East of Suez Fuel Availability Outlook 15 Oct 2024

VLSFO and HSFO supply remains tight in Singapore

Bunker demand is low in Zhoushan

LSMGO availability is good in Omani ports

PHOTO: Industrial cargo ships in Busan port area, South Korea. Getty Images

PHOTO: Industrial cargo ships in Busan port area, South Korea. Getty Images

Singapore and Malaysia

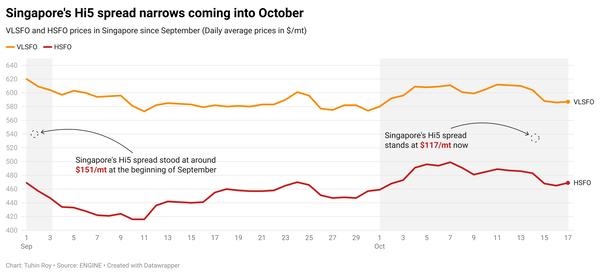

VLSFO availability in Singapore remains tight amid strong bunker demand, with recommended lead times of 10-13 days, consistent with last week. Prompt HSFO supply is also strained, with lead times of 10-12 days advised.

In contrast, LSMGO is more readily available, with stable lead times of 2-5 days.

Residual fuel oil stocks in Singapore have averaged 2% higher this month compared to September, according to Enterprise Singapore. Despite this slight rise, fuel oil inventories are still below the January peak of 22.49 million bbls. Fuel oil imports have increased by 1% month-on-month, while exports have surged by 15%.

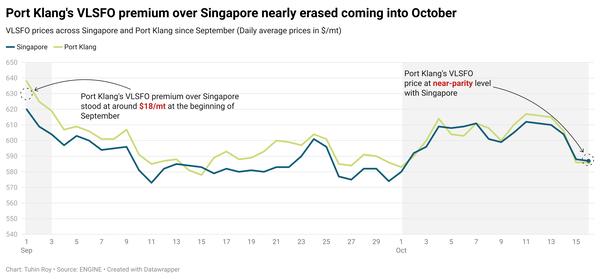

At Malaysia's Port Klang, VLSFO and LSMGO supplies are abundant, with some suppliers able to offer prompt deliveries for smaller volumes. However, HSFO availability remains limited.

East Asia

In Zhoushan, VLSFO and LSMGO availability remain normal amid low demand. Some suppliers have revised their delivery lead times for both grades from 3-5 days last week to 4-7 days now.

HSFO supply has tightened in Zhoushan due to stock shortages among several suppliers, pushing lead times from 3-5 days last week to 7-10 days.

In Northern China, the ports of Dalian and Qingdao have ample VLSFO and LSMGO supplies, though HSFO is limited in Qingdao. In Tianjin, both HSFO and LSMGO remain in short supply, but VLSFO availability is solid. Shanghai has strong LSMGO availability, but VLSFO and HSFO are scarce. Fuzhou has good supplies of both VLSFO and LSMGO, while Xiamen has restrictions on LSMGO availability, though VLSFO supply is good. In Yangpu and Guangzhou, the prompt availability of both grades remains limited.

In Hong Kong, lead times for all fuel grades remain steady at around seven days, unchanged from last week.

In Taiwanese ports like Hualien, Taichung, and Keelung, VLSFO and LSMGO supplies are stable, with prompt lead times of 2-3 days, the same as last week. In Kaohsiung, supply has improved across all grades, with lead times shortening from 4-5 days last week to 2-3 days.

In southern South Korean ports, VLSFO and LSMGO supplies have improved slightly, with lead times decreasing from around 11 days last week to 3-8 days now. However, HSFO supply remains tight, with lead times extending to about 11 days.

In western ports, VLSFO and LSMGO lead times have dropped significantly from 10-14 days last week to as little as four days. HSFO lead times remain steady at around 10 days.

