Future Fuel Talks: Methanol to benefit from global trade roots - Methanol Institute CEO

China is leading green methanol’s early supply push, but the Americas region is catching up. And the EU is gearing up to take on a bigger role in the next phase of global production growth, Gregory Dolan told ENGINE.

IMAGE: Technician showing first batch of e-methanol produced at European Energy's Kassø plant in Denmark. European Energy

IMAGE: Technician showing first batch of e-methanol produced at European Energy's Kassø plant in Denmark. European Energy

Gregory Dolan is the chief executive of the Methanol Institute (MI) and believes the IMO’s newly approved Net-Zero Framework sends a clear signal that the global regulator is ready to support low-carbon fuels at scale. MI is a trade body for the global methanol industry, representing producers, suppliers and methanol-focused shipping companies.

Once adopted, the IMO framework will require ships to progressively reduce the well-to-wake GHG fuel intensity (GFI) of the energy used onboard, starting with 4-17% cuts in 2028, compared to 2008 levels.

Its adoption could mark a tipping point for ensuring global access to green methanol and help close the cost gap between fossil fuels and renewable alternatives, Dolan said in an exclusive interview with ENGINE.

Some experts worry that the framework could leave a sizeable funding gap and fuel suppliers without policy-backed incentives to justify investments in scaling up e-fuels. Dolan, however, argues that it lays the groundwork for green fuels to grow. MI estimates it could generate up to $12 billion/year to support green marine fuel production growth, if adopted as planned.

He also believes the initial scale-up will be led by Asia and the Americas, with the EU likely to catch up in the coming years. As for concerns over the added cost of transporting fuel from production sites to major bunkering hubs, Dolan expects methanol's status as a globally traded commodity will help to keep it affordable and accessible.

Green methanol remains significantly more expensive than fossil methanol and several other fuels. Do you think the IMO has done enough with its approved framework to lower costs by driving up economies of scale in supply and demand?

The agreement reached at MEPC 83 marks a significant step forward in providing regulatory clarity for alternative fuels. It offers practical measures that support shipping’s decarbonisation journey and serves as a catalyst for innovation and investment. While questions remain about the strength of the measures, the introduction of a GHG pricing mechanism – particularly the rewards for zero and near-zero (ZNZ) fuels – is expected to help close the cost gap between fossil and renewable options like green methanol.

As GHG intensity targets become more stringent – measured on a well-to-wake basis – this will further incentivise cleaner production pathways. Conventional ‘grey’ methanol can also be blended with blue, bio- or e-methanol to meet carbon intensity thresholds, providing flexibility and scalability.

At the EU level, the FuelEU Maritime Regulation and the EU ETS complement the IMO’s work by reinforcing the business case for low-carbon methanol. FuelEU’s pooling mechanism in particular makes e-methanol an attractive compliance strategy. According to a recent study we conducted with energy expert Jeroen Dierickx, these policies create a level playing field that supports the transition to sustainable fuels.

Methanol is no longer in the pilot phase; it is moving to full-scale adoption. The technology is proven, regulations are aligning, and what’s needed now is greater production, port availability, and investment in green corridors to ensure global access.

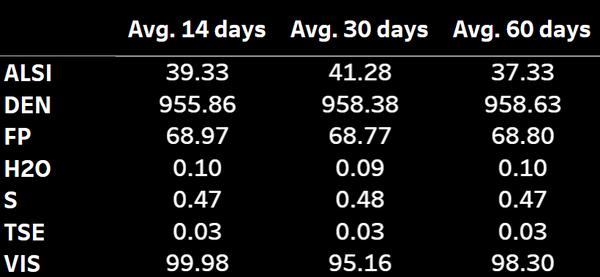

MAP: World map showing currently operational bio- and e-methanol plants. Methanol Institute via Gena Solutions

MAP: World map showing currently operational bio- and e-methanol plants. Methanol Institute via Gena Solutions

The Methanol Institute’s database shows that most bio-methanol production plants in operation and under construction today are concentrated in the Americas and Asia. Do you expect these regions to become the primary hubs for producing green methanol as a marine fuel, or could the trend shift as more e-methanol plants come online in the EU later this decade?

