Americas Market Update 30 Oct 2024

Bunker benchmarks in the Americas ports have taken mixed directions, and bunkering remains suspended in GOLA.

Changes on the day, to 08.00 CDT (13.00 GMT) today:

- VLSFO prices up in Houston ($6/mt) and Los Angeles ($3/mt), and down in Zona Comun ($17/mt), New York ($11/mt) and Balboa ($10/mt)

- LSMGO prices up in Los Angeles ($4/mt), and down in Balboa ($13/mt), New York ($3/mt) and Houston ($2/mt)

- HSFO prices up in New York ($9/mt), Houston ($8/mt) and Los Angeles ($3/mt) and Balboa ($5/mt)

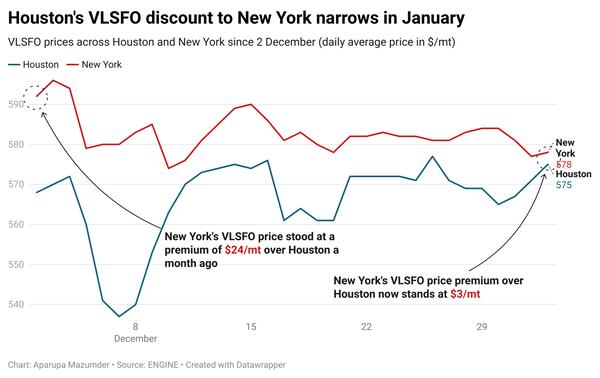

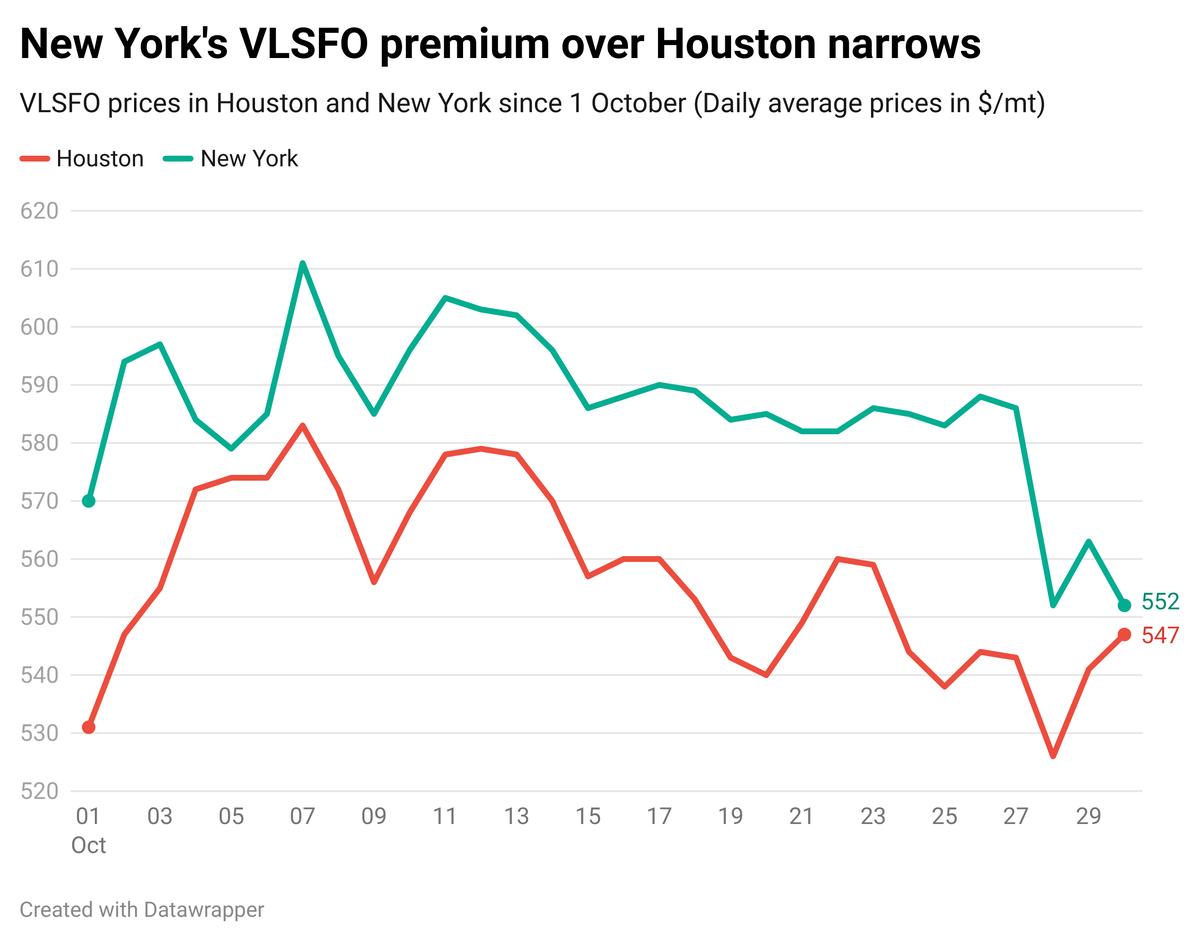

New York’s VLSFO price has countered Brent’s upward movement and has dropped in the past day. Meanwhile, Houston’s VLSFO price has gained with support from a higher-priced firm offer. This has narrowed New York’s VLSFO price premium over Houston from $22/mt yesterday, to just $5/mt now.

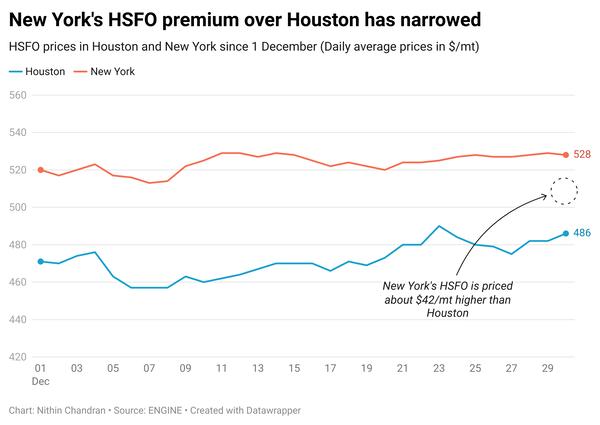

New York’s HSFO price has also gained since yesterday, narrowing the port’s Hi5 spread from $40/mt to $20/mt and is much narrower than Houston’s Hi5 spread of $55/mt.

Bunkering has remained suspended in the Galveston Offshore Lightering Area (GOLA) since yesterday due to rough weather conditions. The area is experiencing wind gusts of up to 29 knots, making barge deliveries difficult there. A window of calm weather from tomorrow evening could enable bunker operations to resume in GOLA before conditions worsen again from Friday evening.

A 24-hour strike by transport unions in Argentina today is expected to curtail maritime operations significantly, Antares Ship Agency said. The strike will halt or severely limit essential services throughout the country, including mooring, tugboats, pilot boats and bunkering.

Brent

The front-month ICE Brent contract inched $0.30/bbl higher on the day, to trade at $71.27/bbl at 08.00 CDT (13.00 GMT) today.

Upward pressure:

Oil prices gained some upward momentum after the American Petroleum Institute (API) reported an unexpected decline of 573,000 bbls in US crude stocks in the week that ended 25 October.

