East of Suez Fuel Availability Outlook 8 Apr 2025

VLSFO and LSMGO availability good in Port Klang

Bunker availability improves in Zhoushan

Several South Korean ports brace for weather disruptions

PHOTO: Tugboat helps to turn around a large container ship on its way out of the Port of Busan, South Korea. Getty Images

PHOTO: Tugboat helps to turn around a large container ship on its way out of the Port of Busan, South Korea. Getty Images

Singapore and Malaysia

VLSFO lead times in Singapore have shortened to 7–10 days, down from 8–13 days last week. LSMGO availability remains stable, with recommended lead times of 2–4 days. In contrast, HSFO lead times have increased to 7–11 days, up from 5–9 days previously.

However, adverse weather conditions may impact bunker deliveries at the port on Sunday.

According to recent data from Enterprise Singapore, the port's residual fuel oil stocks in March averaged 2% higher than in February, though total volumes stayed below 20 million bbls. This comes despite a significant 53% surge in net fuel oil imports—imports rose by 1.17 million bbls, while exports declined slightly by 257,000 bbls. Middle distillate inventories in Singapore also rose, averaging 2% higher in March compared to the previous month.

In Malaysia’s Port Klang, VLSFO and LSMGO remain readily available, with prompt deliveries possible for small quantities. However, HSFO supply continues to be tight.

East Asia

HSFO availability in Zhoushan has improved amid weak demand, with lead times dropping from 7–10 days last week to 5–7 days now. VLSFO and LSMGO lead times remain unchanged at approximately 5–7 days.

In Hong Kong, lead times for all fuel grades remain steady at around seven days, in line with recent weeks. However, bunker operations may face disruptions over the weekend due to expected adverse weather conditions.

In Taiwan, VLSFO and LSMGO supply remains stable across major ports including Hualien, Taichung, Kaohsiung and Keelung, with typical lead times of about two days.

Lead times for all fuel grades across several South Korean ports have decreased from 4–12 days last week, to 3–10 days now.

However, high waves and strong winds are expected to hamper bunker operations in Ulsan, Onsan and Yeosu between 12-14 April, Daesan and Taean between 12-13 April, and Busan between 10-14 April.

Rough weather may disrupt bunker deliveries in Vietnam’s Ho Chi Minh on 8 and 13 April, and in Hai Phong on 10 and 12 April.

South Asia

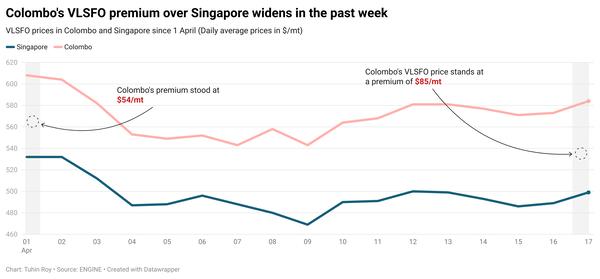

In Sri Lanka, suppliers in Colombo hold robust inventories of VLSFO and LSMGO, offering prompt deliveries. In Hambantota, both fuel grades are also available for immediate deliveries.

Middle East

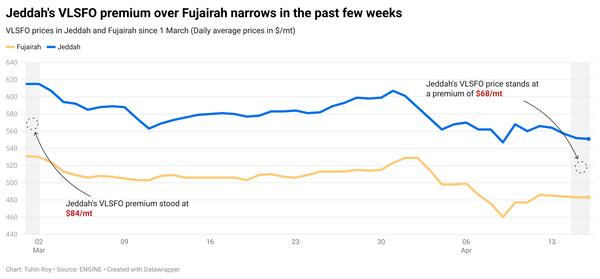

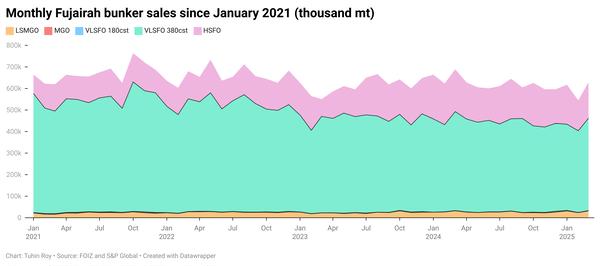

In Fujairah, prompt bunker supply remains limited, with lead times for all grades steady at 5–7 days, consistent with last week. Suppliers in Khor Fakkan report similar lead times.

Meanwhile, LSMGO remains readily available at Omani ports such as Sohar, Salalah, Muscat and Duqm.

By Tuhin Roy

Please get in touch with comments or additional info to news@engine.online

Contact our Experts

With 50+ traders in 12 offices around the world, our team is available 24/7 to support you in your energy procurement needs.