Americas Market Update 17 Jan 2025

Bunker benchmarks in key Americas ports have moved in mixed directions, and high wind gusts could disrupt bunkering operations in US Gulf Coast ports until 22 January.

Changes on the day, to 07.00 CST (13.00 GMT) today:

- VLSFO prices up in Zona Comun ($5/mt), and down in Balboa ($3/mt), Houston, New York and Los Angeles ($2/mt)

- LSMGO prices down in Balboa ($7/mt), Houston ($2/mt) and New York ($1/mt)

- HSFO prices up in New York ($6/mt) and Houston ($2/mt), and down in Balboa ($3/mt)

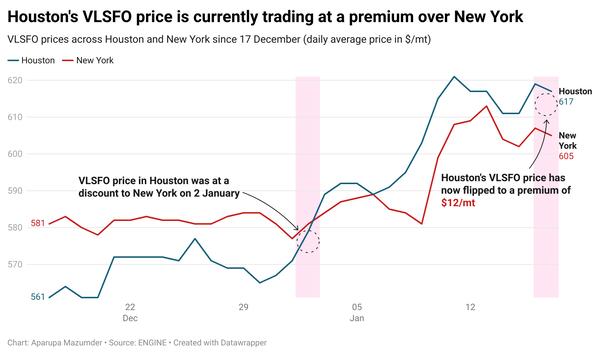

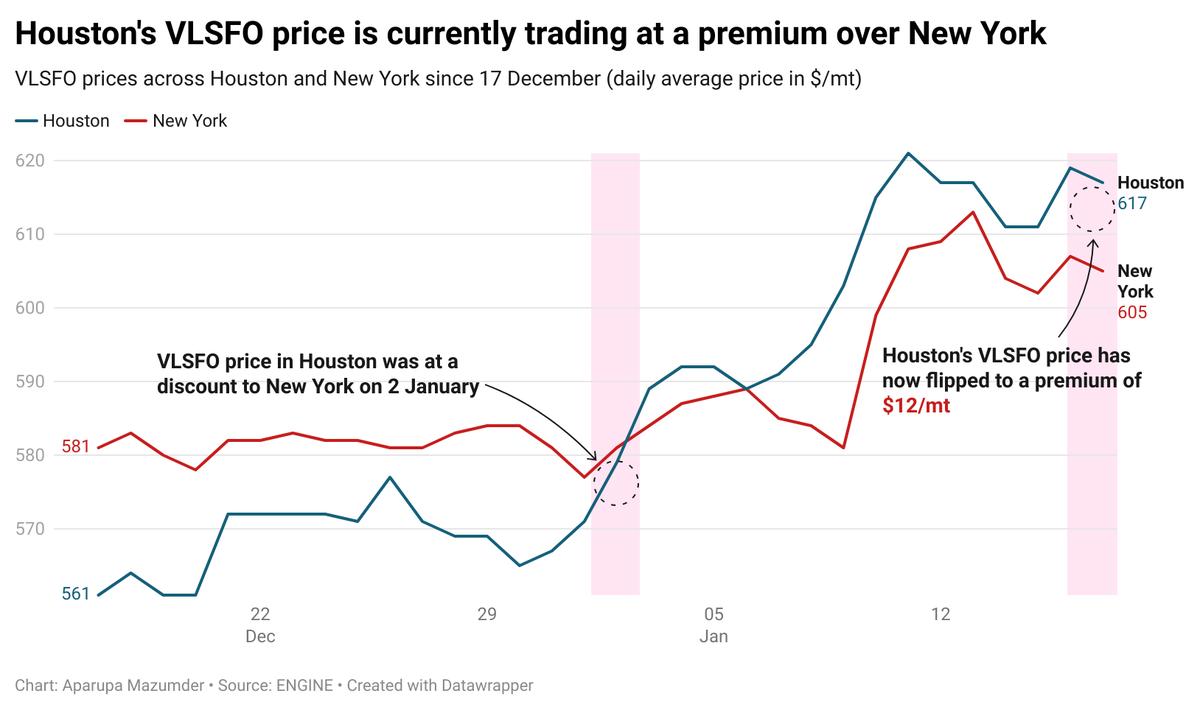

Regional bunker fuel prices have largely tracked Brent’s downward movement, with VLSFO’s price dropping in Houston, New York, Los Angeles and Balboa. These price movements have flipped Houston’s VLSFO price discount to New York from a month ago, to a $12/mt premium now.

Prompt availability across all fuel grades is tight in Houston, with recommended lead times of at least 7 days for VLSFO and LSMGO. High winds over the last few days have created some backlogs by delaying bunker deliveries in the port.

The US Gulf Coast is currently in the fog season, which has reduced visibility around the region. Bunkering operations around the area may be disrupted through this week.

Major delays to bunker deliveries are expected in ports including Houston, Texas City, Galveston, Port Bolivar, Freeport, Lake Charles, Port Arthur, Beaumont, Galveston Offshore Lightering Area (GOLA), and Corpus Christi Offshore, a source says. “Hard freeze might come to [US Gulf Coast] area with ice / snow in some forecasts Monday/Tuesday [20, 21 January],” the source adds.

High wind gusts have disrupted bunkering operations in Argentina’s Zona Comun. Bunker deliveries at the port may face extended delays until 20 January, according to a source. Prompt VLSFO availability is tight at the anchorage, with lead times of at least seven days advised.

Brent

The front-month ICE Brent contract has moved $0.36/bbl lower on the day, to trade at $81.04/bbl at 07.00 CST (13.00 GMT).

Upward pressure:

Brent’s price has mostly remained above $80/bbl this week, as cold weather conditions in the US has driven oil demand up.

Oil prices have found support from the “prevailing colder-than-normal northern hemisphere winter,” VANDA Insights’ founder and analyst Vandana Hari remarked.

Commercial US crude oil inventories declined by 1.96 million bbls to touch 412 million bbls for the week ending 10 January, according to data from the US Energy Information Administration (EIA).

Downward pressure:

Brent futures felt some downward pressure following media reports suggesting that the incoming Donald Trump administration is considering a different approach to the recent sanctions placed against Russia’s energy sector.

President-elect Trump, who takes office on 20 January, has vowed to resolve the ongoing conflict in eastern Europe with a peace deal between Russia and Ukraine.

“Crude oil retreated amid reports that Trump’s advisors were crafting a strategy that could see sanctions on Russia’s oil industry lifted,” ANZ Bank senior market analyst Daniel Hynes commented.

The exiting Joe Biden's administration announced new and stricter sanctions last week, which could dramatically impact Russia’s oil exports, according to market analysts.

Oil prices felt more pressure after an initial six-week ceasefire deal was reached between Israel and the Iran-backed Hamas armed group.

Brent price gains were modestly capped by “the Israel-Hamas Gaza ceasefire deal, and speculation over the Donald Trump administration’s approach to the Gaza and Ukraine wars as well as Iran and Venezuela, once it takes over the reins in the US on Monday, January 20,” Hari added.

By Aparupa Mazumder

Please get in touch with comments or additional info to news@engine.online

Contact our Experts

With 50+ traders in 12 offices around the world, our team is available 24/7 to support you in your energy procurement needs.