East of Suez Market Update 28 Apr 2025

Prices in East of Suez ports have moved up, and VLSFO availability is tight in Singapore.

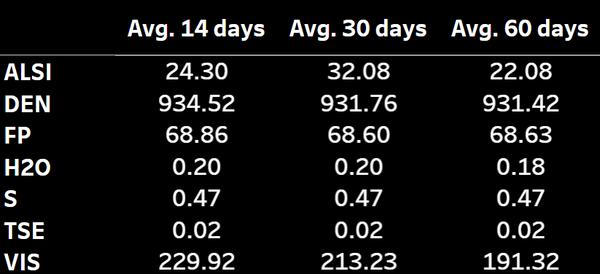

Changes on the day from Friday, to 17.00 SGT (09.00 GMT) today:

- VLSFO prices up in Zhoushan ($12/mt), Singapore and Fujairah ($8/mt)

- LSMGO prices up in Singapore ($17/mt), Fujairah ($10/mt) and Zhoushan ($8/mt)

- HSFO prices up in Zhoushan ($12/mt), Singapore ($10/mt) and Fujairah ($4/mt)

- B24-VLSFO at a $229/mt premium over VLSFO in Singapore

- B24-VLSFO at a $232/mt premium over VLSFO in Fujairah

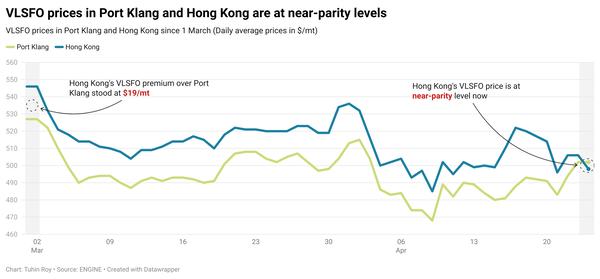

VLSFO prices in the three major Asian bunker ports have increased by $8-12/mt over the weekend. Singapore’s VLSFO price is at a marginal premium of $5/mt over Fujairah and a slight discount of $5/mt to Zhoushan.

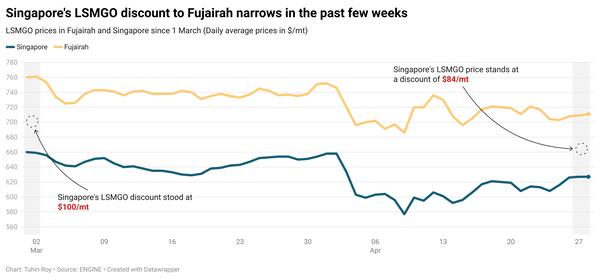

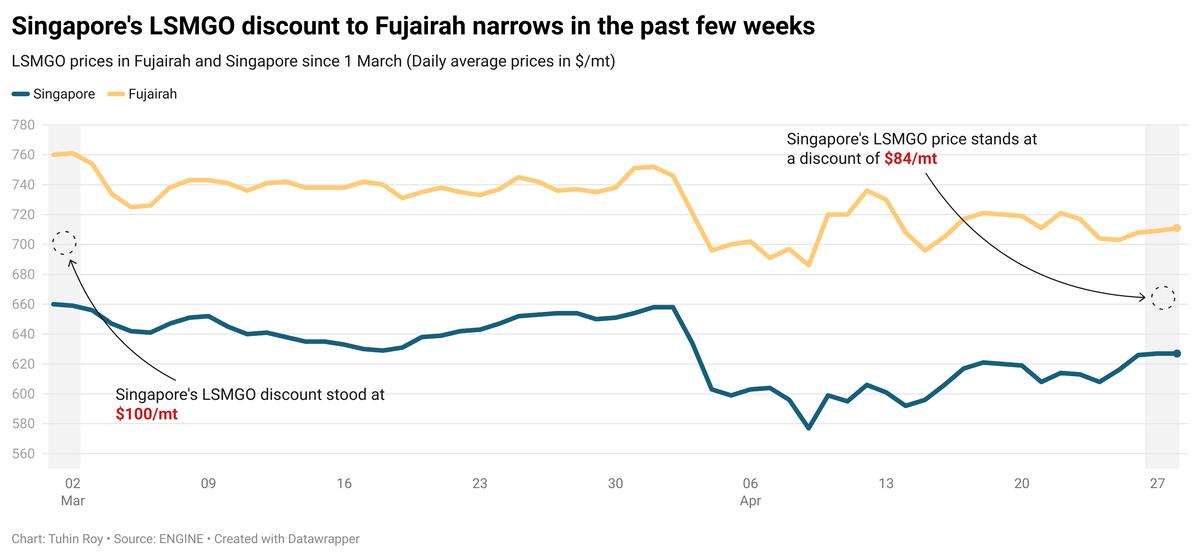

Singapore’s LSMGO price has surged by $17/mt, marking the steepest increase among the three major East of Suez ports. This rise is partially supported by a 50-150 mt LSMGO stem fixed in the port. Despite the sharp price increase, Singapore’s LSMGO remains at a discount of $84/mt to Zhoushan and $33/mt to Fujairah.

In Singapore, VLSFO lead times currently range from 8-21 days, up from 6-18 days last week. HSFO lead times are stable at 7-10 days, nearly unchanged from last week. LSMGO availability has improved, with recommended lead times of 2-7 days, down from 6-8 days last week.

In Fujairah, despite subdued demand, prompt availability remains tight, with lead times for all fuel grades holding steady at 5-7 days, unchanged from last week.

Brent

The front-month ICE Brent contract has gained by $0.25/bbl on the day from Friday, to trade at $66.75/bbl at 17.00 SGT (09.00 GMT).

Upward pressure:

Brent crude’s price has moved higher over the weekend as market participants continued to monitor trade tensions between two of the largest oil consumers of the world – the US and China.

Last week, the US administration said that it was willing to lower tariffs on Beijing, according to several media reports.

A partial easing of tariff tensions between the two countries can help soothe market worries, according to market analysts. However, uncertainty over a full resolution persists.

“The market awaits definitive news on the prospect of a thaw in the US-China tariffs battle,” Vanda Insights founder and analyst Vandana Hari said.

Downward pressure:

Brent’s price felt some downward pressure as leaders from the US and Iran held a third round of negotiations in Oman on Saturday. The meeting focused on reimposing restrictions on Tehran’s uranium enrichment program, Reuters reports.

“The US and Iran characterised their third round of talks on a potential new nuclear deal in Oman on Saturday as productive,” Hari said.

Oil analysts and traders are closely monitoring the talks for signs of any progress that could potentially lead the Trump administration to lift some sanctions on Iranian oil and bring more supply back to the market.

By Tuhin Roy and Aparupa Mazumder

Please get in touch with comments or additional info to news@engine.online

Contact our Experts

With 50+ traders in 12 offices around the world, our team is available 24/7 to support you in your energy procurement needs.