Americas Market Update 10 Mar 2025

The region’s bunker prices have moved in mixed directions and bunkering operations at Zona Comun might be suspended due to rough weather. PHOTO: The Statue of Liberty seen from New York Harbor. Getty Images

PHOTO: The Statue of Liberty seen from New York Harbor. Getty Images

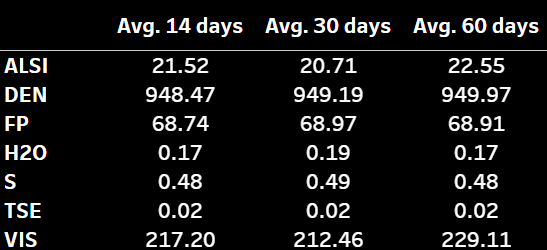

Changes on the day from Friday, to 07.00 CST (13.00 GMT) today:

- VLSFO prices up in Balboa ($11/mt), Houston ($7/mt) and Zona Comun ($3/mt), unchanged in New York, and down in Los Angeles ($1/mt)

- LSMGO prices up in Los Angeles ($8/mt), Houston ($6/mt) and Balboa ($3/mt), and down in New York ($9/mt)

- HSFO prices up in Houston ($2/mt), and down in Balboa ($7/mt), Los Angeles ($4/mt) and New York ($3/mt)

New York’s LSMGO prices have fallen, even as prices have risen across major Americas ports. At the start of the year, New York traded at a slight discount to Houston, but it has since shifted to a premium of $48/mt.

Bunker fuel availability remains strong across all grades in Houston, with no significant supply constraints. In New York, VLSFO and LSMGO continue to be readily available, with suppliers now advising shorter lead times of 3-5 days.

Visibility across most port locations in the Gulf of Mexico remains normal this week. However, areas like Galveston, Port Arthur, and Marsh Island may see reduced visibility due to moderate to high fog threats, especially between 13-14 March.

Argentina’s Zona Comun may suspend operations due to rough weather conditions. Strong wind gusts of over 20 knots are forecast at the anchorage through 12 March, a source says.

Bunker deliveries in Montreal are experiencing delays due to adverse weather, a situation expected to persist until 12 March. Barges are currently operating only during daylight hours, another source said.

Brent

The front-month ICE Brent contract has gained $0.20/bbl on the day from Friday, to trade at $70.73/bbl at 07.00 CST (13.00 GMT).

Upward pressure:

Brent’s price found little support after Kazakhstan’s Energy Minister Almassadam Satkaliyev said the government has instructed oil majors to cut production in an effort to stay within OPEC+’s designated output quotas, Reuters reported.

The country’s deputy energy minister Alibek Zhamauov said that oil production will be reduced through May 2025, as well as exports via the Caspian Pipeline Consortium (CPC), Kazakhstan’s biggest pipeline operator, will be slashed during the same period, the report added.

The country also plans on delaying the “full ramp-up of the Tengiz oil field to the second half of the year to comply with its OPEC+ quota,” VANDA Insights’ founder and analyst Vandana Hari remarked.

Downward pressure:

Brent crude’s price gains were limited by the impending threat of a US trade war with Canada, Mexico and China, driven by tariff uncertainties that have rattled financial markets and weighed on demand growth sentiment.

“Though [Brent] prices managed to creep back above US$70/bbl… tariff uncertainty is a key driver behind the weakness,” two analysts from ING Bank said.

Besides, a Bloomberg report on Friday suggested that Russian President Vladimir Putin is now open to a ceasefire deal with Ukraine, which could hopefully end the three-year-long conflict between Kyiv and Moscow.

A ceasefire deal between Russia and Ukraine could see the US lifting its sanctions on Russian oil exports, which in turn could increase global oil supply, according to market analysts.

“The US is reportedly exploring ways to swiftly ease energy sanctions on Russia if it agrees Ukraine ceasefire deal,” Hari added.

By Gautamee Hazarika and Aparupa Mazumder

Please get in touch with comments or additional info to news@engine.online

Contact our Experts

With 50+ traders in 12 offices around the world, our team is available 24/7 to support you in your energy procurement needs.