Europe & Africa Market Update 16 Oct 2024

Regional bunker benchmarks have moved in mixed directions, and bunker fuel availability has improved slightly in the ARA.

Changes on the day to 09.00 GMT today:

- VLSFO prices up in Durban ($11/mt) and Rotterdam ($5/mt), and unchanged in Gibraltar

- LSMGO prices up in Gibraltar ($5/mt), and down in Rotterdam ($10/mt) and Durban ($1/mt)

- HSFO prices unchanged in Rotterdam and Gibraltar

- Rotterdam’s B30-VLSFO was indicated at a $228/mt premium over its VLSFO

Bunker fuel availability has improved slightly compared to last week in Rotterdam and in the wider ARA hub, a trader told ENGINE. But lead times remain unchanged at 5–7 days for optimal coverage from suppliers. Bunker demand has also picked up in the ARA hub, the trader added.

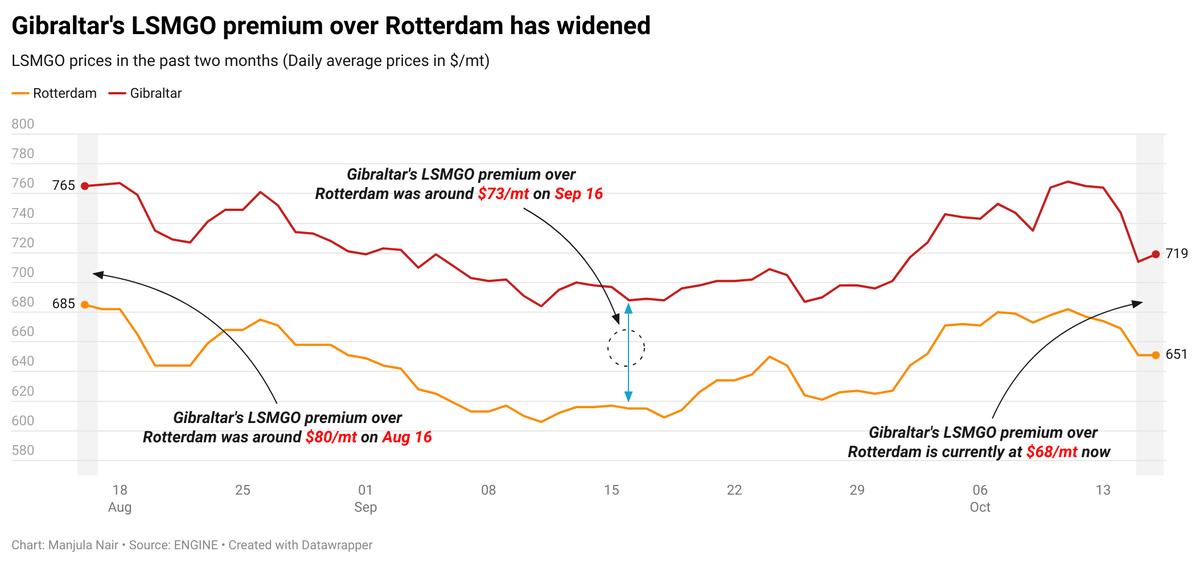

Rotterdam’s LSMGO price has fallen by a steep $10/mt in the past day, while Gibraltar’s LSMGO price has gained some. These diverging price moves have widened Gibraltar's LSMGO premium over Rotterdam by $15/mt in the past day.

In Gibraltar, availability across all grades is good with lead times of 3–4 days advised. Wind gusts of 20-27 knots are forecast in the area today and may impact bunkering in the port. In nearby Ceuta, bunkering is proceeding smoothly with five vessels due to arrive for bunkers today, down from seven yesterday, said shipping agent Jose Salama & Co.

Bunker fuel availability is tight in Barcelona, with prompt HSFO being particularly scarce, a trader said. The earliest delivery date for VLSFO and LSMGO with some suppliers is 23 October, the trader added.

Brent

The front-month ICE Brent contract has gained $0.16/bbl on the day, to trade at $74.25/bbl at 09.00 GMT.

Upward pressure:

Brent's price inched up amid uncertainties about further geopolitical developments in the Middle East.

Oil market traders and analysts are currently on the hook as Israel ramps up its plans to counterstrike Iran’s military facilities.

“The country [Israel] is free to act how it chooses after more than a year battling Iranian proxy groups and fending off two direct long-range attacks from the [Iran] Islamic Republic,” ANZ Bank’s senior commodity strategist Daniel Hynes remarked.

On the supply front, Brent’s price felt some upward thrust after the International Energy Agency (IEA) reported that global oil supply plunged by 640,000 b/d in September to 102.8 million b/d, primarily caused by political disputes in Libya and field maintenance work in Kazakhstan and Norway.

The report comes one day after OPEC’s monthly oil market report. OPEC's report stated that the 12 core members of the group produced an average of 26.04 million b/d of crude oil in September, about 604,000 b/d lower than their combined production in August.

“For now, oil exports from Iran and neighboring countries are unaffected but the market remains on tenterhooks, awaiting the next developments in the crisis,” Price Futures Group’s senior market analyst Phil Flynn said.

Downward pressure:

Brent’s price shed the previous week’s gains following reports, which suggested that Israel will not target Tehran’s oil and nuclear facilities.

An exclusive report by The Washington Post revealed that Israeli Prime Minister Benjamin Netanyahu’s administration is willing to strike Tehran’s military resources instead.

The news has eased risk premiums and moved Brent’s price lower, according to market analysts. “The [Washington Post] report eased concerns that oil supply would be disrupted, resulting in the diminishing geopolitical risk premium,” Hynes said.

Brent’s price felt more downward pressure after OPEC reduced its world oil demand growth forecast to 1.9 million b/d, with total consumption averaging 104.1 million b/d in 2024, about 106,000 b/d lower than its earlier projection.

“Oil prices dropped after OPEC cut its 2024 demand forecast for the third consecutive time, effectively conceding that China’s economic slowdown and structural shifts, like the rise of electric vehicles, could be sounding the death knell for any more super cycles,” SPI Asset Management’s managing partner Stephen Innes remarked.

By Manjula Nair and Aparupa Mazumder

Please get in touch with comments or additional info to news@engine.online

Contact our Experts

With 50+ traders in 12 offices around the world, our team is available 24/7 to support you in your energy procurement needs.