Americas Market Update 20 Jan 2025

Bunker benchmarks have largely gained in key Americas ports, and high wind gusts have suspended bunker deliveries in the Galveston Offshore Lightering Area (GOLA).

Changes on the day from Friday, to 07.00 CST (13.00 GMT) today:

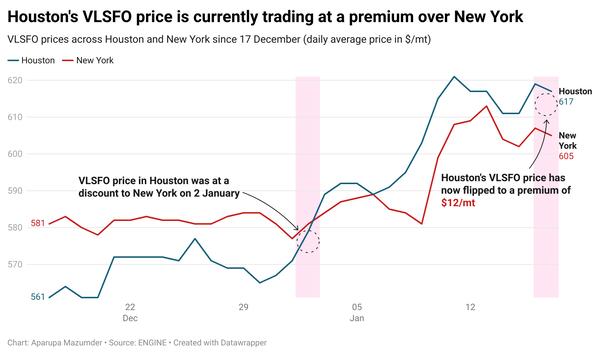

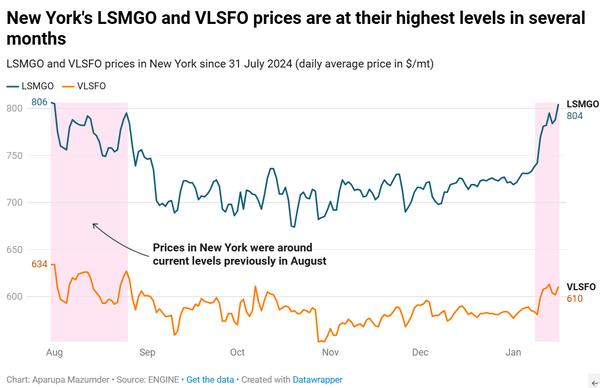

- VLSFO prices up in Los Angeles ($12/mt), New York ($11/mt), Zona Comun ($9/mt), Houston ($4/mt) and Balboa ($1/mt)

- LSMGO prices up in Houston ($14/mt) and New York ($10/mt), and down in Balboa ($5/mt)

- HSFO prices up in New York ($8/mt) and Houston ($5/mt), and unchanged in Balboa

Regional bunker fuel prices have largely tracked Brent’s upward movement, with LSMGO prices gaining the most in Houston and New York.

