East of Suez Market Update 21 Oct 2024

Prices in East of Suez ports have moved in mixed directions, and VLSFO and LSMGO supply has tightened in China’s Zhoushan.

Changes on the day from Friday, to 17.00 SGT (09.00 GMT) today:

- VLSFO prices unchanged in Singapore, and down in Fujairah and Zhoushan ($3/mt)

- LSMGO prices down in Fujairah ($14/mt), Singapore ($9/mt) and Zhoushan ($3/mt)

- HSFO prices up in Singapore ($2/mt), unchanged in Fujairah, and down in Zhoushan ($3/mt)

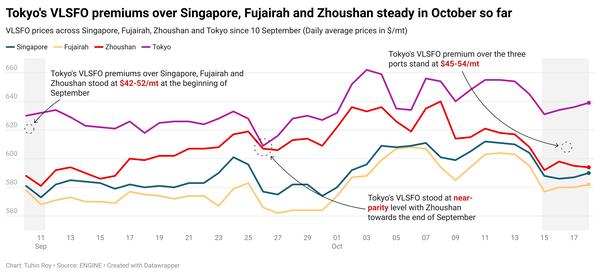

VLSFO benchmarks in East of Suez ports have remained stable over the weekend, with no significant changes. Zhoushan’s VLSFO price is nearly at parity with Singapore, while the benchmark stands at a small premium of $9/mt over Fujairah.

VLSFO and LSMGO availability has tightened in Zhoushan, as several suppliers are running low on stocks. Most suppliers now recommend lead times of 7-10 days, up from 4-7 days last week. HSFO supply is still under pressure, with lead times unchanged at 7-10 days.

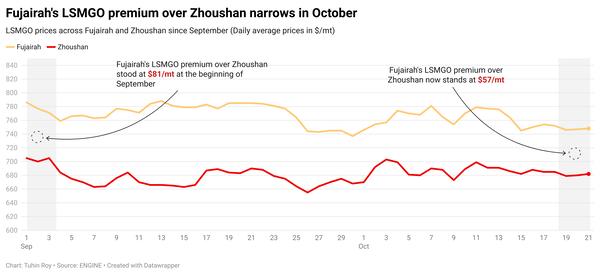

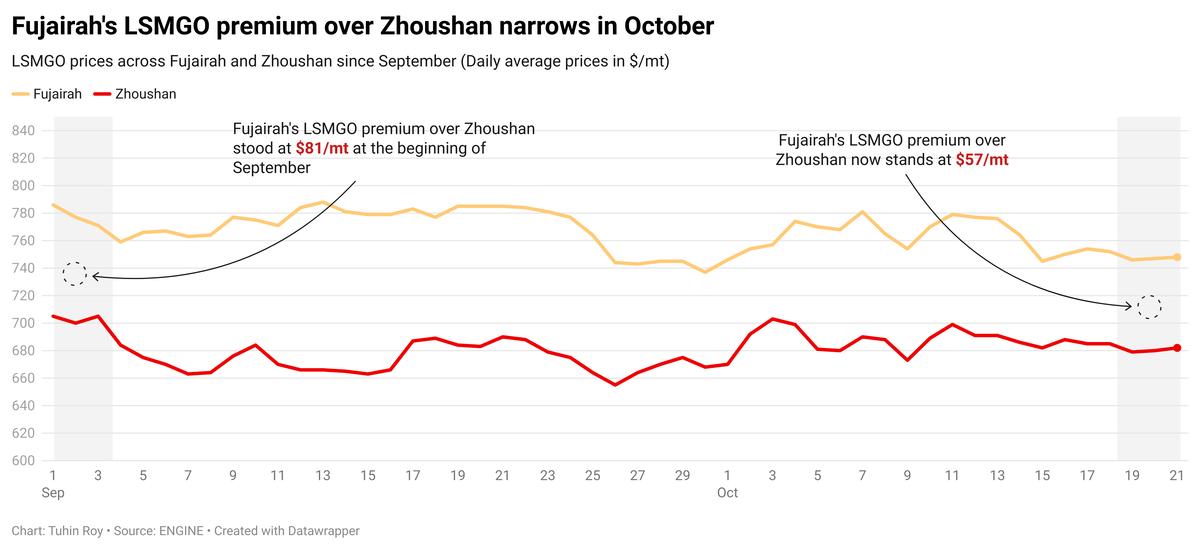

In Fujairah, the LSMGO price has dropped sharply by $14/mt, partly due to a few lower-priced indications in the port. Despite this drop, Fujairah’s LSMGO premiums over Singapore and Zhoushan stand at $93/mt and $57/mt, respectively.

Prompt availability of all grades in Fujairah remains tight despite low demand. However, some suppliers have reduced lead times from 7-10 days last week, to 5-7 days now. Khor Fakkan is facing a similar situation, with lead times for all grades recommended at 5-7 days.

Brent

The front-month ICE Brent contract has lost $0.56/bbl on the day from Friday, to trade at $73.85/bbl at 17.00 SGT (09.00 GMT).

Upward pressure:

Brent’s price found marginal support from the recent killing of Yahya Sinwar, a prominent Hamas leader. The killing was confirmed after the Israel Defense Forces (IDF) released footage on the social media platform X (formerly Twitter).

The news has prompted oil market analysts and traders to expect more planned attacks by Israel. “Oil still awaits the coming response by Israel against Iran for its record-breaking missile barrage on Israel,” Price Futures Group’s senior market analyst Phil Flynn remarked.

“Iran also is the major funder of what’s left of Hamas, so Israel still sees Iran as a legitimate target,” he added.

Brent’s price found additional support after the US Energy Information Administration (EIA) reported a decline in US crude stocks last week. Commercial crude oil inventories in the US dropped by 2.19 million bbls to touch 421 million bbls on 11 October, according to data from EIA.

Downward pressure:

Brent futures declined due to easing of concerns about supply disruptions in the Middle East.

According to a report by The Guardian, US President Joe Biden has urged Israeli Prime Minister Benjamin Netanyahu to make progress towards a ceasefire deal in Gaza. “The removal of key Hamas leaders in recent weeks has presented an opportunity for a reset in the broader Israel/Hamas war,” ANZ Bank’s senior commodity strategist Daniel Hynes said.

Meanwhile, other reports suggest that Israel would avoid targeting Tehran’s oil and energy facilities.

China’s economic recovery has been little, despite the announcement of a stimulus package. This has led to sublime factory activity in the world’s second-largest oil consumer and capped Brent’s price gains.

Chinese crude oil imports declined in the previous month, to touch 11.07 million b/d, down from 11.56 million b/d imported in August.

“China’s economy is still fragile,” SPI Asset Management’s managing partner Stephen Innes said. “The pressure on Beijing to deliver bolder fiscal reforms and more substantial stimulus measures is intensifying,” he added.

By Tuhin Roy and Aparupa Mazumder

Please get in touch with comments or additional info to news@engine.online

Contact our Experts

With 50+ traders in 12 offices around the world, our team is available 24/7 to support you in your energy procurement needs.