Europe & Africa Market Update 9 Jan 2025

Bunker benchmarks in most European and African ports have gone down with Brent, and LSMGO is still dry in Durban.

Changes on the day to 09.00 GMT today:

- VLSFO prices down in Durban ($10/mt), Rotterdam ($7/mt) and Gibraltar ($5/mt)

- LSMGO prices down in Rotterdam ($29/mt) and Gibraltar ($18/mt)

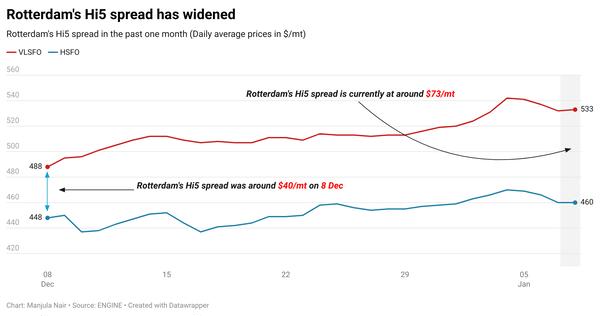

- HSFO prices down in Rotterdam ($12/mt) and Gibraltar ($5/mt)

- Rotterdam B30-VLSFO at a $177/mt premium over VLSFO

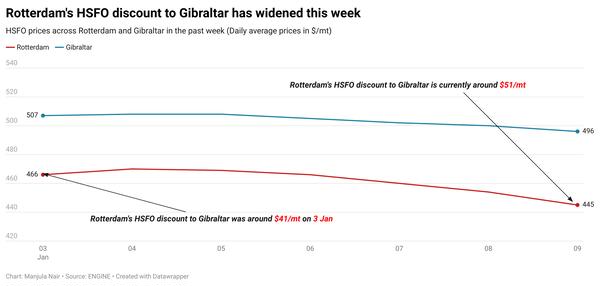

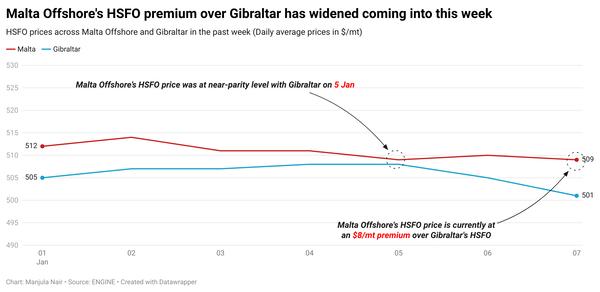

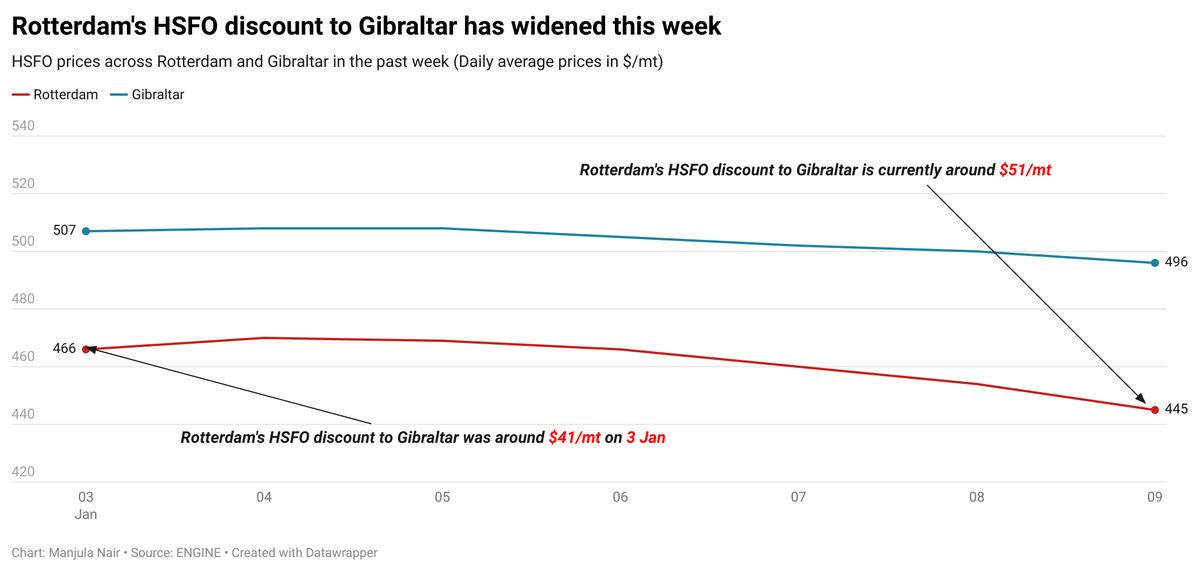

Rotterdam’s HSFO price has fallen by a steep $12/mt in the past day. A lower-priced prompt stem fixed at $448/mt for 150-500 mt has added downward pressure on the benchmark. The price moves have widened Rotterdam's HSFO discount to Gibraltar to around $51/mt now.

HSFO supply is still tight for very prompt delivery in Rotterdam, a trader said. Lead times of 5-7 days are advised for optimal coverage. VLSFO availability in the ARA hub is comparatively better with recommended lead times of 3-5 days.

LSMGO prices have plunged in Rotterdam and Gibraltar in the past day. These downward price movements have widened Rotterdam’s LSMGO discount to Gibraltar by $11/mt to $74/mt now. Prompt LSMGO availability is good in Rotterdam and Gibraltar, with lead times of 3-5 days recommended in both ports.

Meanwhile, LSMGO supply is dry in the South African port of Durban, a trader told ENGINE. VLSFO supply is tight in the port, with lead times of 7-10 days advised.

Brent

The front-month ICE Brent contract has moved $1.73/bbl lower on the day, to trade at $76.11/bbl at 09.00 GMT.

Upward pressure:

Brent futures have gained support from expectations of strong winter fuel demand. Oil demand in January is expected to rise by 1.4 million b/d year-on-year to 101.4 million b/d, driven mainly by increased heating fuel consumption in the northern hemisphere, according to Reuters, citing JPMorgan analysts. They noted that colder-than-normal winter conditions, and an earlier start to travel in China for the Lunar New Year holidays, are boosting heating fuel usage.

Anticipations of stricter sanctions on Russian and Iranian oil firms have also lent support to oil prices. New sanctions are expected to take effect after US President-elect Donald Trump’s inauguration later this month.

“Concerns over Iranian and Russian oil flows will also be providing some support,” two analysts from ING Bank have said.

Market watchers are also worried about global supply tightening amid rising demand, further adding to Brent’s upward momentum.

Downward pressure:

Despite a drop in commercial US crude oil stocks, build-ups in gasoline and distillate stocks have exerted some downward pressure on Brent futures.

The latest data from the US Energy Information Administration (EIA) revealed an increase in gasoline and distillate stockpiles last week in the US. Gasoline inventories rose by 6.33 million bbls to 237 million bbls, while middle distillate stocks increased by 6.07 million bbls to 128 million bbls.

Oil prices declined “on the back of a bearish weekly US oil stockpiles report,” said Vandana Hari, founder and analyst at VANDA Insights.

By Manjula Nair and Tuhin Roy

Please get in touch with comments or additional info to news@engine.online

Contact our Experts

With 50+ traders in 12 offices around the world, our team is available 24/7 to support you in your energy procurement needs.