It will likely be a combination of both. New industrial plants need space to be built, as well as the right investment and regulatory climates, so there are multiple issues to address in increasing capacity.

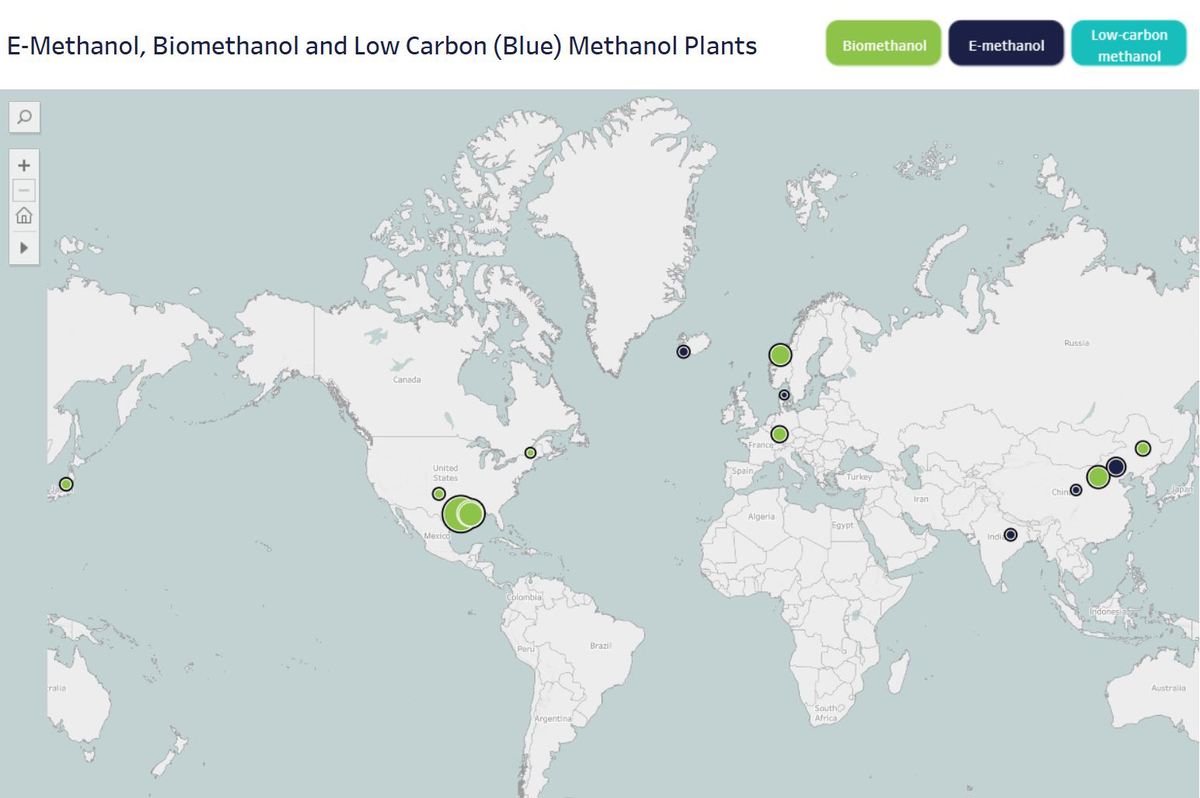

We can see that China dominates near-term supply, and countries like the US, Brazil, Chile and Uruguay are developing as well. The next phase will see the EU make a bigger contribution to the production of renewables in the near term.

