East of Suez Market Update 4 Feb 2025

Prices in East of Suez ports have moved down, and prompt availability is tight across all grades in the UAE ports of Fujairah and Khor Fakkan.

Changes on the day, to 17.00 SGT (09.00 GMT) today:

- VLSFO prices down in Zhoushan ($20/mt), Singapore ($8/mt) and Fujairah ($6/mt)

- LSMGO prices down in Singapore ($6/mt), Fujairah ($4/mt) and Zhoushan ($3/mt)

- HSFO prices down in Zhoushan ($16/mt), Singapore ($7/mt) and Fujairah ($2/mt)

Zhoushan’s VLSFO price has dropped by $20/mt in the past day, the steepest decline among Asia’s three major bunker ports. This has brought its VLSFO to a $12/mt discount to Singapore, while its premium over Fujairah has been erased.

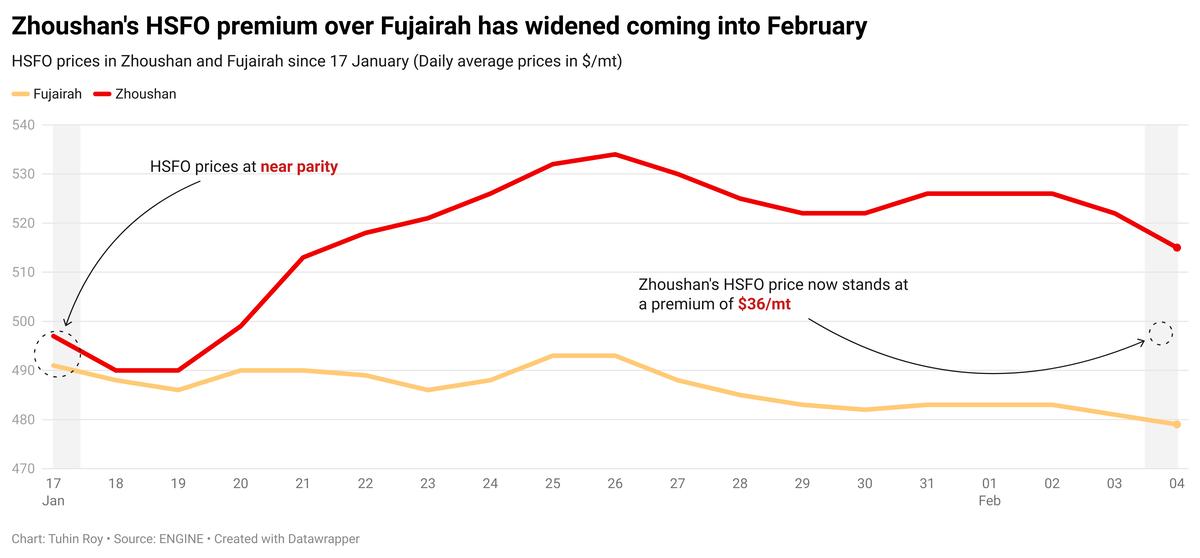

Zhoushan’s HSFO price has fallen by $16/mt. Despite this drop, HSFO stands at a premium of $36/mt over Fujairah and $16/mt over Singapore.

In Zhoushan, the recommended lead time for VLSFO and LSMGO deliveries has decreased to about four days, down from 7–9 days last week. HSFO supply remains tight, with lead times extending into mid-February due to low stocks with several suppliers.

In Fujairah, prompt availability remains tight despite weak demand, with lead times for all fuel grades holding steady at 5–7 days. Some suppliers can offer prompt stems at higher costs. Similarly, in Khor Fakkan, suppliers recommend lead times of 5–7 days for all grades.

Brent

The front-month ICE Brent contract has moved $1.50/bbl lower on the day, to trade at $74.94/bbl at 17.00 SGT (09.00 GMT).

Upward pressure:

Brent’s price found some support after OPEC+ announced yesterday to stick to its current production policy of gradually raising oil output from April.

At the previous ministerial gathering in December, the group decided to delay the unwinding of the 2.2 million b/d production cut to April 2025, from January 2025.

The unwinding of the group's voluntary production cut will take place on a monthly basis until the end of September 2026.

“OPEC+ held its Joint Ministerial Monitoring Committee (JMMC) meeting yesterday, and as widely expected the group recommended no change to its output policy,” two analysts from ING Bank said.

The decision to extend production cuts into 2025 signals that OPEC+ believes demand growth might not be robust enough to accommodate the full return of supply anticipated in 2025.

Downward pressure:

Brent’s price moved lower after Canada and Mexico came to a last-minute deal with the US, which will see tariffs postponed by at least a month.

Both Mexico and Canada agreed to put more resources on the shared US border to combat the fentanyl drug flow into the US. The delay has put some downward pressure on Brent’s price.

“The oil market gave back a lot of its gains yesterday after Mexico and Canada came to a deal with the US, which saw a delay in the implementation of tariffs,” ING Bank’s analysts said.

By Tuhin Roy and Aparupa Mazumder

Please get in touch with comments or additional info to news@engine.online

Contact our Experts

With 50+ traders in 12 offices around the world, our team is available 24/7 to support you in your energy procurement needs.