Americas Market Update 18 Oct 2024

Regional bunker benchmarks have mostly declined, and bunker operations remain suspended in GOLA.

Changes on the day to 08.00 CDT (13.00 GMT) today:

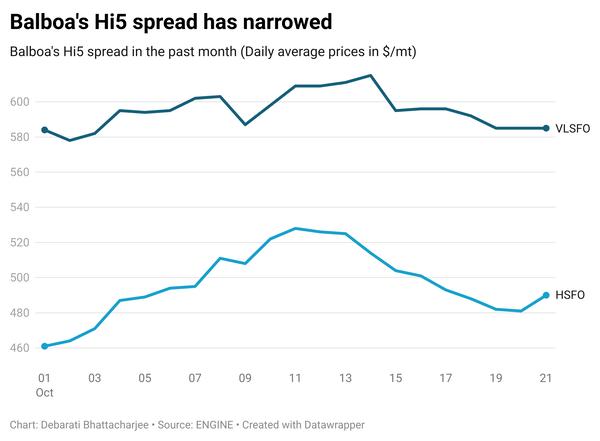

- VLSFO prices unchanged in New York, and down in Balboa ($3/mt), Houston and Zona Comun ($2/mt), and Los Angeles ($1/mt)

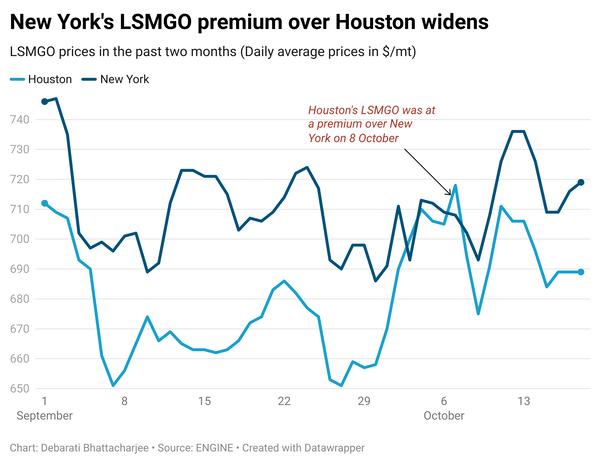

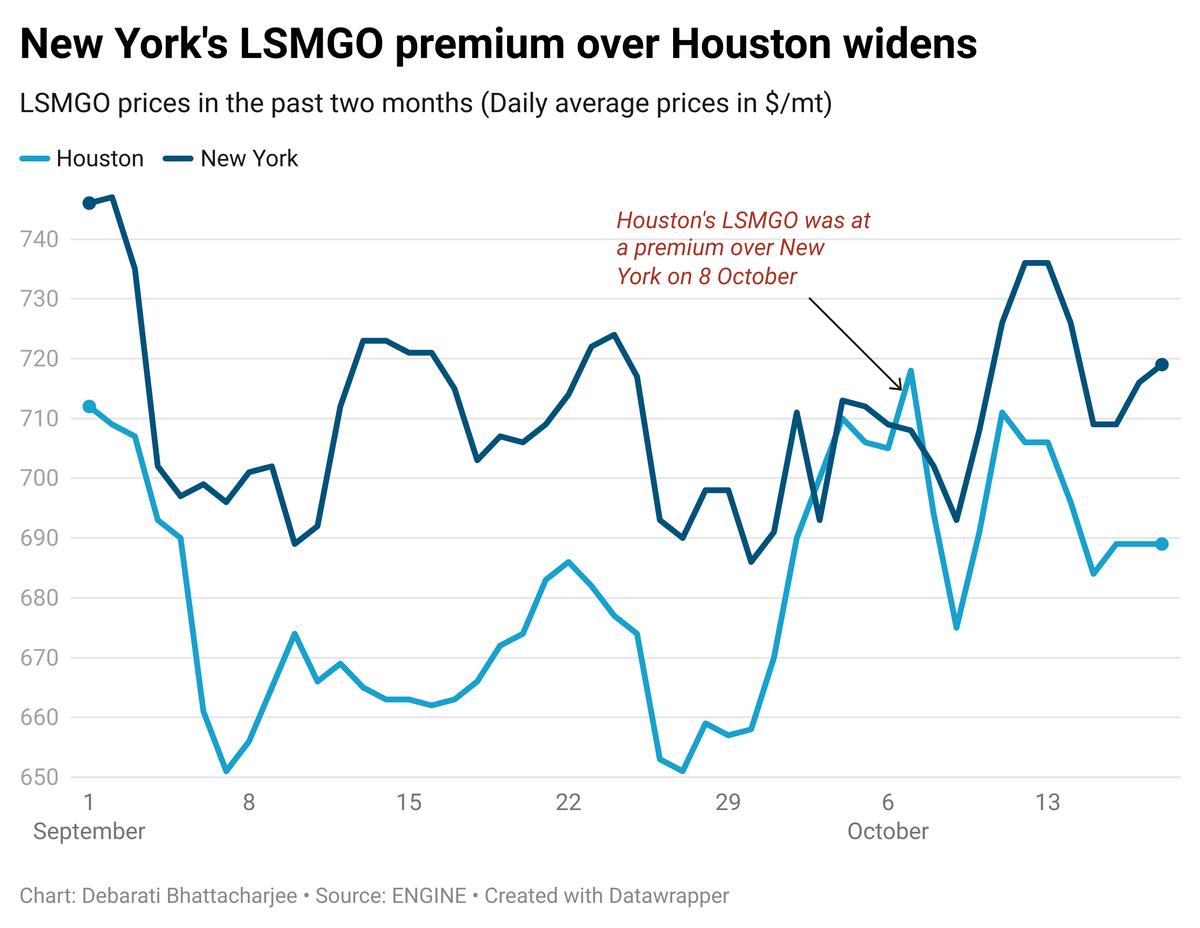

- LSMGO prices unchanged in Los Angeles, and down in Balboa ($6/mt), Houston ($5/mt) and New York ($1/mt)

- HSFO prices up in New York ($2/mt), unchanged in Los Angeles, and down in Balboa ($7/mt) and Houston ($1/mt)

Houston's LSMGO price has dropped more than New York’s LSMGO price in the past day, widening its LSMGO price premium over Houston from $28/mt yesterday, to $32/mt now.

Demand for VLSFO and LSMGO has picked up in the past two days in Houston. Most suppliers are able to offer both fuel grades with a lead time of 4-6 days, a source said.

Bunkering has remained suspended in the Galveston Offshore Lightering Area (GOLA) since Wednesday due to rough weather conditions. The area is experiencing wind gusts of up to 29 knots, making barge deliveries difficult there.

Bunkering has also remained suspended in the Bahamas’ Freeport since yesterday because of the rough weather. The area is experiencing strong wind gusts of up to 33 knots, making bunkering difficult there. Rough weather conditions are forecast until next Tuesday.

Brent

The front-month ICE Brent contract has gained $0.07/bbl on the day, to trade at $74.41/bbl at 08.00 CDT (13.00 GMT) today.

Upward pressure:

Brent crude’s price has inched up as supply concerns emerged amid escalations in the Middle East.