For instance, European Energy in Denmark has successfully produced the first e-methanol at its Kassø Power-to-X facility, achieved using biogenic CO2 sourced at a local biogas facility. The production will now be ramped up, and the facility will have the capacity to produce 42,000 mt/year of e-methanol using three electrolysers and a methanol loop designed.

Repsol has approved an €800 million [$912 million] investment in a bio-methanol project in Tarragona, Spain. This could become the first European project to produce renewable and circular methanol from waste through gasification. Cepsa has partnered with C2X to build an e-methanol plant in the port of Huelva in southern Spain. C2X is majority owned by A.P. Moller Holding, with A.P. Moller – Maersk as a minority owner, so we can expect that fuel to be headed for the marine market.

MAP: World map showing upcoming or planned bio- and e-methanol plants by 2030. Methanol Institue via Gena Solutions

MAP: World map showing upcoming or planned bio- and e-methanol plants by 2030. Methanol Institue via Gena Solutions

Do you foresee a geographical imbalance between green methanol production and global bunkering hubs? Could this imbalance ultimately drive up the delivered cost of the fuel by necessitating long-haul methanol cargo shipments?

Bunkering capacity for methanol is increasing. According to Clarksons data, dedicated methanol bunkering facilities are available at 20 ports [worldwide], with another 15 under development. The locations of these facilities are the ports of call for the first movers in methanol adoption, mainly liner operators, whose schedules mean that capacity can reflect well-established trade patterns.

Methanol is different from the current refined oil products and bunker fuel trades in that the molecule is the same wherever it is produced, with no quality issues. Its liquid state and simple handling mean costs for infrastructure are low, and existing fuel oil bunker suppliers can easily convert existing supply to handle methanol as demand increases.

With methanol as an established internationally traded commodity, there are unlikely to be many obstacles to shipping it at predictable cost to wherever it is needed. Like the current use of biofuels in shipping, we may see low-carbon or renewable methanol produced in one region being shipped to the nearest major bunkering hub, which does come at some cost. For example, renewable methanol produced in Chinese provinces may be moved to Shanghai for aggregation, and then forward-shipped to the world’s largest bunkering hub, Singapore.

Do you see China emerging as a leader in methanol bunkering, or will adoption be limited to domestic short-sea routes?

Probably both, for similar reasons. As one end of the route linking global supply container and raw materials chains, China can serve as a competitive bunkering location for international deep-sea vessels, including container ships, tankers and bulk carriers currently capable of operating on methanol, and those still to be delivered.

The commitments made by [shipping companies like] COSCO and China Shipping to build methanol-capable vessels is evidence that their strategy has methanol as a key fuel. The Port of Shanghai wants to be a global bunkering hub for green methanol with a methanol bunkering target of 3 million mt/year by 2030.

At the same time, [domestic factors are also at play and] the requirement to reduce pollution and lower carbon emissions means that smaller river and coastal tonnage can adopt methanol at low cost and be assured of local supply.

We have seen in the work supported by MI that ships from the smallest pilot boats to barges, short sea and offshore vessels, all the way to the largest cargo ships, can run safely and efficiently on methanol. As arguably the world’s most influential maritime nation, China is positioning itself as a leader in the adoption of methanol as a safe, clean marine fuel.

Could the changing regulatory environment in the US slow down green methanol production and future investments in the region?

In the short term, we may see a slowdown. But we should remember that administrations serve limited terms and energy producers – as well as their customers – prefer certainty against which to make investment plans.

It is worth remembering that although the new Trump administration is likely to reduce regulation around oil drilling and oil production, US fossil fuel output is already high: it hit record levels in 2024. So, we are likely to see increased investment across the board, which could include petrochemicals –such as methanol, – as much as it will LNG and oil production.

For instance, HIF Global is planning new e-fuel projects in the US with energy construction projects in the country. It will start in Matagorda, Texas, taking advantage of energy-abundant, established CO2 networks and skilled labour markets. It is also planning additional investments in US ports to provide distribution networks for e-fuels in the US and globally.

