Singapore’s fuel oil stocks decline 18% despite higher net imports

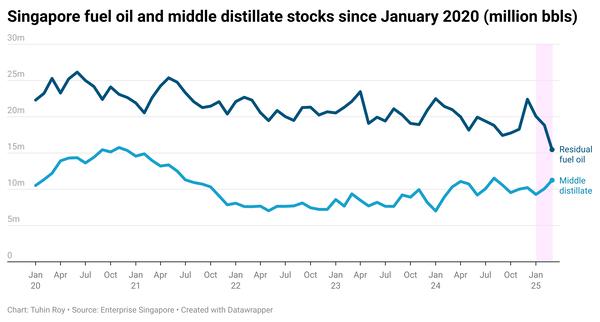

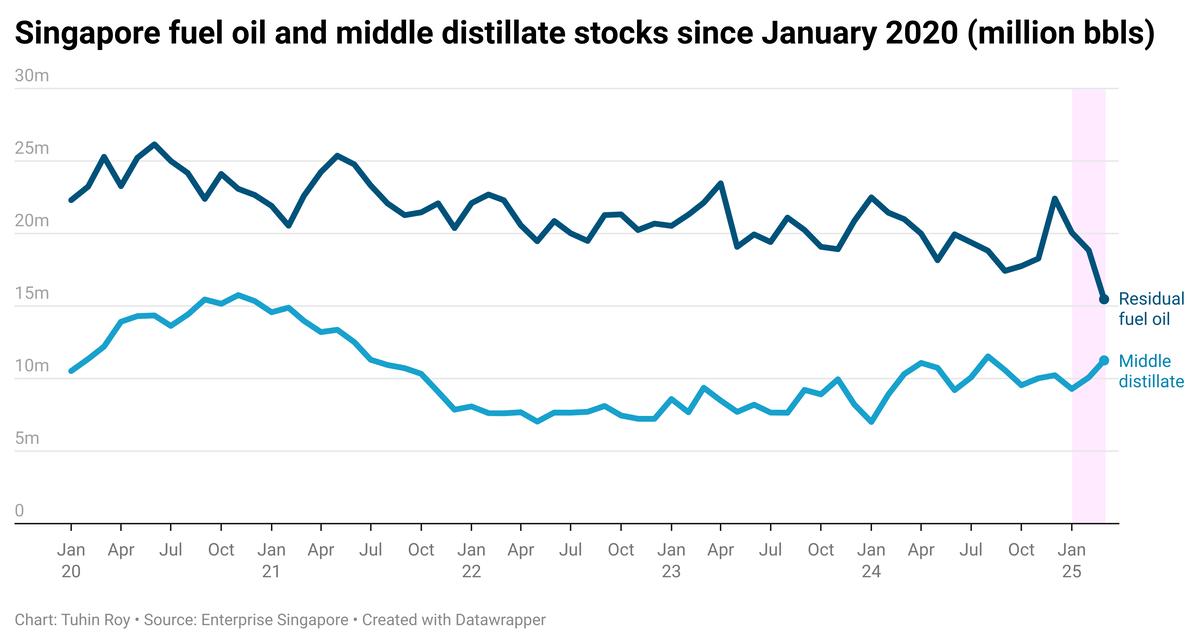

Singapore’s residual fuel oil stocks have averaged 18% lower so far in March than across February, Enterprise Singapore’s latest data shows.

Changes in monthly average Singapore stocks from February to March (so far):

- Residual fuel oil stocks down 3.38 million bbls to 15.47 million bbls

- Middle distillate stocks up 1.17 million bbls to 11.25 million bbls

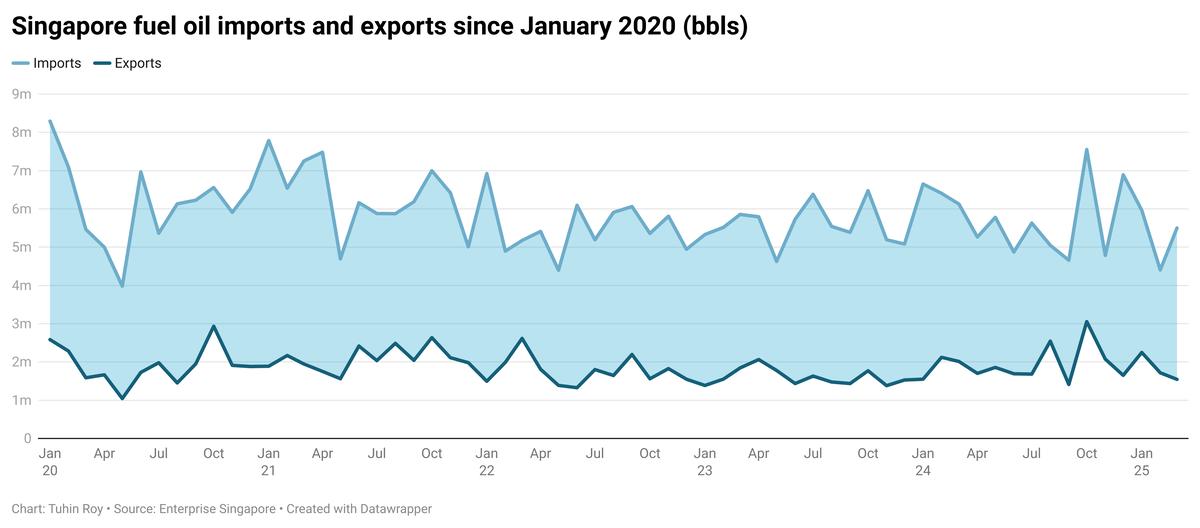

Singapore’s fuel oil stocks have dropped below 16 million bbls, despite a 47% increase in net fuel oil imports this month. Fuel oil imports have risen by 1.10 million bbls, while exports have declined by 171,000 bbls.

According to cargo tracker Vortexa, most fuel oil imports this month have come from Brazil (28%), Kuwait (15%) and Estonia (11%). Meanwhile, Singapore's fuel oil exports have primarily been sent to Malaysia (62%) and Sri Lanka (11%).

In contrast, the port’s middle distillate stocks have surged, averaging 12% higher so far this month.

Changes in Singapore fuel oil trade from February to March (so far):

- Fuel oil imports up 1.10 million bbls to 5.50 million bbls

- Fuel oil exports down 171,000 bbls to 1.55 million bbls

- Fuel oil net imports up 1.27 million bbls to 3.96 million bbls

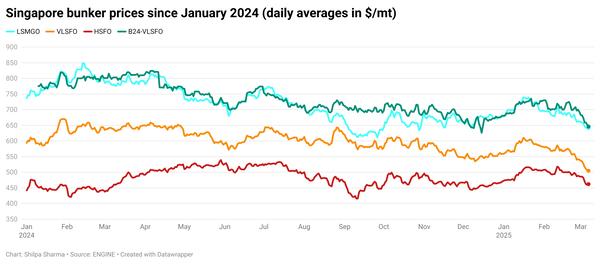

VLSFO bunker availability in Singapore has tightened, with lead times extending to 5–12 days, up from 2–10 days last week. LSMGO lead times have also increased, rising from 2–4 days to 5–9 days. In contrast, HSFO supply has improved, with lead times shortening from 2–10 days last week to 3–7 days now.

By Tuhin Roy

Please get in touch with comments or additional info to news@engine.online

Contact our Experts

With 50+ traders in 12 offices around the world, our team is available 24/7 to support you in your energy procurement needs.