Americas Market Update 12 Mar 2025

Bunker prices across the Americas have moved in mixed directions, and dense fog may disrupt bunkering operations in the US Gulf Coast this week.

PHOTO: Container vessels docked in Balboa Port under gray cloudscape. Getty Images

PHOTO: Container vessels docked in Balboa Port under gray cloudscape. Getty Images

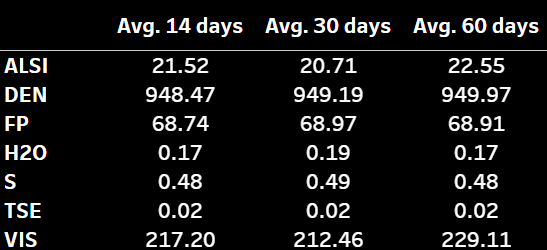

Changes on the day to 07.00 CST (13.00 GMT) today:

- VLSFO prices up in Houston, Los Angeles, Zona Comun ($3/mt) and Balboa ($1/mt), and down in New York ($5/mt)

- LSMGO prices up in Los Angeles ($4/mt), Houston ($1/mt), and down in New York ($9/mt) and Balboa ($3/mt)

- HSFO prices up in Los Angeles ($3/mt), down in Balboa ($20/mt), Houston ($6/mt) and New York ($3/mt)

Balboa’s HSFO price saw the sharpest decline, while its VLSFO price steadily increased. These diverging price movements have narrowed the port’s Hi5 spread from $94/mt on 3 November to $58/mt.

Los Angeles and Houston’s VLSFO price has gained in the past session, while prices have dipped in New York. Los Angeles’ VLSFO price has moved sharply above New York and Houston’s in the past month and is currently at premiums of $74-82/mt.

New York's LSMGO and VLSFO prices have declined. According to a source, suppliers are able to offer both fuel grades for prompt deliveries.

However, bunker operations at the East Coast port may face disruptions until 16 March due to high wind gusts.

A dense layer of fog has reduced visibility in US Gulf Coast ports. Bunker operations could be delayed this week, according to a source.

Brent

The front-month ICE Brent contract has gained $0.29/bbl on the day, to trade at $70.28/bbl at 07.00 CST (13.00 GMT).

Upward pressure:

Brent’s price inched up on the back of supply-related concerns after US Energy Secretary Chris Wright said that the Donald Trump-led US government is prepared to tighten sanctions on Iranian oil production, Bloomberg reports.

Besides, the US Energy Information Administration (EIA) has maintained its forecast for Brent’s price this year. It projects the Brent spot price to average around $74/bbl in 2025 amid decreasing crude oil production in Iran and Venezuela in the first half of this year.

Stricter sanctions on Iran and Venezuela’s oil and energy sectors will likely dent global oil production growth in the first and second quarters of 2025, the US energy agency said.

This news has supported Brent’s price as the sanctions are expected to bridge the gap between oil production and consumption in 2025, according to market analysts.

The EIA report “showed that surplus expectations for the market over 2025 and 2026 were reduced thanks to sanctions,” two analysts from ING Bank remarked. “The EIA now expects the global market to be in a 100k b/d [100,000 b/d] surplus in 2025, compared to a previous forecast for a surplus of 500k b/d [500,000 b/d],” they added.

Downward pressure:

Brent’s price gains were limited by a rise in US crude stocks, reported by the American Petroleum Institute (API).

Crude oil inventories in the US rose by 4.2 million bbls in the week that ended 7 March, the API estimated, while market participants were expecting a smaller build of 2.1 million bbls in the week.

“Numbers overnight from the American Petroleum Institute (API) were fairly bearish,” ING Bank’s analysts said. A rise in US crude stocks indicates weakness in oil demand, which can put downward pressure on Brent crude’s price.

Oil’s gains were also capped following media reports that Ukraine is ready to accept a US-brokered 30-day ceasefire deal with Russia. The news has raised expectations that Moscow’s crude oil may “start flowing freely on the international market,” ANZ Bank’s senior commodity strategist Daniel Hynes said.

However, there is still uncertainty over Russia’s stance on the proposed agreement.

By Gautamee Hazarika and Aparupa Mazumder

Please get in touch with comments or additional info to news@engine.online

Contact our Experts

With 50+ traders in 12 offices around the world, our team is available 24/7 to support you in your energy procurement needs.