East of Suez Market Update 15 Oct 2024

Prices in East of Suez ports have moved down, and prompt availability of all grades remains very tight in Fujairah.

Changes on the day to 17.00 SGT (09.00 GMT) today:

- VLSFO prices down in Zhoushan ($29/mt), Fujairah ($19/mt) and Singapore ($11/mt)

- LSMGO prices down in Fujairah ($26/mt), Zhoushan ($20/mt) and Singapore ($13/mt)

- HSFO prices down in Singapore ($15/mt), Fujairah ($14/mt) and Zhoushan ($9/mt)

Bunker benchmarks in East of Suez ports have followed Brent’s downturn, declining for the second straight day. Zhoushan's VLSFO price has dropped by $29/mt, the largest decrease among the three major Asian bunker ports. As a result, Zhoushan's VLSFO price has shifted from a premium over Singapore to a discount of $9/mt, while its premium over Fujairah stands at $8/mt.

VLSFO and LSMGO availability in Zhoushan remains stable, despite lower demand, though lead times have increased slightly from 3-5 days last week, to 4-7 days now. HSFO supply has tightened in the port, with some suppliers experiencing stock shortages. This has pushed lead times from 3-5 days last week, to 7-10 days now.

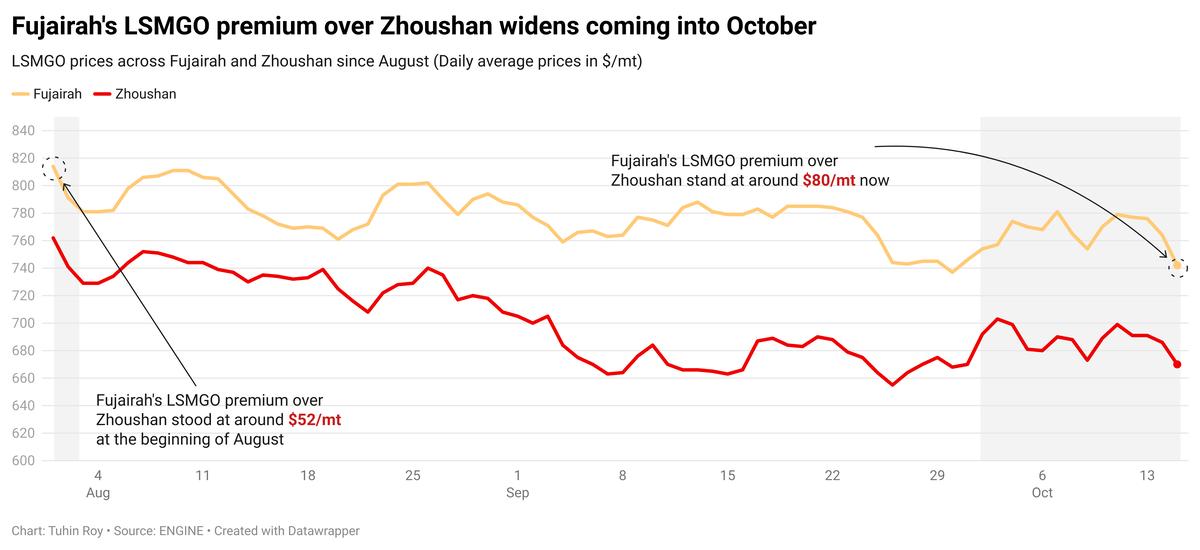

In Fujairah, LSMGO price has fallen sharply by $26/mt, influenced by a few lower-priced LSMGO indications. However, the port’s LSMGO premium over Zhoushan has widened from around $52/mt in the beginning of August to around $80/mt now.

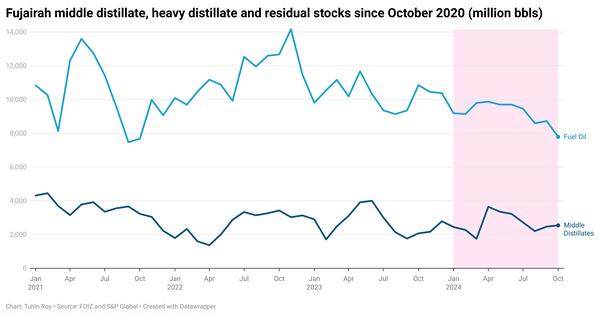

Availability of all grades in Fujairah is still “super tight,” with suppliers suggesting lead times of 7-10 days, consistent with last week. Khor Fakkan faces a similar situation, with recommended lead times of 7-10 days for all grades.

Brent

The front-month ICE Brent contract has declined by $3.62/bbl on the day, to trade at $74.09/bbl at 17.00 SGT (09.00 GMT).

Upward pressure:

Brent’s price found some support from the decline in OPEC+ oil output. The 12 core OPEC members produced an average of 26.04 million b/d of crude oil in September, about 604,000 b/d lower than their combined production in August.

Crude oil production in Libya, Iraq, Nigeria and Saudi Arabia decreased last month, the Vienna-headquartered group said.

Oil production in Iraq, the group’s second-largest producer, declined by 155,000 b/d to 4.11 million b/d in September, while output in Libya fell by 410,000 b/d last month to 540,000 b/d, OPEC said.

“The OPEC report also showed that Iraq belatedly made progress to implementing its share of output cuts due since the start of the year,” ANZ Bank’s senior commodity strategist Daniel Hynes remarked.

Downward pressure:

Brent’s price plummeted following the latest comments from Israel that it may not target Iran’s oil infrastructure.

According to a Washington Post report, Israeli Prime Minister Benjamin Netanyahu has assured US President Joe Biden that the Israel Defense Forces (IDF) will target Tehran’s military infrastructure, rather than oil or nuclear facilities.

This news has suggested a more limited retaliation, rather than a full-scale war in the Middle East, and has eased some supply concerns, according to oil market analysts.

“Israel has assured the US that it will not strike crude oil or nuclear facilities in Iran,” two analysts from ING Bank said. “This has removed a big overhang for the oil market in the immediate term,” they added.

Lower crude oil imports from China, the world’s second-largest oil consumer, has also put downward pressure on Brent’s price. China imported 11.07 million b/d of crude oil in September, down from 11.56 million b/d imported in August.

“Chinese trade data yesterday has not helped [oil market’s] sentiment either,” ING Bank’s analysts said.

Meanwhile, Chinese economic stimulus announced over the weekend has not supported oil prices, analysts said. Chinese Finance Minister Lan Foan announced new measures, stating that Beijing would help local governments tackle debt and offer subsidies to people with low incomes, without mentioning the size of the fiscal stimulus.

“[Brent] crude oil prices sank as sentiment fell on the lack of new stimulus from China,” Hynes added.

By Tuhin Roy and Aparupa Mazumder

Please get in touch with comments or additional info to news@engine.online

Contact our Experts

With 50+ traders in 12 offices around the world, our team is available 24/7 to support you in your energy procurement needs.