Europe & Africa Market Update 21 Jan 2025

Bunker benchmarks in European and African ports have moved in mixed directions, and bunkering is partially suspended in Huelva.

Changes on the day to 09.00 GMT today:

- LSMGO prices up in Rotterdam ($5/mt) and Gibraltar ($1/mt)

- VLSFO prices down in Rotterdam, Durban ($8/mt) and Gibraltar ($2/mt)

- HSFO prices unchanged in Gibraltar, and down in Rotterdam ($4/mt)

- Rotterdam B30-VLSFO at a $203/mt premium over VLSFO

Rotterdam’s LSMGO price has increased some. A higher-priced prompt LSMGO stem booked in Rotterdam in the past day has pushed the benchmark higher.

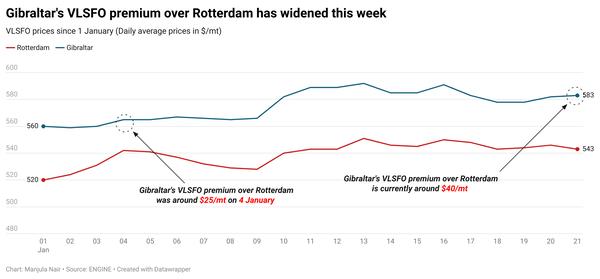

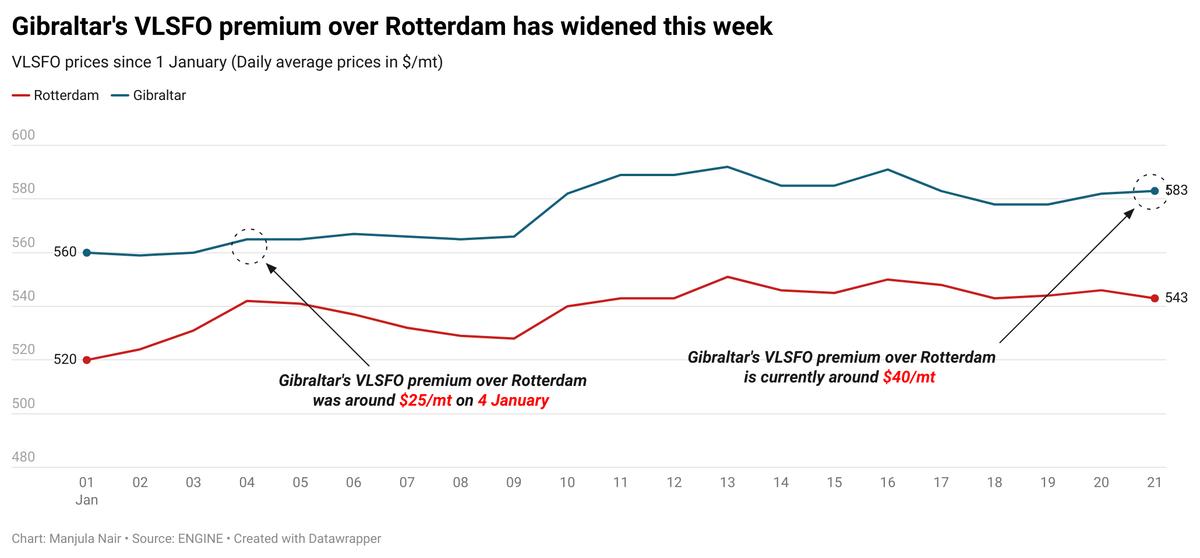

Bunker prices have mostly held steady in Gibraltar. The port's VLSFO price has edged down, while the grade's price in Rotterdam has increased some. These diverging price moves have widened Gibraltar’s premium over Rotterdam by $6/mt to around $40/mt now.

Congestion has slightly eased in Gibraltar, with five vessels waiting for bunkers today, down from six yesterday, according to port agent MH Bland. Bunkering is proceeding normally in the nearby Ceuta port, where 10 vessels are due to arrive today, said shipping agent Jose Salama & Co. A supplier is facing 6-8 hours of delay in Ceuta.

Meanwhile, bunkering is partially suspended in Spain’s Huelva, MH Bland said. Bunkering operations in the port have been suspended since Monday afternoon due to bad weather conditions. Bunker deliveries by barge can still take place at the anchorage area. Strong wind gusts of up to 32 knots are forecast in Huelva today.

Brent

The front-month ICE Brent contract has lost $1.05/bbl on the day, to trade at $79.42/bbl at 09.00 GMT.

Upward pressure:

Oil prices have found some support from the latest positions data, as money managers and hedge funds increased their net-long bets on ICE Brent futures over the last reporting week, driven by fresh buying in the global oil market.

Speculators bought about 27,000 lots as of last Tuesday to leave them with net-long positions in Brent futures of 254,000 lots, according to futures and options data from ICE Futures Europe.

The surge in buying came amid growing supply-related concerns from Russia, following stricter US sanctions against the country’s energy sector. “Investors have built the most bullish position in petroleum for nearly nine months, anticipating US sanctions will reduce exports from Russia and Iran and cause inventories to deplete even faster,” independent market analyst John Kemp remarked.

When speculators boost their net-long positions, oil prices typically rise. Conversely, when they reduce these positions, prices tend to decline, leading to a cycle where their actions can influence the market and oil prices.

Downward pressure:

Brent’s price has shed over $1/bbl following Donald Trump’s inaugural speech as the 47th US President. His speech has reassured oil investors of a US supply influx this year.

“Crude oil fell as Trump promised to boost US crude production. He reiterated his goal to encourage more output by cutting red tape and allowing drilling on previously banned federal lands,” ANZ Bank’s senior commodity strategist Daniel Hynes said.

The potential tariffs on Canada and Mexico could reduce some supply to the US. However, incentives aimed at increasing domestic production will help offset these concerns, according to market analysts.

“Donald Trump signed a flurry of executive orders hours after taking oath as US President on Monday. Nearly all the measures that are directly or indirectly material for the oil markets are slow-burn and may prompt a knee-jerk reaction in crude futures,” VANDA Insights’ founder and analyst Vandana Hari remarked.

By Manjula Nair and Aparupa Mazumder

Please get in touch with comments or additional info to news@engine.online

Contact our Experts

With 50+ traders in 12 offices around the world, our team is available 24/7 to support you in your energy procurement needs.