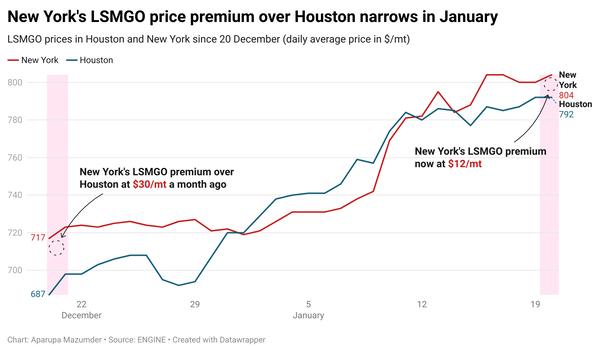

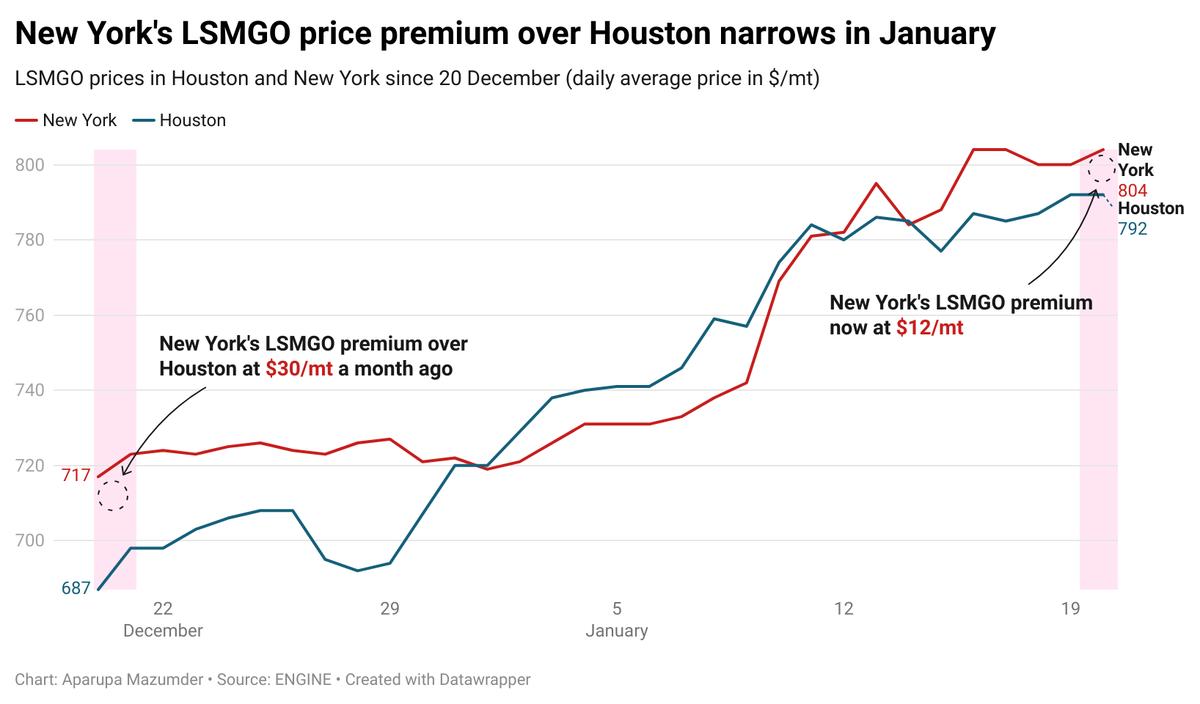

A higher-priced 50-150 mt LSMGO stem fixed in Houston at $799/mt for prompt delivery on Saturday put upward pressure on the benchmark. This has narrowed Houston’s LSMGO price discount to New York from $30/mt a month ago, to $12/mt now.

High wind gusts around Houston could delay barge operations. Rough weather conditions are currently impacting most of the US Gulf Coast ports, according to a source. The situation is expected to worsen this week as the “Arctic Front starts proceeding through [the] area,” the source said.

On the West Coast, prompt availability across all grades in Los Angeles and Long Beach has improved in January, with suppliers advising lead times of less than seven days for VLSFO and LSMGO.

Bad weather conditions are expected to delay bunker barge reloadings and bunker deliveries at Zona Comun until 21 January, according to another source. Prompt VLSFO availability is tight at the anchorage, with expected lead times of around seven days.

Brent

The front-month ICE Brent contract has moved $0.45/bbl higher on the day from Friday, to trade at $80.70/bbl at 07.00 CST (13.00 GMT).

Upward pressure:

The latest round of extensive US sanctions against Russia’s energy sector, targeting the country’s major oil and tanker companies have fuelled some supply concerns in the global oil market, thereby supporting Brent's price.

“The market was already displaying signs of tightening before the outgoing Biden administration imposed the most sweeping round of sanctions to date on the 'shadow fleet' of tankers exporting crude from Russia,” independent market analyst John Kemp remarked.

The new sanctions are already prompting many Asian buyers to look for other alternatives. It could impact nearly 1 million b/d of Russian crude oil exports, according to market analysts.

“Last week an Indian bureaucrat told the media that sanctioned vessels won’t be allowed to discharge at India’s ports,” ANZ Bank senior commodity strategist Daniel Hynes said.

“In China, companies have been snapping up cargo from the Middle East, after Chinese ports were urged to forbid sanctioned oil tankers from docking or unloading at their terminals,” he added.

Downward pressure:

The ceasefire deal achieved in Gaza after 15 months of relentless conflict, and right ahead of president-elect Donald Trump's swear-in ceremony into the White House has taken some risk appetite off the oil market and capped Brent’s price rise.

There is a “fair amount of uncertainty” across financial markets, ahead of Trump's presidential inauguration later today, two analysts from ING Bank remarked. “This combined with it being a US holiday today, means that some market participants may have decided to take some risk off the table,” they added.

Additionally, Iran-aligned Houthi militants announced yesterday a temporary halt on all armed operations against commercial vessels transiting the Red Sea, except Israeli-owned or -flagged ships.

The Houthis will stop attacking commercial and cargo vessels transiting the crucial Red Sea trade route and the Bab al-Mandab transit as a ceasefire deal has been reached in the Gaza Strip, the Yemeni armed group’s spokesperson Mohammed al-Bukhaiti said on social media platform X (formerly Twitter).

Oil prices retreated as the “Yemen-based Houthis signaled a pause in their months-long attacks on commercial ships following a ceasefire deal between Israel and Hamas,” Price Futures Group senior market analyst Phil Flynn commented.

By Aparupa Mazumder

Please get in touch with comments or additional info to news@engine.online

Contact our Experts

With 50+ traders in 12 offices around the world, our team is available 24/7 to support you in your energy procurement needs.