Europe & Africa Market Update 19 Nov 2024

Bunker benchmarks in European and African ports have gained with Brent, and LSMGO has tightened in Gibraltar.

Changes on the day to 09.00 GMT today:

- VLSFO prices up in Durban ($26/mt), Rotterdam ($17/mt) and Gibraltar ($7/mt)

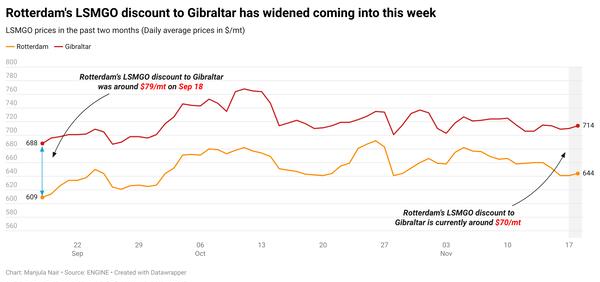

- LSMGO prices up in Rotterdam ($17/mt) and Gibraltar ($7/mt)

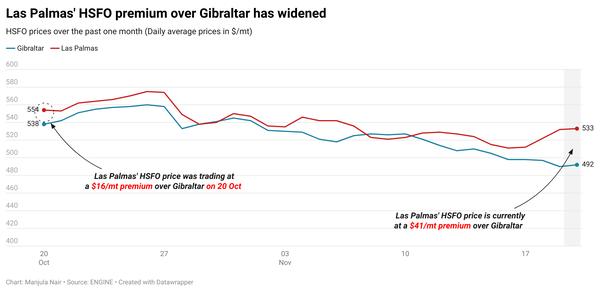

- HSFO prices up in Rotterdam ($13/mt), and down in Gibraltar ($16/mt)

- Rotterdam B30-VLSFO at a $117/mt premium over VLSFO

HSFO and VLSFO grades remain tight in Rotterdam and across the wider ARA hub, a trader told ENGINE. Recommended lead times remain consistent from last week for HSFO with 7-10 days and 5-7 days for VLSFO.

A higher-priced LSMGO stem fixed for prompt delivery in Rotterdam has pushed the benchmark higher in the past day. LSMGO availability has improved in the ARA coming into this week, with several suppliers able to supply with lead times of 3-5 days.

