Europe & Africa Market Update 14 Nov 2024

Most bunker benchmarks in European and African ports have tracked Brent’s upward movement, and Rotterdam's Hi5 spread has narrowed.

Changes on the day to 09.00 GMT today:

- VLSFO prices up in Gibraltar ($6/mt) and Rotterdam ($5/mt), and down in Durban ($2/mt)

- LSMGO prices up in Gibraltar ($14/mt) and Durban ($5/mt), and unchanged in Rotterdam

- HSFO prices up in Rotterdam ($21/mt) and Gibraltar ($3/mt)

- Rotterdam B30-VLSFO at a $169/mt premium over VLSFO

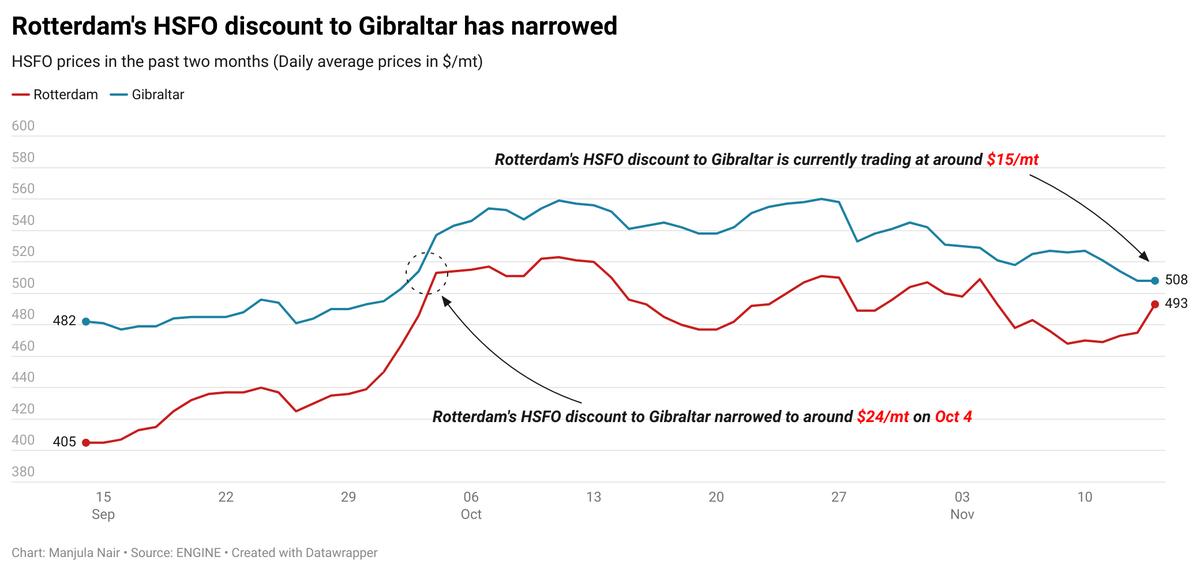

Rotterdam’s HSFO price has witnessed a steep rise in the past day, while Gibraltar’s HSFO price has risen by a modest $3/mt. These price moves have narrowed Rotterdam’s HSFO price discount to Gibraltar by $18/mt to $15/mt now. HSFO is very tight in Rotterdam and across the wider ARA hub with lead times of 7-10 days advised by traders. This has pushed Rotterdam's HSFO price higher and narrowed the port's Hi5 spread from $38/mt to $22/mt.

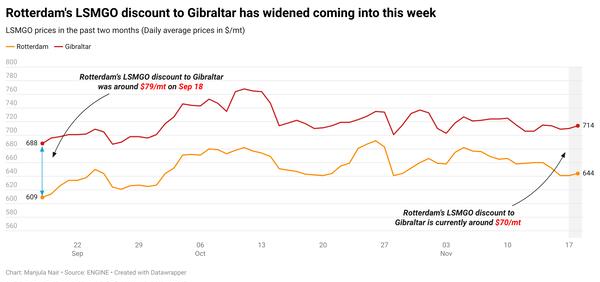

Gibraltar’s LSMGO price has gained the most in the past day. The price increase has widened Gibraltar's LSMGO price premium over Rotterdam by $14/mt to $60/mt now. Bunkering disruptions are forecast in Gibraltar on Friday and Saturday because of the forecast of wind gusts of 21-27 knots in the area.

Off Malta, a lower-priced prompt delivery HSFO stem has pulled the benchmark down in the past day. The price drop has flipped Malta’s HSFO price premium over Gibraltar to a $9/mt discount now. Malta Offshore has good bunker availability and suppliers there can offer prompt delivery dates. Recommended lead times are 3-4 days for VLSFO and LSMGO, while HSFO supply is subject to enquiry.

Brent

The front-month ICE Brent contract has moved $0.13/bbl higher on the day, to trade at $72.40/bbl at 09.00 GMT.

Upward pressure:

Brent futures gained some upward support after the American Petroleum Institute (API) projected a decline in US crude oil stocks.

Crude oil inventories in the US dropped by 770,000 bbls in the week that ended 8 November, according to the API estimates.

The weekly inventory drop was against market expectations of a 1 million-bbl rise. A fall in US crude stocks indicates growth in oil demand, which can put upward pressure on Brent’s price.

Additionally, US inflation data suggested a gradual approach toward the US Federal Reserve's (Fed) 2% target. The US inflation rate, measured by the change in the Consumer Price Index (CPI), came in flat at 0.2% in October, matching the previous month's figure.

“The consumer price index met expectations, easing fears of a surprise uptick that might have thrown a wrench in the Fed’s easing plans,” SPI Asset Management’s managing partner Stephen Innes remarked.

Focus will remain on the International Energy Agency’s (IEA) monthly forecast for global oil demand, analysts said. “Oil traders are on edge as the International Energy Agency (IEA) prepares to release its latest monthly oil market report,” Innes added.

Downward pressure:

Oil market traders have reacted to “unconfirmed reports” of a complete overturn in diplomatic relations, analysts said, suggesting that Iran is opting not to retaliate against Israel, following Donald Trump’s victory in the 47th US presidential election.

“Any response may now not come until negotiations with the new administration begin,” ANZ Bank’s senior commodity strategist Daniel Hynes said.

Brent’s price felt some downward pressure after OPEC cut its forecast for oil demand growth in its latest oil market report. The Saudi Arabia-led group expects oil consumption to increase by 1.8 million b/d this year, about 107,000 b/d lower than its previous month's projection.

“It [OPEC] attributed the change to weakening demand in China and India,” Hynes said.

By Manjula Nair and Aparupa Mazumder

Please get in touch with comments or additional info to news@engine.online

Contact our Experts

With 50+ traders in 12 offices around the world, our team is available 24/7 to support you in your energy procurement needs.