Israel has ramped up air assaults on southern Lebanon this week, according to the Israeli Defense Forces (IDF). “The IDF will continue to operate to eliminate the threats of Hezbollah,” it said on social media platform X (formerly Twitter).

The IDF has also reportedly eliminated Iran-aligned Hamas armed group’s prominent leader Yahya Sinwar, it said. This comes at a time when reports indicate that Israel has prepared plans for a potential strike on Iran. “There have been reports that Israel will launch its attack [on Iran] ahead of the US Presidential election,” Price Future Group’s senior market analyst Phil Flynn remarked.

Brent’s price also gained after the US Energy Information Administration (EIA) reported a decline in US crude stocks. Commercial crude oil inventories in the US dropped by 2.19 million bbls to touch 421 million bbls on 11 October, according to data from EIA.

A drop in US crude stocks indicates growth in oil demand, which can put upward pressure on Brent’s price. “Crude oil prices ended higher… as US oil inventories fell more than anticipated while Middle East tensions linger,” two analysts from ING Bank said.

Downward pressure:

Oil demand growth concerns from China have continued to cap Brent’s price gains.

Chinese crude oil imports declined in the previous month, to touch 11.07 million b/d, down from 11.56 million b/d imported in August.

The drop in crude imports has indicated a slowdown in oil demand growth in the world’s second-largest crude oil-consuming nation, according to market analysts. “Concerns over China demand continue to weigh [on oil prices],” analysts from Saxo Bank said.

By Debarati Bhattacharjee and Aparupa Mazumder

Please get in touch with comments or additional info to news@engine.online

Contact our Experts

With 50+ traders in 12 offices around the world, our team is available 24/7 to support you in your energy procurement needs.