East of Suez Market Update 29 Jan 2025

Most prices in East of Suez ports have been rangebound, and HSFO availability is tight in Zhoushan.

Changes on the day, to 17.00 SGT (09.00 GMT) today:

- VLSFO prices up in Fujairah ($3/mt), and unchanged in Singapore and Zhoushan

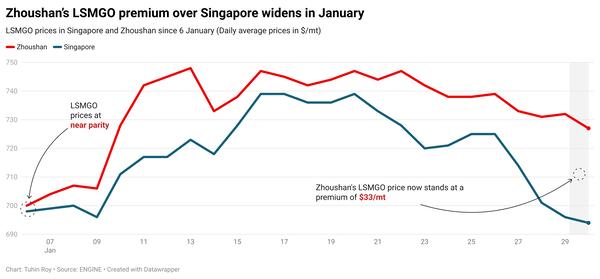

- LSMGO prices up in Zhoushan ($8/mt) and Fujairah ($2/mt), and down in Singapore ($1/mt)

- HSFO prices up in Singapore ($2/mt) and Fujairah ($1/mt), and unchanged in Zhoushan

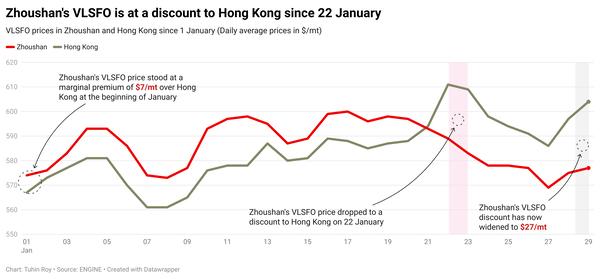

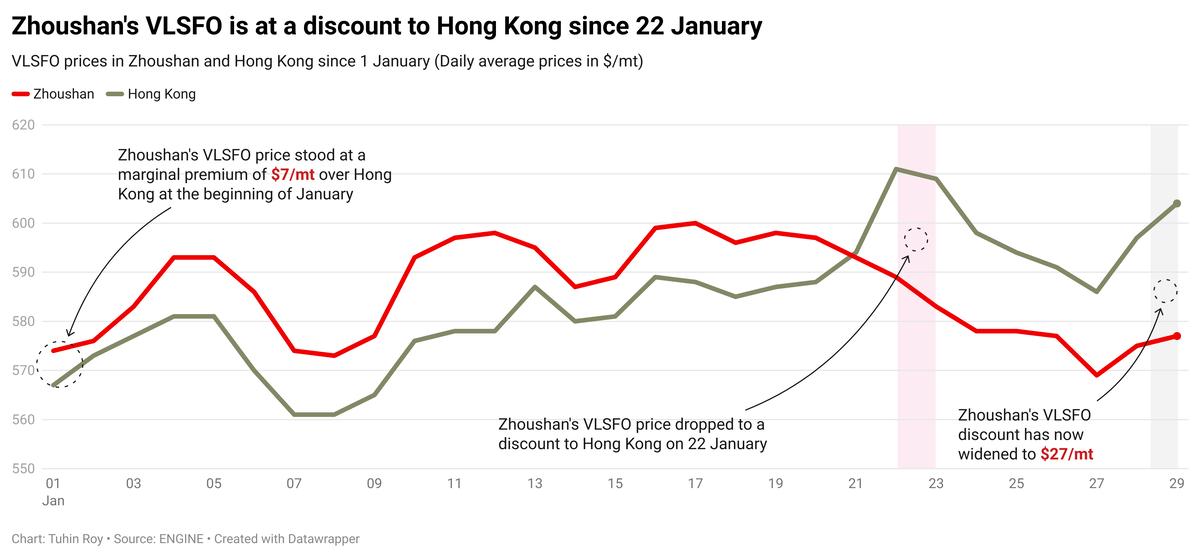

VLSFO prices across East of Suez ports have remained largely stable for the third straight day. Zhoushan’s VLSFO price is a $10/mt discount to Singapore and at a near-parity level with Fujairah.

Lead times in Zhoushan for VLSFO and LSMGO deliveries are 7–9 days, unchanged from last week. However, HSFO availability has tightened, with lead times now stretching into mid-February due to low stock levels among several suppliers. Last week, HSFO lead times were around 5–7 days.

Bunker demand in Zhoushan remains subdued due to the Chinese New Year holidays until 4 February. Most suppliers will not accept new orders during this period.

Hong Kong’s VLSFO price is at a $27/mt premium over Zhoushan. Lead times for all fuel grades in Hong Kong remain steady at about seven days. However, bunker deliveries could face disruptions on 30–31 January, when adverse weather conditions are forecast.

Brent

The front-month ICE Brent contract has lost $0.50/bbl on the day, to trade at $77.11/bbl at 17.00 SGT (09.00 GMT).

Upward pressure:

Concerns over whether US President Trump could impose new taxes, tariffs and sanctions against Russia have lent some support to Brent.

The oil market’s attention will be on the US Federal Reserve’s policy meeting, market analysts said. “[The] looming tariffs could disrupt the Treasury rally… adding another layer of complexity to the Fed's calculation,” SPI Asset Management managing partner Stephen Innes said.

Market participants also await OPEC’s upcoming ministerial meeting on 3 February, where key members are expected to stick to current production levels, with the aim to support oil prices.

“The [oil] market expects OPEC to stick with its current policy, with supply curbs to continue this quarter before unwinding them from April,” ANZ Bank senior commodity strategist Daniel Hynes remarked.

Downward pressure:

Brent has moved lower as demand concerns gripped the world's top two oil consumers: the US and China.

Crude oil inventories in the US rose by about 2.9 million bbls in the week that ended 24 January, according to the American Petroleum Institute (API).

A surge in US crude stocks can indicate a drop in oil demand, which can cap Brent's price rise. “Overall prices trade a tad softer after… API reported a weekly increase in US stockpiles,” analysts from Saxo Bank said.

China's Manufacturing Purchasing Managers' Index (PMI) came in at 49.1 for January, well below market expectations.

A PMI below 50 signals a contraction in economic activity, and could reflect weaker economic health and potentially reduced demand for commodities like oil.

By Tuhin Roy and Aparupa Mazumder

Please get in touch with comments or additional info to news@engine.online

Contact our Experts

With 50+ traders in 12 offices around the world, our team is available 24/7 to support you in your energy procurement needs.