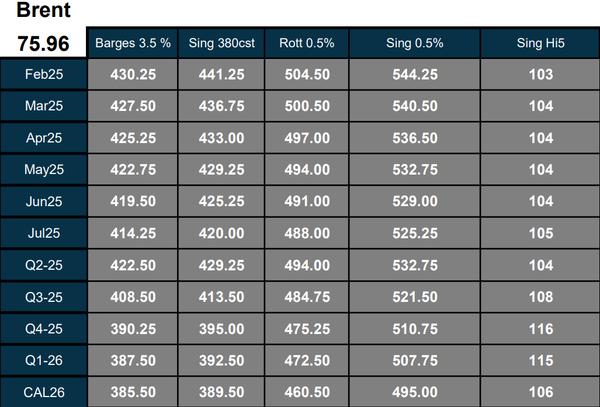

Fuel Switch Snapshot: Curtains down on 2024

Rotterdam LNG’s discount to B24-VLSFO widens

Port dues waived for B100-powered ships in Singapore

Dutch biofuel rebates steady

CHART: The dots represent bunker fuel prices adjusted for calorific contents to become VLSFO-equivalents, with the estimated levels of EU ETS costs excluded from the prices. ENGINE, PRIMA Markets, NYMEX

CHART: The dots represent bunker fuel prices adjusted for calorific contents to become VLSFO-equivalents, with the estimated levels of EU ETS costs excluded from the prices. ENGINE, PRIMA Markets, NYMEX

VLSFO-equivalent LNG has concluded 2024 with a $118/mt premium over VLSFO in Rotterdam, and a $148/mt premium over VLSFO in Singapore. LNG was even at premiums over LSMGO, with $19/mt over the LSMGO price in Rotterdam and $63/mt in Singapore. These prices don't include EU Allowance (EUA) costs, which would marginally favour LNG's lower CO2 emissions.

In Rotterdam, LNG’s discount to B24-VLSFO HBE has widened by $4/mt over the past week, to reach $49/mt.

In contrast, LNG has lost its advantage in Singapore. It has reverted to a premium, with the B24-VLSFO UCOME blend now $2/mt cheaper in the Asian port.

Singapore will grant full port dues concession to ships powered by 100% biofuel (B100) for two years starting in 2025.

B100 UCOME was priced at around $1,281/mt in Singapore last week, reflecting a modest $3/mt increase from the previous week.

Rotterdam’s B24-VLSFO HBE has closed the year at a $167/mt premium over VLSFO, while Singapore’s B24-VLSFO UCOME follows closely with a $145/mt premium.

