 20% higher so far in April compared to March. At 23.01 million bbls, Singapore’s fuel oil stocks have reached a multi-year high. The port has also recorded a 21% increase in net fuel oil imports in April, with imports rising by 1.33 million bbls and exports increasing by 455,000 bbls. In contrast, middle distillate stocks have averaged 10% lower in April than in March.

At Malaysia’s Port Klang, both VLSFO and LSMGO are readily available, with prompt delivery possible for smaller volumes. However, HSFO supply remains limited.

East Asia

In Zhoushan, lead times for VLSFO remain at 5–7 days, while LSMGO lead times have shortened from 5–7 days last week to 1–3 days. HSFO supply has improved significantly, with several suppliers now recommending lead times of 3–5 days, down from around eight days last week.

Bunkering activity in China is expected to stay subdued during the Labor Day holiday period from 1–5 May.

In northern China, Dalian and Qingdao have healthy stocks of VLSFO and LSMGO, though HSFO remains limited in Qingdao. Tianjin continues to face tight supply for both VLSFO and HSFO, while LSMGO availability is stable.

In Shanghai, VLSFO and HSFO remain under supply pressure, but LSMGO is readily available. Further south, Fuzhou maintains strong supply of both VLSFO and LSMGO. Xiamen has good VLSFO availability, though LSMGO supply is limited. Prompt deliveries of both VLSFO and LSMGO continue to be challenging in Yangpu and Guangzhou.

In Hong Kong, lead times for all fuel grades continue to hold steady at approximately seven days, showing no change from recent weeks.

Meanwhile in Taiwan, VLSFO and LSMGO availability remains stable across Hualien, Keelung, Kaohsiung, and Taichung, with lead times still around two days, consistent with last week.

Fuel availability across all grades has tightened at several South Korean ports, with lead times increasing from 3–7 days last week to around nine days now.

Bunker operations are also expected to face disruptions due to high waves and strong winds: in Ulsan, Onsan, and Busan from 1–5 May; in Daesan and Taean from 30 April–4 May; and in Yeosu from 1–6 May.

Prompt VLSFO supply remains tight at several Japanese ports, including Tokyo, Chiba, Yokohama, Kawasaki, Osaka, Kobe, Sakai, Nagoya, Yokkaichi, and Mizushima.

While LSMGO availability is generally stable, prompt deliveries can be difficult to secure in Osaka, Kobe, Sakai, Nagoya, Yokkaichi, and Mizushima. HSFO supply is also limited at many locations. In Oita, all fuel grades are available only upon enquiry.

Bunker operations across Japan are expected to remain subdued during the Golden Week holidays from 29 April to 5 May, as most suppliers will only fulfill pre-booked stems and not accept new ones during this period.

In Vietnam, rough weather may disrupt bunker deliveries in Ho Chi Minh from 30 April to 1 May.

Oceania

In Western Australia, VLSFO and LSMGO remain well supplied in Kwinana, Fremantle, and Kembla, with recommended lead times of 7–8 days. In New South Wales, Sydney has ample LSMGO availability, though prompt HSFO deliveries remain difficult.

Port Kembla’s anchorage is closed today due to high swells and strong winds. While harbour movements continue, pilotage may be disrupted as shipping is evaluated on a case-by-case basis, according to GAC Hot Port News.

In Victoria, both Melbourne and Geelong report strong availability of VLSFO and LSMGO, but prompt HSFO remains scarce. Queensland’s ports—Brisbane and Gladstone—also maintain good stocks of VLSFO and LSMGO, with lead times of 7–8 days, though HSFO supply in Brisbane is limited.

In New Zealand, VLSFO is adequately stocked in Tauranga and Auckland, but bunker operations in Tauranga could face intermittent disruptions from 29 April to 1 May due to adverse weather.

South Asia

Adverse weather is expected to disrupt bunker deliveries at the Indian ports of Kandla and Sikka from 29 April to 3 May.

In contrast, fuel availability at Sri Lanka’s Colombo and Hambantota ports remains steady across all grades, with recommended lead times holding at around four days, unchanged from last week.

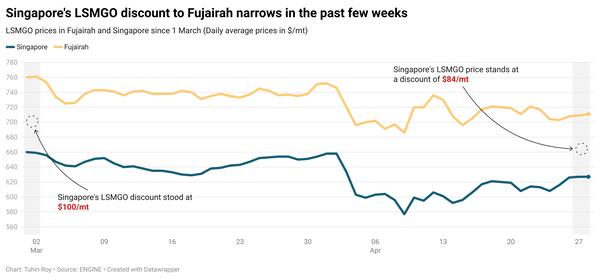

Middle East

Prompt bunker availability in Fujairah remains tight, with lead times for all grades unchanged from last week at 5–7 days. Khor Fakkan mirrors these lead time recommendations.

In Basrah, Iraq, VLSFO and LSMGO are readily available, while both grades are nearly depleted in Ras Laffan, Qatar, and Suez, Egypt.

At Egypt’s Suez, deliveries could be disrupted by adverse weather on 30 April, while Port Said may experience similar issues from 30 April to 2 May.

In Saudi Arabia, Jeddah has adequate LSMGO supply but limited VLSFO. Bunker deliveries in Jeddah and Yanbu may face weather-related disruptions on 3 May and 2–3 May, respectively.

In Djibouti, bunker supply is strained, with VLSFO and HSFO stocks nearly exhausted and LSMGO running low.

Meanwhile, Omani ports including Sohar, Salalah, Muscat, and Duqm continue to report ample LSMGO availability.

By Tuhin Roy

Please get in touch with comments or additional info to news@engine.online

Contact our Experts

With 50+ traders in 12 offices around the world, our team is available 24/7 to support you in your energy procurement needs.