A drop in US crude stocks indicates growth in oil demand, which can put upward pressure on Brent’s price.

Additionally, oil market traders and analysts are bracing for the US elections on 5 November. A change in the US government could impact economic policies in the world's top oil consuming nation, which could have several implications for oil.

However, according to SPI Asset Management’s managing partner Stephen Innes, “the US labour market is stabilising, potentially giving the Fed more confidence to proceed with rate cuts—even as election-related uncertainties loom.”

Lower interest rates in the US can further boost demand growth for dollar-denominated commodities like oil as it makes the greenback weaker against other currencies.

Downward pressure:

Brent’s price moved lower as Israel's latest attack on Iran was not directed toward the country's oil facilities.

Israel launched over 100 missiles into Iran on Saturday, but none were directed toward the latter’s energy or nuclear facilities. As a result, supply-related concerns in the global oil market have eased, capping Brent’s price gains.

Oil moved lower due to “a deflation of Mideast risk premium on easing Israel-Iran tensions,” VANDA Insights’ founder and analyst Vandana Hari said.

Meanwhile, Israeli Prime Minister Benjamin Netanyahu revealed plans to hold a diplomatic meeting this week to resolve the conflict in Lebanon, Reuters reported. This news has added some downward pressure on Brent’s price.

“The prospect of a ceasefire in Gaza and the apparent de-escalation of tensions across the broader Middle East has seen the market almost completely remove the geopolitical risk premium it had priced into the [oil] market last week,” ANZ Bank’s senior commodity strategist Daniel Hynes said.

By Tuhin Roy and Aparupa Mazumder

Please get in touch with comments or additional info to news@engine.online

Contact our Experts

With 50+ traders in 12 offices around the world, our team is available 24/7 to support you in your energy procurement needs.