Europe & Africa Fuel Availability Outlook 11 Dec 2024

Prompt HSFO supply tight in the ARA

VLSFO tight in Las Palmas

Strong VLSFO demand in Walvis Bay

PHOTO: Passenger ships in the Port of Piraeus. Getty Images

PHOTO: Passenger ships in the Port of Piraeus. Getty Images

Northwest Europe

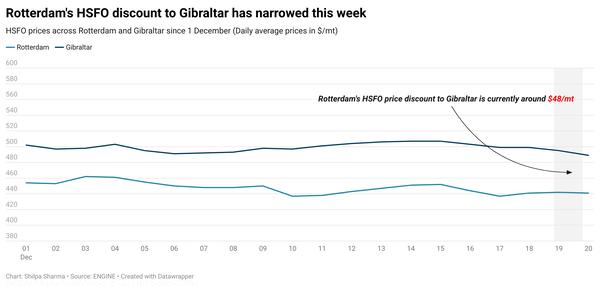

HSFO supply is a bit tight for prompt delivery in Rotterdam and in the rest of the ARA, with lead times of 5-7 days recommended for the grade. VLSFO and LSMGO availability continues to be normal with lead times of 3-5 days.

The ARA’s independently held fuel oil stocks dipped by 2% in November compared to October, according to Insights Global data.

The region imported 301,000 b/d of fuel oil in November, an increase from 262,000 b/d imported in October, according to data from cargo tracker Vortexa. The ARA imported low-sulphur fuel oil (LSFO) and HSFO in a 51/49 ratio in November, unlike October's 45/55 ratio which was tilted towards HSFO.

The UK (16% of the total) was the region’s biggest fuel oil import source in November. The US (12%) ranked second and France (11%) at third. Other import sources were Sweden (10%) and India (9%).

The ARA hub’s independent gasoil inventories - which include diesel and heating oil - registered a 3% dip in November. The region imported 359,000 b/d of gasoil and diesel in November, a moderate decline from 411,000 b/d imported in October, according to Vortexa data.

In the German port of Hamburg, prompt supply is good across all three grades, a trader said. Lead times of 3-5 days are advised.

Mediterranean

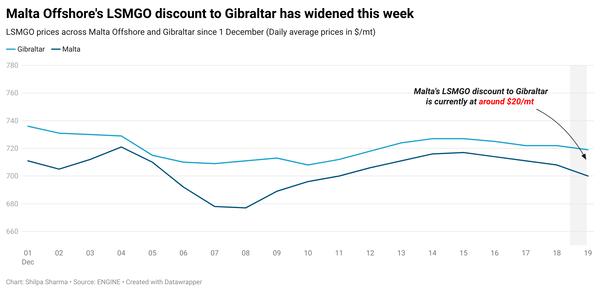

HSFO and LSMGO tightness has eased in Gibraltar, a trader said. As a result, lead times have come down to 3-5 days for both grades. VLSFO lead time has remained consistent since last week with suppliers able to offer prompt delivery dates of 3-5 days across all three grades.

The port is forecast with calm weather for the rest of this week, before strong wind gusts of 20-25 knots are set to hit on Sunday and Monday. This may trigger bunkering disruptions in the port area.

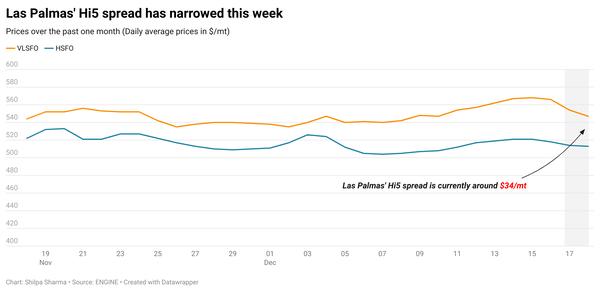

In the Canary Islands’ Port of Las Palmas, VLSFO availability has tightened and a trader advises 5-7 days of lead time for the grade. Recent weather issues have caused some backlog, a trader said adding that VLSFO availability was tight for a couple of suppliers last week.

HSFO and LSMGO availability has been consistent in Las Palmas since last week, with suppliers unable to offer for very prompt delivery dates. Lead times of 5-7 days are advised for both grades in Las Palmas. Rough weather may disrupt bunkering in the port on Wednesday and Thursday, a source said.

Bunker availability is normal in the Spanish port of Barcelona with suppliers offering on a case-to-case basis, a trader said. Lead times of 5-7 days are advised for HSFO, VLSFO and LSMGO.

Availability is normal in the Portuguese ports of Lisbon and Sines, a source said. Lead times of 3-5 days are advised for all three grades.

Demand has been low in the Greek port of Piraeus, a trader told ENGINE. Despite low demand, prompt availability is tight and lead times of 7-10 days are advised for all three grades. This tightness could be exacerbated by a three-day refinery strike announced for Saturday in Piraeus, the trader said. Availability is expected to stabilise from Tuesday onwards.

Other Mediterranean bunkering locations such as off Malta and Istanbul have witnessed a spike in demand. Availability is tight in both locations. Rough weather is forecast off Malta and in Istanbul on Friday, which may disrupt bunkering, a source said.

Africa

In South Africa’s Durban and Richards Bay, VLSFO availability is still tight for prompt delivery dates, according to a trader. Lead times of 7-10 days are advised by traders for full coverage.

Prompt availability of LSMGO is still very tight in Durban. A trader advised lead times of 7-10 days for the grade. Rough weather is forecast in Durban on Friday, when strong wind gusts of 26 knots are forecast. After a brief window of calm weather on Saturday, wind gusts will escalate to 36 knots on Sunday and may impact bunkering in the area.

In Mauritius' Port Louis, prompt bunker availability is good for all three grades, a trader said. Bad weather may impact bunkering in Port Louis on Friday and Saturday.

Off Namibia's Walvis Bay has good bunker availability with around five days recommended for all three grades, according to a trader. VLSFO and LSMGO have witnessed strong bunker demand, the source added. Adverse weather is forecast off Walvis Bay from Wednesday. It could last well into next week and may impact bunkering in the area.

Meanwhile, civil unrest in Mozambique could trigger bunkering disruptions. Vessel operators and shipping companies should prepare for possible delays and interruptions, shipping agent Inchcape Shipping Services said. The country is facing civil unrest following the announcement of its national election results in October.

Ports in Mozambique are currently operational, but disruptions could be triggered by the civil unrest, the shipping agent added.

By Manjula Nair

Please get in touch with comments or additional info to news@engine.online

Contact our Experts

With 50+ traders in 12 offices around the world, our team is available 24/7 to support you in your energy procurement needs.