Americas Market Update 15 Jan 2025

Bunker fuel prices in key Americas ports have largely declined and bunker operations in Zona Comun may face disruptions tomorrow due to high wind gusts.

Changes on the day, to 07.00 CST (13.00 GMT) today:

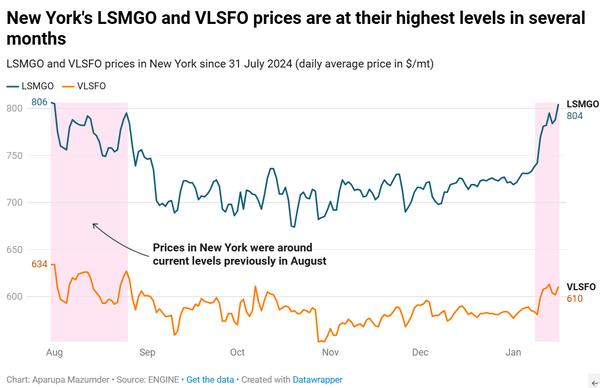

- VLSFO prices down in New York ($8/mt), Balboa ($6/mt), Los Angeles, Houston ($5/mt) and Zona Comun ($4/mt)

- LSMGO prices up in Balboa ($7/mt), and down in New York ($3/mt) and Houston ($10/mt)

- HSFO prices up in Balboa ($3/mt), and down in New York and Houston ($3/mt)

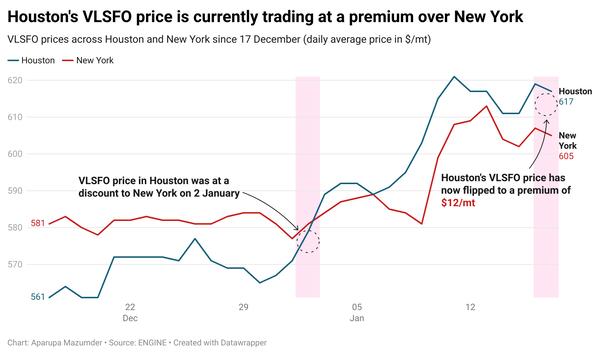

VLSFO and LSMGO prices in New York and Houston have declined, tracking Brent’s downward movement.