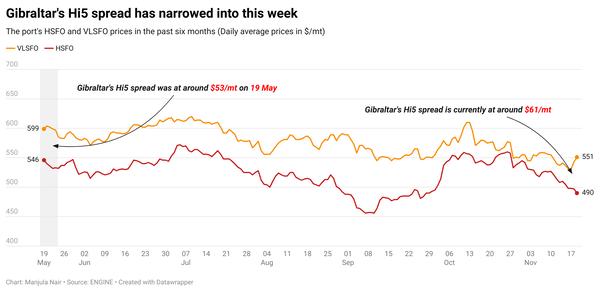

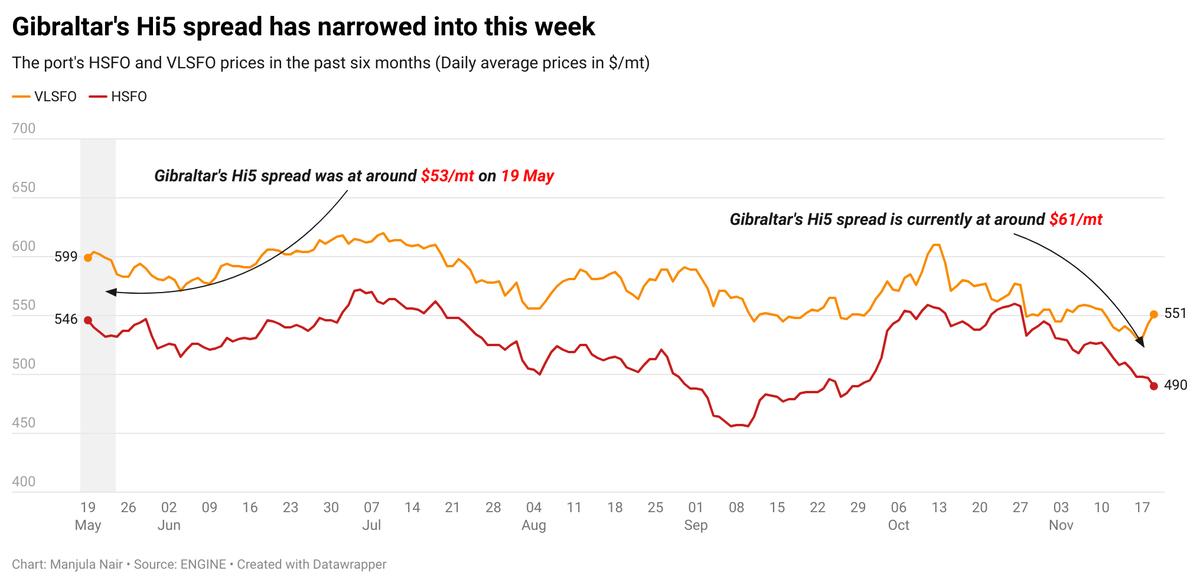

In Gibraltar, a 150-500 mt prompt delivery HSFO stem fixed at $475/mt has pulled the benchmark lower. The port's Hi5 spread has widened from $36/mt yesterday to $59/mt now.

LSMGO has tightened in Gibraltar port, with lead times now at 5-7 days from 3-5 days last week. A supplier is not offering LSMGO at the moment due to an unknown blending issue at its refinery, a trader told ENGINE.

Gibraltar continues to grapple with congestion. 15 vessels are waiting to receive bunkers today, up from 14 yesterday, according to a source. Gibraltar witnessed adverse weather last week that has caused a backlog in the port.

Brent

The front-month ICE Brent contract has moved $1.88/bbl higher on the day, to trade at $72.87/bbl at 09.00 GMT.

Upward pressure:

The sudden escalation of the Russia-Ukraine conflict has pushed oil prices higher.

Brent’s price surged after Washington approved Ukraine’s use of long-range missiles against Russia, ramping up tensions between the two warring nations, according to media reports.

“[Brent] crude oil roared to life, surging nearly 3%, as geopolitical tensions reignited with the US greenlighting Ukraine’s use of long-range missiles against Russia,” SPI Asset Management’s managing partner Stephen Innes said.

Meanwhile, oil production of about 755,000 b/d in Norway’s Johan Sverdrup field has been cut due to a power outage, Reuters reports. This news has also supported oil prices.

“A halt of production at the 755k b/d [755,000 b/d] Johan Sverdrup field in Norway due to a power outage… provided further upside [to oil],” two analysts from ING Bank said.

Downward pressure:

Demand growth concerns simmering in China, the world's second-largest oil consumer, have continued to put some downward pressure on Brent’s price.

Chinese oil consumption in October dropped by 5.4% month-on-month, with refiners processing about 59.54 million mt of crude oil last month, according to data from the National Bureau of Statistics (NBS).

“Chinese demand concerns continue to overshadow global tight supply and optimistic predictions for the upcoming Thanksgiving travel expectations,” Price Futures Group’s senior market analyst Phil Flynn said.

Moreover, recent economic data from China has raised concerns among market participants about the inefficacy of Beijing's latest stimulus package. Earlier this month, China unveiled a 10 trillion yuan ($1.40 trillion) stimulus package to support economic growth in the country.

China's October industrial output increased 5.3% year-on-year, slipping from a 5.4% growth recorded in September, the NBS reported.

Weakness in industrial output indicates weak economic health, as well as a contraction in the manufacturing sector, which includes production, inventory levels, etc. It highlights demand growth concerns, ultimately weighing down on prices of commodities like oil.

By Manjula Nair and Aparupa Mazumder

Please get in touch with comments or additional info to news@engine.online

Contact our Experts

With 50+ traders in 12 offices around the world, our team is available 24/7 to support you in your energy procurement needs.