East of Suez Market Update 24 Apr 2025

Prices in East of Suez ports have moved down, and availability of all grades is normal in Hong Kong.

Changes on the day, to 17.00 SGT (09.00 GMT) today:

- VLSFO prices down in Zhoushan ($17/mt), Singapore ($15/mt) and Fujairah ($6/mt)

- LSMGO prices down in Fujairah ($24/mt), Zhoushan ($21/mt) and Singapore ($17/mt)

- HSFO prices down in Zhoushan ($15/mt), Fujairah ($11/mt) and Singapore ($10/mt)

- B24-VLSFO at a $222/mt premium over VLSFO in Singapore

Zhoushan’s VLSFO benchmark has dropped by $17/mt in the past day, marking the steepest decline among the three major Asian bunker ports. The port's VLSFO price is now at near-parity with both Singapore and Fujairah.

Lead times for VLSFO and LSMGO in Zhoushan have increased from 4–6 days last week, to 5–7 days currently.

HSFO supply in Zhoushan has tightened significantly despite subdued demand, as several suppliers are struggling with low stocks. Consequently, HSFO lead times have been extended to the end of April, compared to the previous 4–6 days.

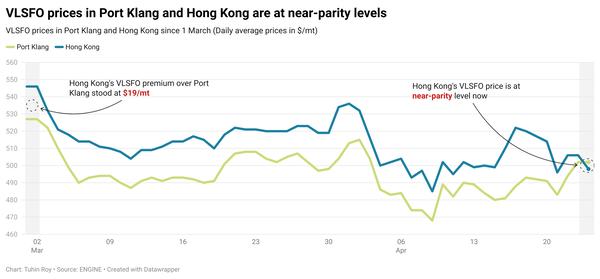

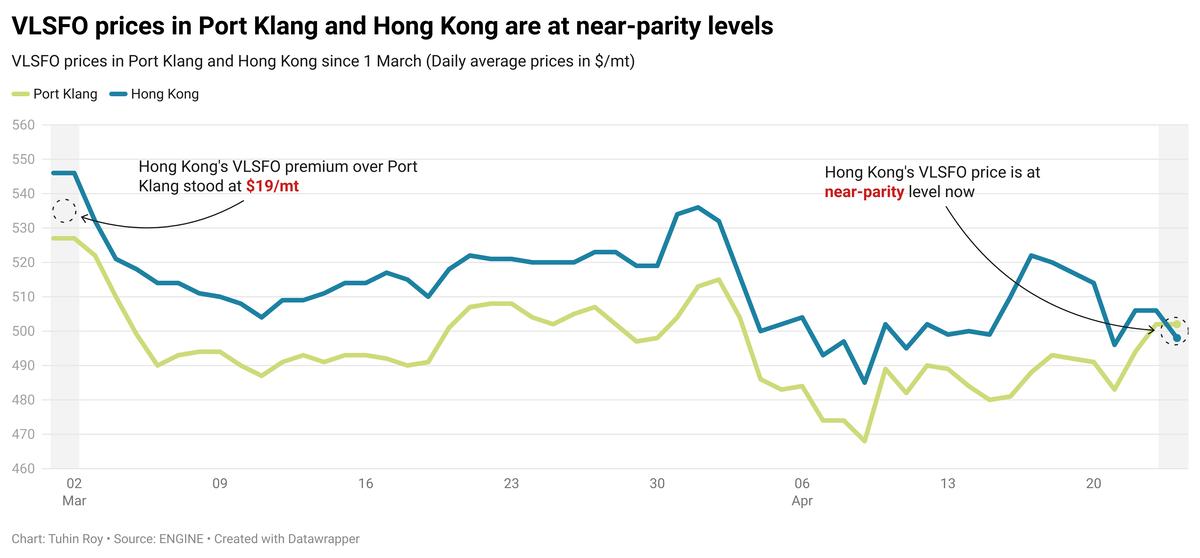

In Hong Kong, the VLSFO price has dropped from a premium of around $19/mt at the start of March to near-parity with Malaysia’s Port Klang.

Lead times for all fuel grades in Hong Kong remain steady at approximately seven days, consistent with recent weeks. Rough weather conditions are expected on 25–26 April, which could disrupt bunkering operations.

At Malaysia’s Port Klang, both VLSFO and LSMGO remain readily available, with prompt deliveries possible for smaller volumes. HSFO, however, continues to be in limited supply.

Brent

The front-month ICE Brent contract has declined by $2.14/bbl on the day, to trade at $66.42/bbl at 17.00 SGT (09.00 GMT).

Upward pressure:

Brent’s price has found some support after concerns about the US-China tariff war eased.

The Wall Street Journal reported that the US administration was willing to lower duties on China to as low as 50% in a bid to start negotiations. This news put some upward pressure on oil.

Yesterday, US treasury’s secretary, Scott Bessent, said that the current 145% import tariffs on Chinese goods should come down before trade talks between the two sides could begin, Reuters reports.

Additionally, US President Donald Trump is reportedly considering tariff exemptions on car part imports from China, according to the Financial Times.

The easing tariff tensions has calmed fears of a global trade war and supported demand expectations for commodities like oil, according to market analysts. “Risk assets [like oil] staged a recovery… amid growing hopes for a de-escalation in US-China trade tensions,” two analysts from ING Bank noted.

Downward pressure:

Concerns about excess supply in the global oil market has capped Brent’s price gains today.

OPEC+ member Kazakhstan, after repeatedly exceeding production quota over the past year, has said it would put national interest before the oil coalition’s and continue to maintain higher production levels, Reuters reports.

OPEC+ has faced internal disagreements over quota compliance in the past, with one such rift prompting Angola to leave the alliance in 2023.

“Kazakhstan is openly flouting quotas, pumping at record levels while Saudi Arabia, once the cartel’s swing producer, is increasingly looking like it’s throwing in the towel on price targeting,” SPI Asset Management managing partner Stephen Innes remarked.

On the demand side, Brent came under pressure after the US Energy Information Administration (EIA) reported a small rise in crude stocks.

Commercial US crude oil inventories gained by 244,000 bbls to touch 443 million bbls for the week ending 18 April, according to data from the EIA. A buildup in inventories typically signals weaker oil demand, which can put downward pressure on Brent's price.

“Oil’s latest leg lower isn’t just a function of oversupply—it’s the market grappling with fractured alliances and fractured demand signals,” Innes said.

By Tuhin Roy and Aparupa Mazumder

Please get in touch with comments or additional info to news@engine.online

Contact our Experts

With 50+ traders in 12 offices around the world, our team is available 24/7 to support you in your energy procurement needs.