Europe & Africa Market Update 16 Jan 2024

Bunker benchmarks in European and African ports have tracked Brent’s upward movement, and LSMGO is still dry in Durban.

Changes on the day to 09.00 GMT today:

- VLSFO prices up in Durban ($28/mt), Gibraltar ($12/mt) and Rotterdam ($8/mt)

- LSMGO prices up in Gibraltar ($24/mt) and Rotterdam ($13/mt)

- HSFO prices up in Rotterdam ($8/mt) and Gibraltar ($6/mt)

- Rotterdam B30-VLSFO at a $215/mt premium over VLSFO

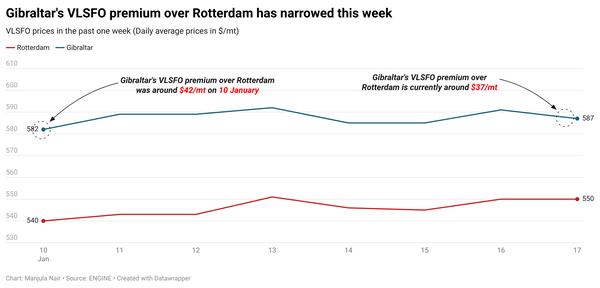

Gibraltar’s HSFO price gain was capped by a lower-priced stem booked for non-prompt delivery in the past day. The port’s VLSFO price has moved up by a sharp $12/mt. These price moves have widened Gibraltar’s Hi5 spread slightly, from $54/mt yesterday to $60/mt now.

Congestion has eased in Gibraltar, with two vessels waiting for bunkers compared to eight vessels yesterday, according to port agent MH Bland. Algeciras is witnessing supplier delays with a supplier reporting a delay of 12-18 hours, the port agent said.

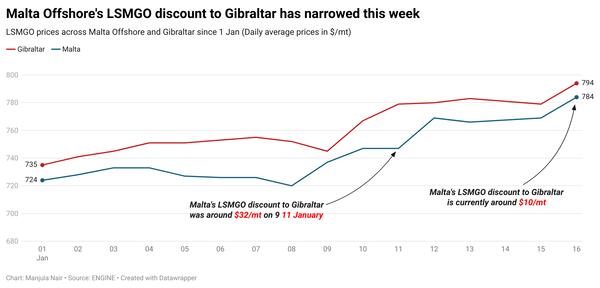

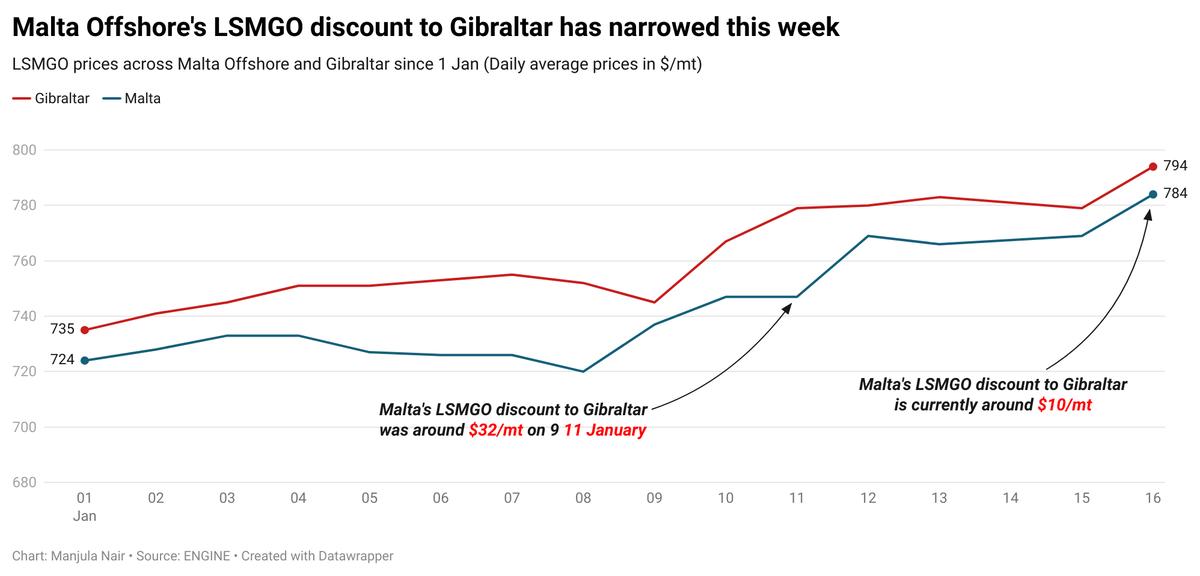

Malta Offshore's LSMGO price, which was at a steep discount to Gibraltar's LSMGO last week, has narrowed this week. Malta's LSMGO price is currently trading at a $10/mt discount to Gibraltar. Availability of all grades is normal off Malta, with lead times of 3-4 days advised, a trader told ENGINE.

Supplier delays are expected off Malta today, MH Bland says. Rough weather off Malta may cause bunkering delays over the next two days, with strong wind gusts of up to 39 knots forecast on Friday, MH Bland said.

Brent

The front-month ICE Brent contract has gained $1.78/bbl on the day, to trade at $81.82/bbl at 17.00 SGT (09.00 GMT).

Upward pressure:

The Brent crude price has moved higher as oil demand growth in the world’s largest consumer got a cheer following a decline in weekly US crude stocks.

Commercial US crude oil inventories declined by 1.96 million bbls to touch 412 million bbls for the week ending 10 January, according to data from the US Energy Information Administration (EIA).

“The US Energy Information Administration’s data for the week ended January 10 also lent some support to crude on Wednesday, showing the eighth consecutive drop in commercial crude stockpiles, to 33-month lows,” VANDA Insights’ founder and analyst Vandana Hari remarked.

Besides, oil reacted positively to the “relatively soft” US inflation data, which has opened the window for interest rate cuts by the US Federal Reserve (Fed) this year, as it tries to bring inflation under its 2% target.

The change in the US inflation rate, based on the Consumer Price Index (CPI), rose by 0.4% in December, edging up from the 0.3% increase recorded in the previous month.

“The US CPI data came in somewhat better than anticipated, registering a modest relief in inflation pressures, with a core print slightly below expectations,” SPI Asset Management managing partner Stephen Innes said.

Downward pressure:

Brent felt some downward pressure as Israeli Prime Minister Benjamin Netanyahu’s war cabinet and the Iran-backed Hamas armed group reportedly reached a six-week initial ceasefire deal.

It will start with the gradual withdrawal of the Israeli army from the Gaza Strip, in exchange for Hamas releasing the Israeli civilians it took hostage on 7 October 2023, according to media reports.

The news has removed some risk appetite from the oil market, as it eased concerns about the possibility of a full-scale war between Israel and Iran, one of the largest OPEC+ oil producers, according to market analysts.

By Manjula Nair and Aparupa Mazumder

Please get in touch with comments or additional info to news@engine.online

Contact our Experts

With 50+ traders in 12 offices around the world, our team is available 24/7 to support you in your energy procurement needs.