The Week in Alt Fuels: The rise of biomethane

Emerging trends suggest that many shipping companies are strategically positioning themselves to benefit from FuelEU Maritime compliance.

PHOTO: Getty Images

PHOTO: Getty Images

For starters, one of FuelEU’s most noticeable impacts has been on liquefied biomethane (LBM), which has gained a significant price advantage under the regulation’s pooling mechanism, according to our estimates.

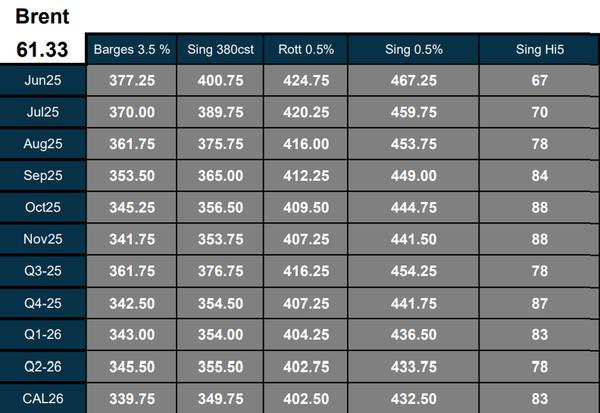

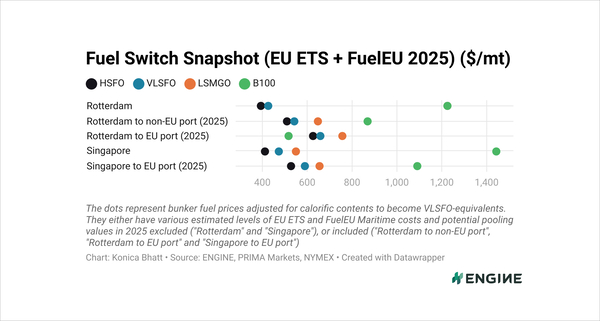

The theoretical overcompliance pooling benefits for LBM under FuelEU range from $546–681/mt, depending on the dual-fuel engine type and its methane slip. LBM also counts as zero-carbon in the EU Emissions Trading System (EU ETS), which means you don't have to pay to burn it.

These two EU regulations, in combination with a Dutch HBE rebate for LBM sold in the Netherlands, brings the the VLSFO-equivalent price of LBM in Rotterdam down to $452–587/mt. That makes it the most cost-effective compliant fuel for intra-EU voyages.

We have taken a conservative view and assume that the compliance surplus generated from using LBM on a vessel can be sold or transferred in a FuelEU pool for a value equivalent to be just compliant with the cheapest LNG compliance option. That value is then multiplied by the number of undercompliant vessels it can bring to a neutral compliance balance.

And bunker buyers with LNG- and LBM-capable vessels seem to be taking note of this, judging by the increased LBM bunkering activity in EU ports.

Norway’s United European Car Carriers (UECC) announced that it will not pass on FuelEU compliance costs to its customers. The pooling value from the compliance surplus it generates by burning biofuels and LBM across its fleet enables it to offset the higher bunker prices it pays for biofuels and LBM.

UECC struck a deal last year with Dutch LNG and LBM supplier Titan, expanding an existing supply agreement for mass-balanced LBM through most of 2025. It also secured an LBM stem from LBM supplier Naturgy in Spain, marking “the first physical molecule delivery of the fuel – instead of mass-balanced.”

Spanish energy firm Molgas started physical LBM deliveries in Zeebrugge in January, a sign that demand has picked up post-FuelEU implementation. The company has scheduled more deliveries in the coming weeks. Last month, it also supplied 200 mt of LBM in Mongstad, Norway.

Titan, which is part-owned by Molgas, recently delivered 500 mt of LBM to a Mitsui O.S.K. Lines (MOL) vessel in Zeebrugge. Spanish energy firm Enagás is gearing up to supply LBM in Barcelona and Huelva.

LNG supplier Gasum has secured a deal to continue supplying Norwegian energy firm Equinor’s tugboats, Borgøy and Bokn, throughout 2025.

Shell predicts that LBM will play a “growing role” in shipping, particularly as FuelEU targets tighten every five years from this year. LBM sales in Rotterdam reached 1,000 mt in 2024, up from zero in 2023.

Beyond LBM, moves are also being made in the methanol space. Two Dutch barge operators are preparing to meet future demand. UniBarge has secured a license to deliver methanol bunkers in the ARA hub, and TankMatch has obtained a long-term permit for methanol bunkering in Rotterdam.

Shore power is another voluntary compliance option, allowing ships to cut fuel consumption while docked, and shore power interest is on the rise.

According to DNV, the number of operational shore power terminals in the EU has risen from 96 in October 2024 to 130 now. The Cruise Lines International Association (CLIA) has reported a 23% increase in shore power-ready ships over the past year, with 147 vessels among its members now equipped.

Ships using wind technology can also earn rewards under FuelEU, based on speed and the power generated by wind-assisted systems. And shipowners appear to be warming up to this option.

There are currently over 60 ships equipped with wind-assisted propulsion, with 80 more on order and over 50 "announced but not yet confirmed," according to International Windship Association (IWSA) secretary general Gavin Allwright. He expects the number of installations to surpass 100 in the second half of 2025.

So, where do things stand? Early indications suggest that LBM bought in the Netherlands is emerging as the most cost-effective compliance option for EU-EU voyages. Suppliers are gearing up for methanol bunkering, while shore power and wind-assisted propulsion are gaining traction.

While it’s still too soon to call FuelEU a success or failure, one thing is clear: many companies are actively aligning with and making the most of the regulation. But the real test will come as compliance targets tighten in the coming years.

In other news this week, the Maritime Technologies Forum (MTF) has issued guidelines recommending shipping companies looking to use ammonia to upgrade their safety management systems. This is to address ammonia hazards and ensure safer operations. Shipping companies should develop new procedures for ammonia storage, handling and spill containment.

Denmark-based shipping companies are ready to invest in low-emission ships, but lack the green fuels to power them, according to Danish Shipping, which represents Danish shipowners. The organisation suggests allocating EU ETS revenue and national subsidies to stimulate more green fuel production.

The current IMO proposal for a global GHG Fuel Standard will make “pay-to-pollute” strategy financially attractive for shipowners and promote the use of LNG on ships, argues Morten Bo Christiansen, head of energy transition at Maersk. “Even adding a reward for low-emission energy sources will not change the highly beneficial business case for LNG versus low-emission fuels,” he said.

By Konica Bhatt

Please get in touch with comments or additional info to news@engine.online

Contact our Experts

With 50+ traders in 12 offices around the world, our team is available 24/7 to support you in your energy procurement needs.