Americas Market Update 6 Feb 2025

Bunker benchmarks across the Americas have moved in mixed directions, and strong wind gusts may cause more bunkering delays in Argentina’s Zona Comun.

Changes on the day, to 07.00 CST (13.00 GMT) today:

- VLSFO prices unchanged in Balboa, and down in Houston ($5/mt), Los Angeles ($4/mt) and New York ($2/mt)

- LSMGO prices up in Los Angeles ($4/mt) and New York ($2/mt), and down in Houston ($10/mt) and Balboa ($6/mt)

- HSFO prices up in Balboa ($1/mt), unchanged in Los Angeles, and down in New York ($4/mt) and Houston ($2/mt)

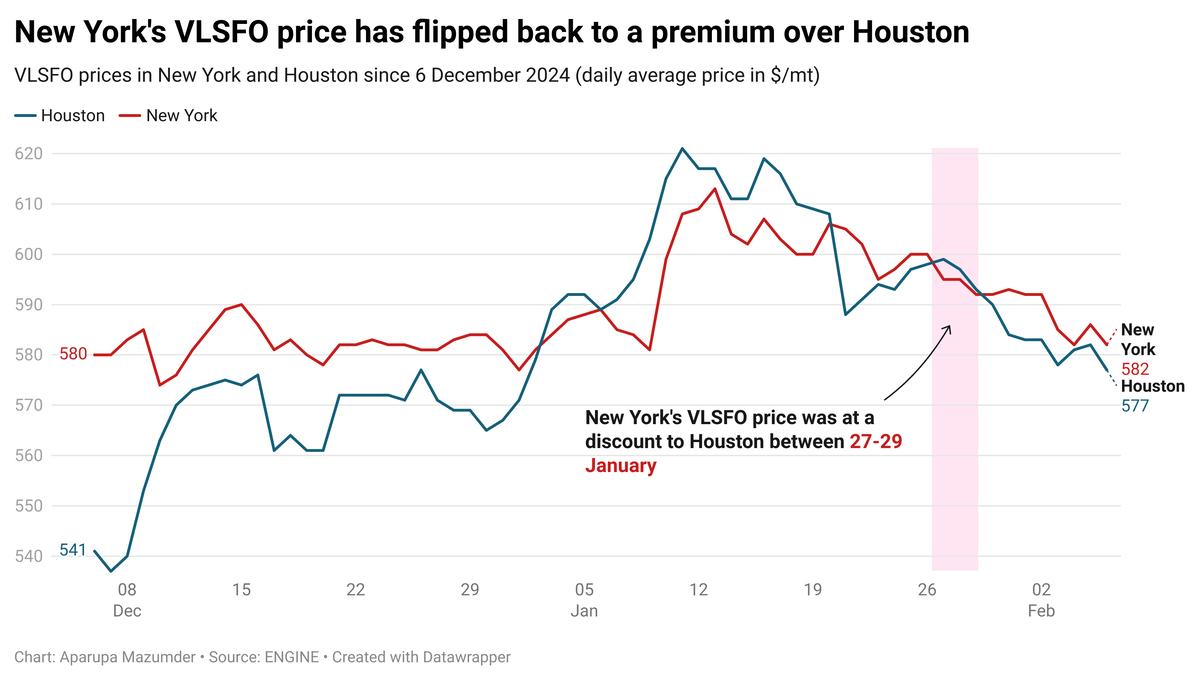

Houston’s VLSFO price has dropped the most in the past session. The grade’s price has also dropped in New York, narrowing the port’s VLSFO premium over Houston to $5/mt now.

Bunker fuel demand is good in Houston, and availability across all fuel grades is currently tight for prompt delivery dates. Suppliers can offer VLSFO and LSMGO stems with a lead time of at least seven days.

A dense layer of fog has reduced visibility in US Gulf Coast ports, delaying bunker operations around other ports including Corpus Christi, Freeport, Galveston, Port Arthur, Lake Charles, New Orleans Outer Anchorage (NOLA), Mobile, Tampa and Pascagoula.

On the West Coast, Los Angeles and Long Beach have seen good availability across all fuel grades, with suppliers recommending lead times of 5-7 days for VLSFO and LSMGO.

High wind gusts may delay bunker deliveries in Canada’s Montreal port between 6-8 February. Barges at the port are only working during daylight hours at the moment.

Further delays are expected in Argentina’s Zona Comun over the weekend. Strong wind gusts forecast between 6-8 February may suspend deliveries.

Brent

The front-month ICE Brent contract has lost $0.40/bbl on the day, to trade at $74.85/bbl at 07.00 CST (13.00 GMT).

Upward pressure:

US President Donald Trump's stance on the Middle Eastern conflict was widely expected to be strict, with global markets bracing for extensive sanctions against one of the biggest oil producers of the region – Iran.

Brent’s price has drawn support from the recent bout of sanctions that Washington has placed on Iranian crude, with an aim to drive Tehran’s oil exports to zero.

Besides, oil prices reacted to Trump’s surprising statement on the US gaining complete control over the Gaza strip. “Oil traders are raising an eyebrow at Trump’s bold proclamation to take over Gaza and relocate Palestinians to neighbouring countries,” SPI Asset Management managing partner Stephen Innes remarked.

Trump said that he plans to completely transform the war-torn enclave into the “Riviera of the Middle East”, where more than 47,000 civilians have been displaced over the last 16 months due to the Israel-Hamas conflict.

“Markets are treating it with skepticism for now, but if there’s even a whisper of U.S. military deployment in the Middle East, expect the risk dial to shift dramatically,” Innes added.

Downward pressure:

Brent futures shed the previous day’s gains after the US Energy Information Administration reported a massive build in US crude stocks.

Commercial US crude oil inventories surged 8.7 million bbls higher to touch 423 million bbls for the week ending 31 January, according to data from the EIA.

“Crude oil benchmarks trade heavily near recent lows after a large build in US inventories reported yesterday,” analysts from Saxo Bank said.

The stock build came despite a one percentage point increase in US refinery utilisation, which reached 84.5%.

Earlier in the week, the American Petroleum Institute (API) also reported a sizeable build of about 5.02 million bbls in US crude inventories during the same time. A surge in US crude stocks can indicate a drop in oil demand, which can cap Brent's price rise.

“Crude oil fell amid signs of weaker demand in the US,” ANZ Bank’s senior commodity strategist Daniel Hynes said. US crude oil inventories are "now at their highest level since November 2024. The weekly build was also the largest in nearly a year,” he added.

By Aparupa Mazumder

Please get in touch with comments or additional info to news@engine.online

Contact our Experts

With 50+ traders in 12 offices around the world, our team is available 24/7 to support you in your energy procurement needs.