East of Suez Market Update 26 Mar 2025

LSMGO and HSFO prices in East of Suez ports have moved down, and availability of all grades is good in Zhoushan.

Changes on the day, to 17.00 SGT (09.00 GMT) today:

- VLSFO prices unchanged in Zhoushan, and down in Fujairah ($4/mt) and Singapore ($1/mt)

- LSMGO prices down in Zhoushan ($5/mt), Singapore and Fujairah ($3/mt)

- HSFO prices down in Singapore ($7/mt), Fujairah and Zhoushan ($6/mt)

- B24-VLSFO at a $208/mt premium over VLSFO in Singapore

- B24-VLSFO at a $234/mt premium over VLSFO in Fujairah

VLSFO prices in the three major Asian bunker ports have remained stable over the past day, with no significant changes. Zhoushan’s VLSFO price is at an $11/mt discount to Singapore and nearly at par with Fujairah.

VLSFO availability in Zhoushan has improved amid weak demand, reducing lead times from 3–5 days last week to about three days now. Lead times for LSMGO and HSFO have also shortened from 3–5 days to three days.

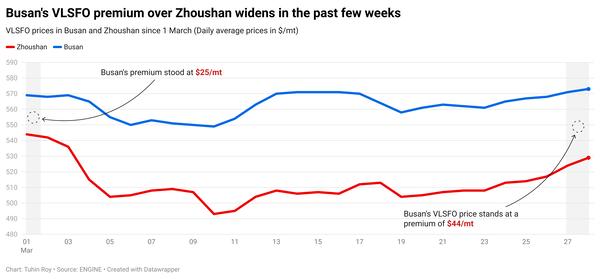

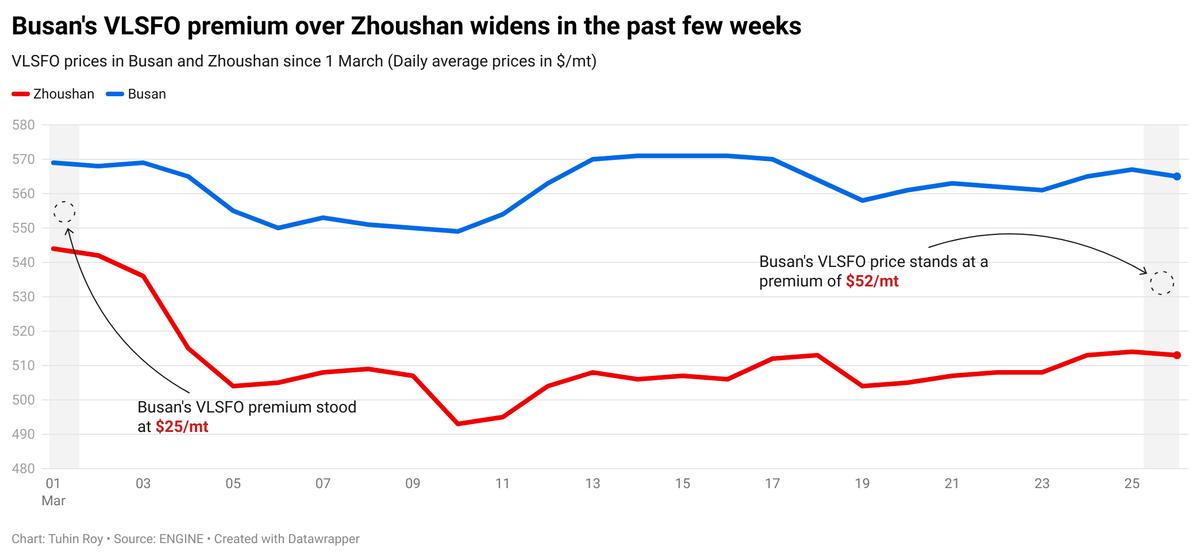

Meanwhile, Japan’s Busan continues to price its VLSFO at elevated levels compared to Zhoushan, with a premium of $52/mt.

In Japan, prompt VLSFO supply remains tight across multiple ports, including Tokyo, Chiba, Yokohama, Kawasaki, Osaka, Kobe, Sakai, Nagoya, Yokkaichi and Mizushima. LSMGO availability is stable, though securing prompt deliveries can be difficult in Osaka, Kobe, Sakai, Nagoya, Yokkaichi and Mizushima.

HSFO is readily available at Tokyo, Chiba, Yokohama and Kawasaki, but prompt supply remains constrained in Osaka, Kobe, Sakai, Nagoya, Yokkaichi and Mizushima. In Oita, all fuel grades are subject to availability.

Brent

The front-month ICE Brent contract has inched $0.08/bbl up on the day, to trade at $73.38/bbl at 17.00 SGT (09.00 GMT).

Upward pressure:

Brent’s price inched up after the American Petroleum Institute (API) reported a draw in US crude stocks.

US crude oil inventories fell by 4.6 million bbls in the week ending 21 March, according to API estimates. The reported drop in US crude inventories exceeded market expectations of a 2.5 million-bbl decrease.

“Numbers overnight from the American Petroleum Institute were bullish,” two analysts from ING Bank noted.

A decline in crude oil stocks typically signals strong oil demand, which can put upward pressure on Brent’s price.

Downward pressure:

Brent’s price gains were capped as oil traders and market analysts assessed the latest efforts to broker a ceasefire in the Russia-Ukraine conflict.

According to a Bloomberg report, officials from the US confirmed that Moscow and Kyiv have agreed to a partial ceasefire deal in the Black Sea, as the truce talks continue in Saudi Arabia.

“Oil prices slid after Russia and Ukraine agreed to a maritime ceasefire,” ING Bank’s analysts said.

A ceasefire deal between Russia and Ukraine could see the US lifting its sanctions on Russian oil exports, which in turn could increase global oil supply, according to market analysts.

By Tuhin Roy and Aparupa Mazumder

Please get in touch with comments or additional info to news@engine.online

Contact our Experts

With 50+ traders in 12 offices around the world, our team is available 24/7 to support you in your energy procurement needs.