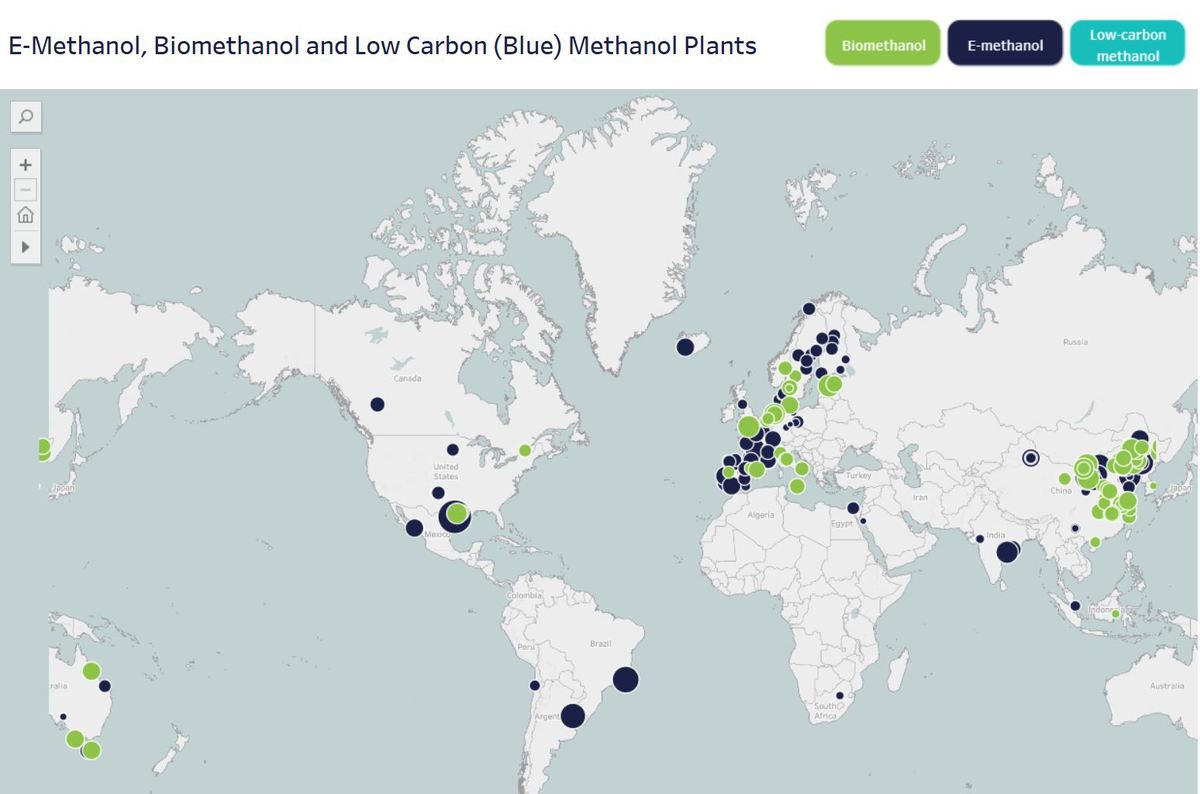

How does projected green methanol supply compare to expected bunker demand by 2035?

Our low-carbon and renewable methanol project database currently tracks 226 projects worldwide, representing 45.8 million mt of low-carbon and renewable [bio- and e-] methanol under development or already in operation.

Of course, not every project will come to fruition, but even if just 25–50% of the projects materialises, it would significantly expand green methanol availability. This will be needed, as hundreds of methanol-capable vessels are scheduled to enter service over the next decade, providing demand for millions of mt of low-carbon and renewable methanol.

By Konica Bhatt

Please get in touch with comments or additional info to news@engine.online

Contact our Experts

With 50+ traders in 12 offices around the world, our team is available 24/7 to support you in your energy procurement needs.