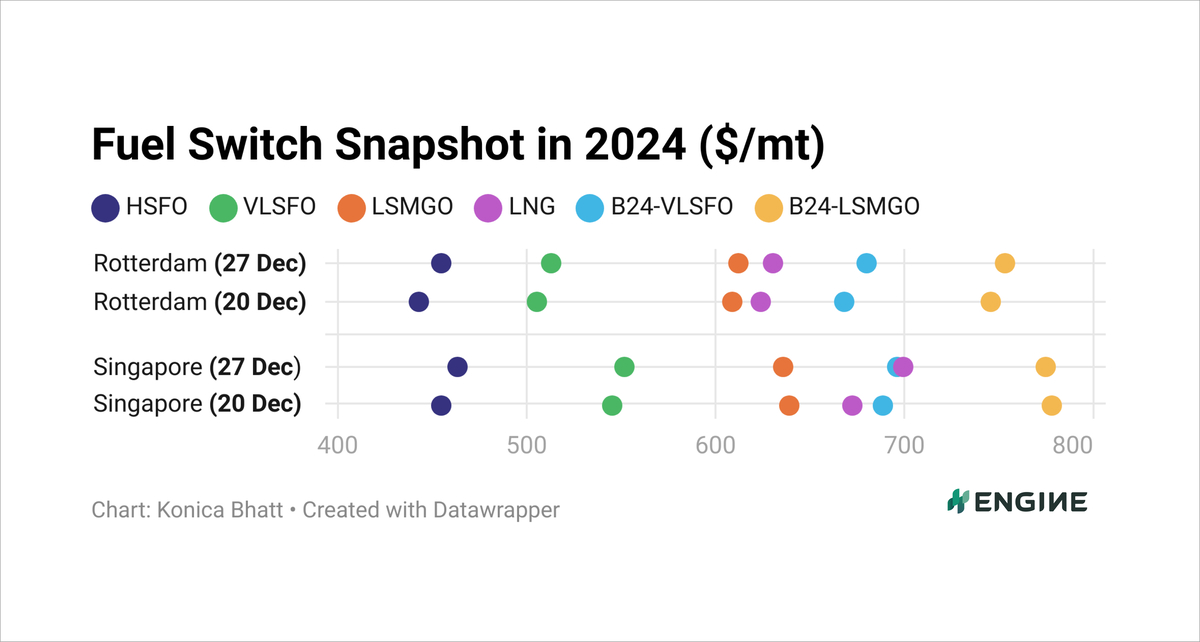

VLSFO

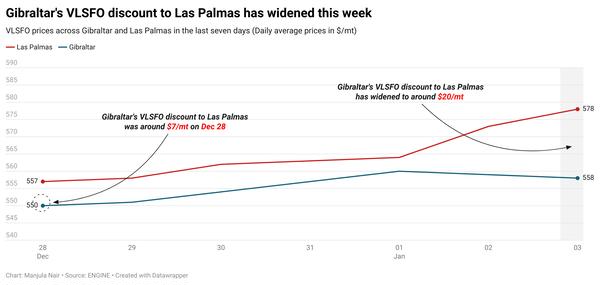

VLSFO prices in Rotterdam and Singapore have remained almost steady over the past week, rising by just $6-7/mt and just trailing behind a modest $9/mt ($1/bbl) gain in front-month ICE Brent futures.

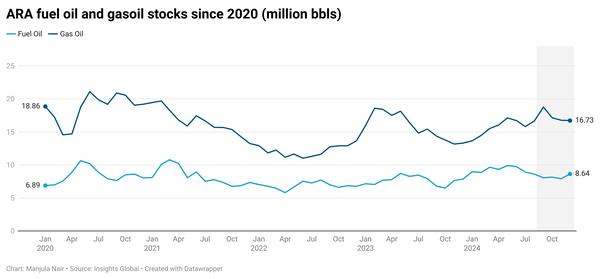

Availability of the grade remains stable in Rotterdam and the wider ARA hub. Suppliers can accommodate prompt deliveries, with lead times recommended at 3-5 days.

VLSFO availability in Singapore remains tight with a standard lead time of 10 days, though expedited deliveries within four days are possible at higher prices.

Biofuels

Rotterdam’s B24-VLSFO HBE has risen by $11/mt, while Singapore’s B24-VLSFO UCOME price has seen a smaller increase of $8/mt over the past week.

The 2025 ticket price for advanced HBE in Rotterdam was accessed by PRIMA Markets at €10.45/GJ ($10.89/GJ) on Friday, slightly down from €10.50/GJ ($10.94/GJ) a week ago. This translates to a theoretical rebate of $97/mt for B30-VLSFO sold in Dutch ports.

The Maritime and Port Authority of Singapore (MPA) has introduced new concessions on port dues for ocean-going ships using biofuels. Ships powered by B100 will qualify for a 100% concession. Those using blends between B50 and B99 are eligible for a 30% concession, while blends ranging from B24 to B49 can avail a 20% concession.

This new policy replaces a previous one, which provided a single 30% concession for vessels using B20 or higher. The policy will be in effect from 1 January 2025 to 31 December 2027 and apply to ships calling at the port for stays of up to four days.

LNG

In the past week, Singapore’s LNG bunker price has bounced back by $32/mt to claw back half of the value it lost in the preceding week.

LNG bunker prices in the region are typically based on underlying Japan/Korea Marker (JKM) values, and the front-month JKM contract has risen from $13.67/MMBtu to $14.29/MMBtu in the past week. An impasse in Russia's gas deal with Ukraine for supply to Europe has also had a knock-on effect to support Asian gas prices.

Rotterdam’s LNG price has come up by $8/mt in the past week. The price has risen with the front-month Dutch TTF Natural Gas contract, as Russia and Ukraine are unlikely to reach a deal for gas transits via Ukraine to Europe when their current deal is about to expire.

Russian President Vladimir Putin says time has run out for a renewal, and as things stand landlocked countries like the Czech Republic, Austria, Hungary and Slovakia will have to look elsewhere for gas.

By Konica Bhatt, Nithin Chandran and Erik Hoffmann

Please get in touch with comments or additional info to news@engine.online

Contact our Experts

With 50+ traders in 12 offices around the world, our team is available 24/7 to support you in your energy procurement needs.