East of Suez Market Update 30 Jan 2025

Prices in key East of Suez ports have moved down, and VLSFO and HSFO availability is tight in Singapore.

Changes on the day, to 17.00 SGT (09.00 GMT) today:

- VLSFO prices down in Fujairah ($10/mt), Singapore ($8/mt) and Zhoushan ($5/mt)

- LSMGO prices down in Zhoushan ($14/mt), Singapore ($8/mt) and Fujairah ($7/mt)

- HSFO prices down in Fujairah and Zhoushan ($6/mt), and Singapore ($4/mt)

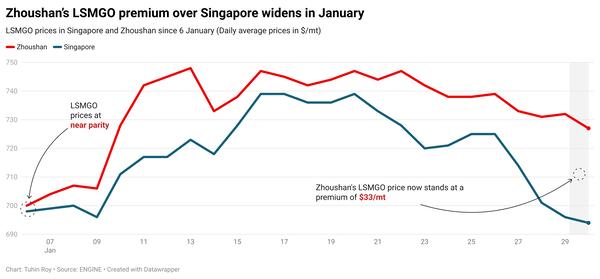

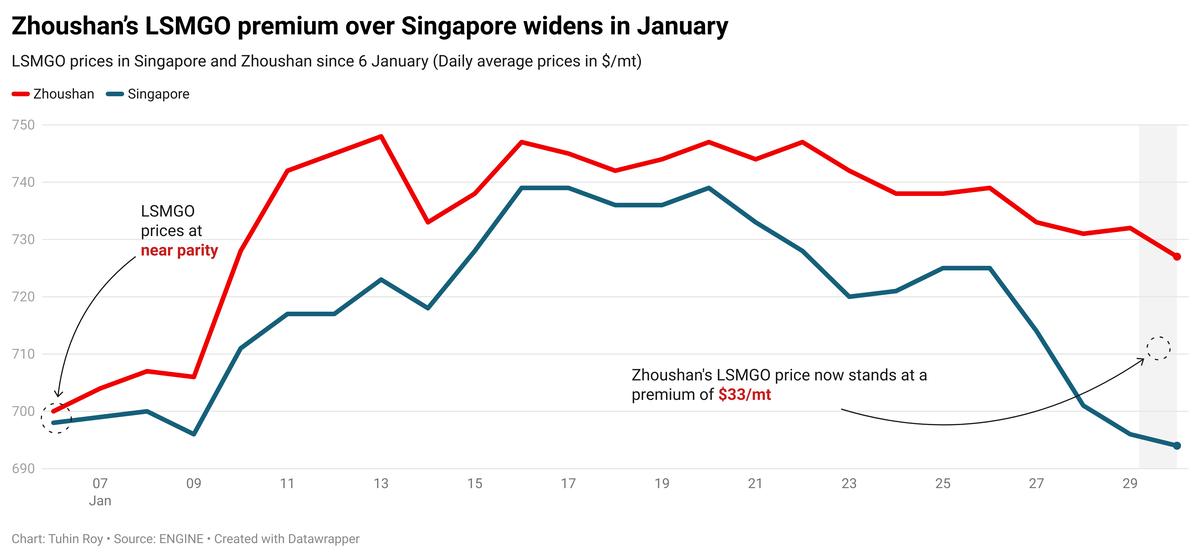

Zhoushan has recorded the steepest price drop for LSMGO among the three major Asian bunker ports. It has fallen to a $32/mt discount to Fujairah, and narrowed its premium over Singapore to $33/mt.

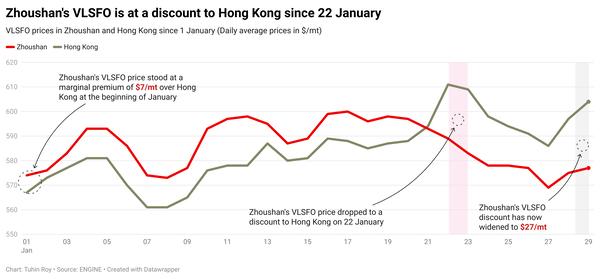

Fujairah's VLSFO price fall has outpaced those of the other two ports in the past day. It is now at discounts of $5/mt to Zhoushan and $12/mt to Singapore.

Lead times for VLSFO and LSMGO deliveries in Zhoushan remain at 7-9 days, unchanged from last week. HSFO availability has tightened due to low stock levels among several suppliers, pushing recommended lead times into mid-February. Last week, HSFO lead times were around 5-7 days.

Bunker demand in Zhoushan remains subdued due to the Chinese New Year holidays, which will last until 4 February, with most suppliers not accepting new orders.

In Singapore, VLSFO availability remains tight, with lead times steady at 7-11 days. HSFO lead times have risen from 7-9 days last week to 10-12 days now, while LSMGO lead times have improved from 5-7 days to 3-6 days.

Brent

The front-month ICE Brent contract has moved $0.93/bbl lower on the day, to trade at $76.18/bbl at 17.00 SGT (09.00 GMT).

Upward pressure:

Brent crude oil has regained some ground this week amid uncertainty around US tariffs on Canada and Mexico.

The two countries, which are still the US’ biggest trading partners, could avoid new levies if they act on illegal migration and fentanyl drug flows, US President Donald Trump has said.

“Earlier in the day, crude oil prices rallied on expectations that the tariffs will go into effect this weekend,” ANZ Bank senior commodity strategist Daniel Hynes remarked.

Downward pressure:

Demand for oil has been relatively slow in top consumers like the US and China so far this year, according to market analysts.

Commercial US crude oil inventories gained 3.5 million bbls to touch 415 million bbls for the week ending 24 January, according to data from the US Energy Information Administration (EIA).

A surge in US crude stocks can indicate a drop in oil demand, which can contribute to cap Brent's price rise. This was the first weekly rise in inventories this year.

“US weekly inventory numbers from the EIA yesterday remained fairly bearish for the oil market,” two analysts from ING Bank said.

Brent has traded less than usual due to the Lunar New Year holiday break in China and several southeast Asian countries.

“Trading volumes were relatively subdued as the Chinese market has been closed for the Lunar New Year Holidays,” ING Bank’s analysts said.

By Tuhin Roy and Aparupa Mazumder

Please get in touch with comments or additional info to news@engine.online

Contact our Experts

With 50+ traders in 12 offices around the world, our team is available 24/7 to support you in your energy procurement needs.