High winds and waves are forecast to intermittently disrupt bunker operations at Ulsan, Onsan, and Busan between 16-20 October, and at Daesan, Taean, and Yeosu between 18-20 October.

In Japan, LSMGO supply remains strong at major ports including Tokyo, Chiba, Yokohama, Kawasaki, Osaka, Kobe, Sakai, Nagoya, Yokkaichi, Mizushima, and Oita. VLSFO is widely available, but prompt supply is tight in Oita.

HSFO is somewhat limited for prompt deliveries in Nagoya, Yokkaichi, and Oita. In the Tokyo Bay area ports of Tokyo, Chiba, Kawasaki, and Yokohama, HSFO supply has tightened due to technical issues at refineries. One refinery has halted HSFO production until 15 October, and two others are experiencing cargo loading delays, according to a source.

Oceania

A bunker barge at Fremantle and Kwinana is in dry dock until mid-November, making VLSFO unavailable by barge, though LSMGO is still available at berth. The port of Kembla remains unaffected, as bunkering is done by truck and ex-pipe.

In New South Wales, Sydney has sufficient LSMGO, but HSFO may require longer lead times. In Victoria, Melbourne and Geelong have ample VLSFO and LSMGO, though prompt HSFO deliveries may be challenging.

In Queensland, Brisbane and Gladstone have sufficient VLSFO and LSMGO with 7-8 day lead times, but HSFO is limited in Brisbane.

In New Zealand, Tauranga and Auckland have good VLSFO supplies, with Auckland also having strong LSMGO availability.

South Asia

VLSFO and LSMGO supplies at Indian ports, including Mumbai, Kandla, Tuticorin, Cochin, and Chennai, remain limited, consistent with recent weeks.

Meanwhile, Sri Lanka’s ports of Colombo and Hambantota have good availability of all fuel grades, with short lead times of around three days.

Middle East

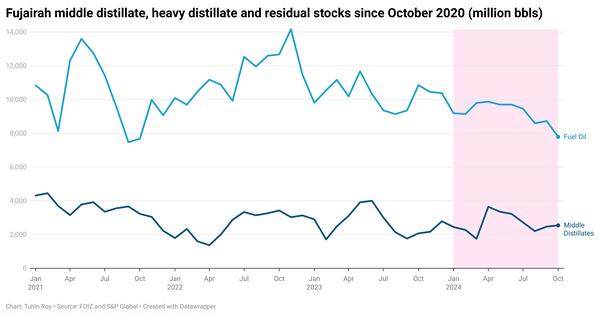

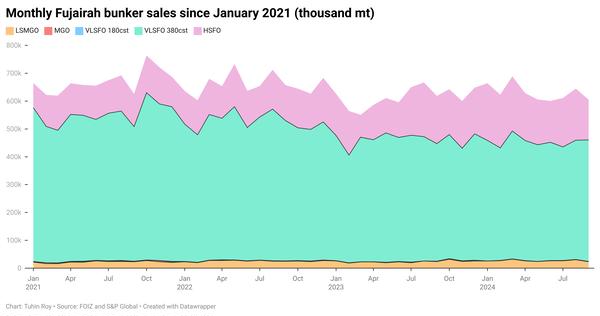

Availability of all grades in Fujairah is still “super tight,” with suppliers suggesting lead times of 7-10 days, consistent with last week. Khor Fakkan faces a similar situation, with recommended lead times of 7-10 days for all grades.

Jeddah port in Saudi Arabia has an abundant supply of VLSFO and LSMGO, while VLSFO is tight in nearby Djibouti, though LSMGO is more readily available there.

Omani ports, including Sohar, Salalah, Muscat, and Duqm, have ample LSMGO supplies with prompt deliveries.

By Tuhin Roy

Please get in touch with comments or additional info to news@engine.online

Contact our Experts

With 50+ traders in 12 offices around the world, our team is available 24/7 to support you in your energy procurement needs.