Europe & Africa Fuel Availability Outlook 6 Nov 2024

Prompt supply is tight in the ARA

Prompt HSFO is tight in Gibraltar

LSMGO supply improves in Durban

PHOTO: Aerial view of Durban Harbour. Getty Images

PHOTO: Aerial view of Durban Harbour. Getty Images

Northwest Europe

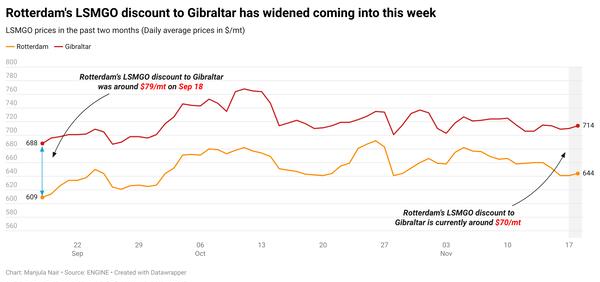

All grades remain in tight supply for prompt dates in Rotterdam. HSFO now requires lead times of 7-10 days, while VLSFO and LSMGO need 5-7 days. Refinery maintenance work in Rotterdam has triggered the supply crunch, a source told ENGINE.

The ARA’s independently held fuel oil stocks averaged 2% higher in October than across September, according to Insights Global data.

The region imported 257,000 b/d of fuel oil in October, up from 229,000 b/d imported in September, according to data from cargo tracker Vortexa. The ARA imported low-sulphur fuel oil (LSFO) and HSFO in a 48/52 ratio in October, unlike September's 51/49 ratio which was leaning towards LSFO.

The UK (22% of the total) emerged as the region’s biggest fuel oil import source in October. The US (12%) came in second, while Turkey ranked third at 9%. This was followed by Lithuania (8%), France and Poland (7% each).

The ARA hub’s independent gasoil inventories - which include diesel and heating oil - came down by 10% in October, despite higher imports. The region imported 410,000 b/d of gasoil in October, a sharp rise from September’s 291,000 b/d, according to Vortexa data.

Securing prompt supply is not a challenge in Germany’s Hamburg port. The port has ample supply for all grades, a trader said. Lead times of 3-4 days are generally recommended, a trader said.

Mediterranean

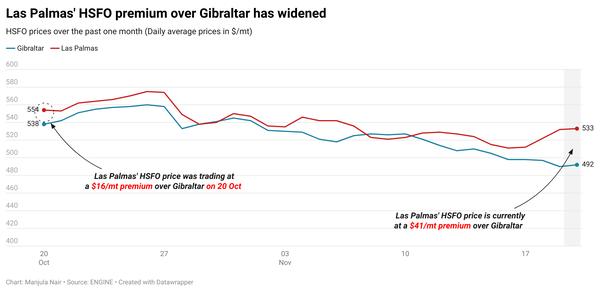

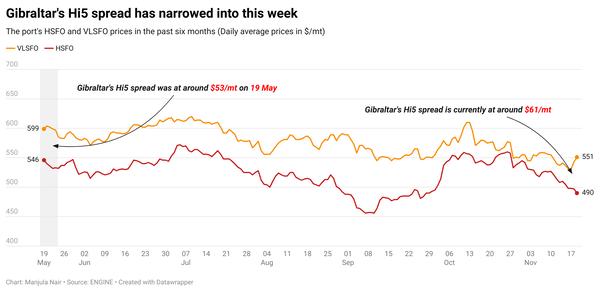

HSFO is tight in Gibraltar for very prompt delivery dates, a trader told ENGINE. Lead times of 5-7 days are recommended for optimal coverage for the grade. VLSFO and LSMGO availability is relatively better with short lead times of 3-5 days advised. Bunkering may be disrupted in Gibraltar on Thursday and Friday because of wind gusts of 19-21 knots.

HSFO is tight in the Spanish ports of Las Palmas and Barcelona, according to a trader.

Las Palmas port in the Canary Islands has faced limited HSFO supply in recent weeks, with recommended lead times now around 11 days. In contrast, VLSFO and LSMGO supply is ample and most suppliers can deliver both grades for prompt dates, a trader said.

In Barcelona, all grades have been tight since the start of the week. HSFO and VLSFO supplies are particularly constrained, with recommended lead times of 7-10 days. LSMGO requires lead times of 5-7 days.

Demand has been negligible in other Mediterranean ports like Piraeus, Malta Offshore and Istanbul, a trader said.

Greece’s Piraeus port has normal availability across all three grades. After experiencing minor supply pressures earlier in the week, conditions eased on Wednesday, with suppliers now offering prompt delivery across all grades.

Bunkering disruptions may occur in Piraeus from Wednesday till Saturday amid rough weather, a source said.

Off Malta, bunker availability is normal for all three grades, a trader told ENGINE. Lead times of 3-4 days are advised across all three grades. Bad weather is forecast between Wednesday and Saturday, which may impact bunkering.

Turkey’s Istanbul also has prompt supply available for all three grades, a trader said. Lead times of 3-4 days are recommended in the port. Adverse weather forecast in the port area between Wednesday and Saturday may disrupt bunkering.

Africa

VLSFO supply is good for non-prompt delivery dates in South Africa’s Durban and Richards Bay with lead times of 7-10 days advised. LSMGO supply has resumed in Durban after recent supply shortages. Lead times of 7-10 days are recommended for the grade.

Rough weather may cause bunkering delays in Durban on Wednesday with wind gusts of up to 30 knots forecast in the area. Bunkering in the area is typically halted when gusts exceed 35 knots and if visibility is low due to heavy rain, a source said.

Meanwhile, supply pressures have eased in Mauritius’ Port Louis, a trader said. Suppliers are now able to offer prompt delivery dates for all grades. The port had previously faced tight supplies with lead times extending up to ten days until last week.

By Manjula Nair

Please get in touch with comments or additional info to news@engine.online

Contact our Experts

With 50+ traders in 12 offices around the world, our team is available 24/7 to support you in your energy procurement needs.