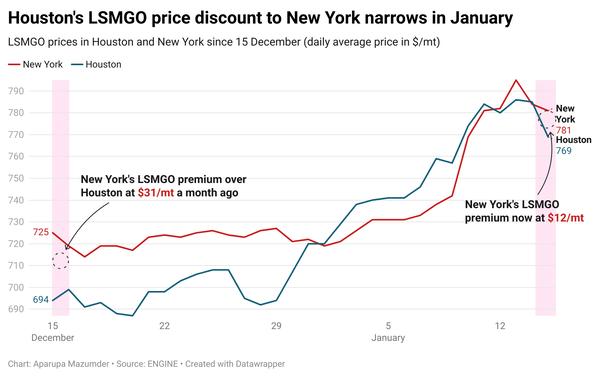

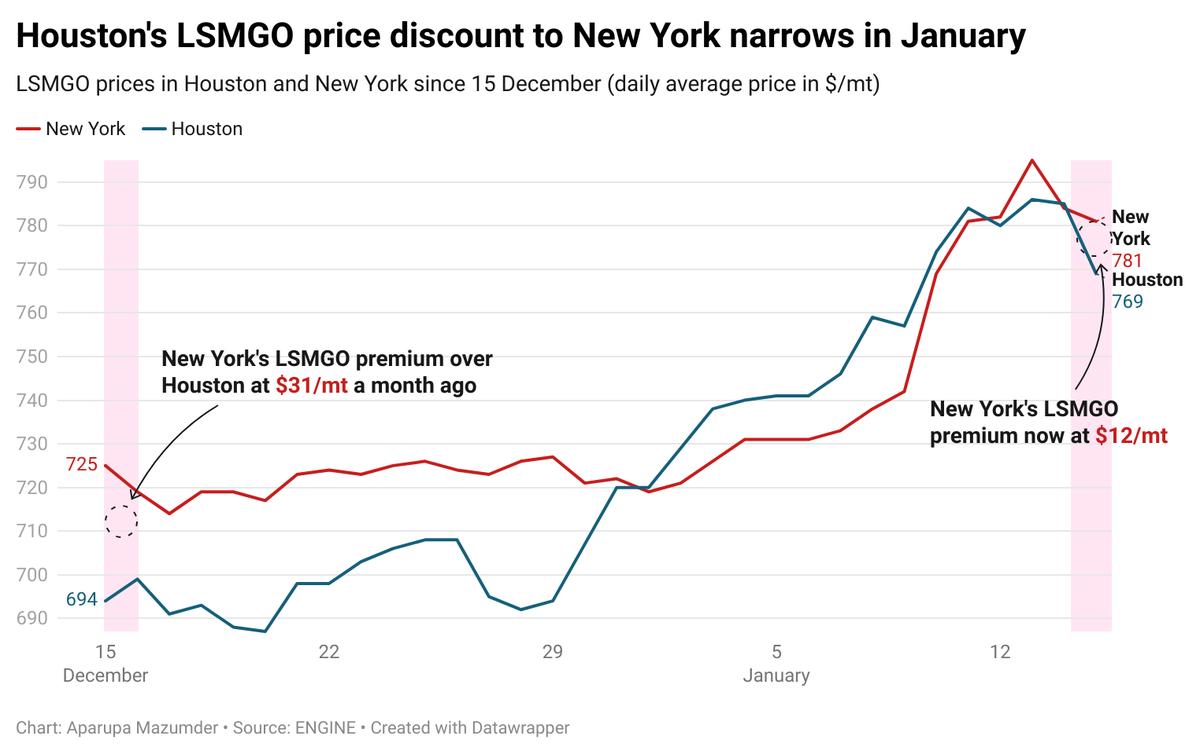

A lower-priced 500-1,500 mt LSMGO stem fixed in Houston at $767/mt for prompt delivery has put downward pressure on the benchmark. The port’s LSMGO price discount to New York has narrowed from $31/mt a month back to $12/mt currently.

Bunker operations in the Galveston Offshore Lightering Area (GOLA) could be disrupted by high wind gusts until 20 January, with deliveries happening on a case-by-case basis. Operations are expected to fully resume between 16-18 January and then be suspended on 19 January, a source says.

Zona Comun's VLSFO price has declined marginally as a prompt 500-1,500 mt stem was fixed at a lower level. High wind gusts and other rough weather conditions can cause possible disruptions to bunker operations in the port between 17-19 January.

Brent

The front-month ICE Brent contract has moved $0.53/bbl lower on the day, to trade at $80.14/bbl at 07.00 CST (13.00 GMT).

Upward pressure:

The latest round of US sanctions against Russia’s energy sector, targeting the country’s largest oil and tanker companies, has supported Brent’s price this week.

Oil market analysts expect these sanctions to tighten over the coming days as Donald Trump prepares to take office on 20 January.

Brent’s price gained more support after the American Petroleum Institute (API) reported a drop in US crude oil inventories, supporting demand growth projections.

Crude oil inventories in the US declined by 2.6 million bbls in the week that ended 10 January, according to the API estimates.

“Crude futures rebounded with Brent trading back above $80, supported by sanctions angst, a potential eight weekly decline in US stockpiles,” analysts from Saxo Bank noted.

The broadly followed US government data on crude oil stockpiles from the US Energy Information Administration (EIA) is due today.

Downward pressure:

Brent’s price gains were capped ahead of US Consumer Price Index (CPI) data, which will be out today.

Inflation rate in the US, measured by the change in CPI, is the key focus this week as financial markets await the Federal Reserve's next steps on easing monetary policies in 2025.

The US CPI data is also expected to support the US Dollar, according to market analysts. “Today’s Consumer Price Index (CPI) looms large, poised to bolster the greenback potentially,” SPI Asset Management managing partner Stephen Innes said.

A stronger US dollar makes commodities like oil costlier for non-dollar holders, ultimately denting demand in the market.

By Aparupa Mazumder

Please get in touch with comments or additional info to news@engine.online

Contact our Experts

With 50+ traders in 12 offices around the world, our team is available 24/7 to support you in your energy procurement needs.