Europe & Africa Market Update 14 Oct 2024

Regional bunker benchmarks in European and African ports have mostly dipped, and prompt bunker availability is good in Gibraltar.

Changes on the day, from Friday to 09.00 GMT today:

- VLSFO prices up in Gibraltar ($4/mt), and down in Durban ($20/mt) and Rotterdam ($1/mt)

- LSMGO prices up in Durban ($6/mt), and down in Gibraltar ($13/mt) and Rotterdam ($4/mt)

- HSFO prices unchanged in Gibraltar, and down in Rotterdam ($4/mt)

- Rotterdam’s B30-VLSFO was indicated at a $281/mt premium over its VLSFO

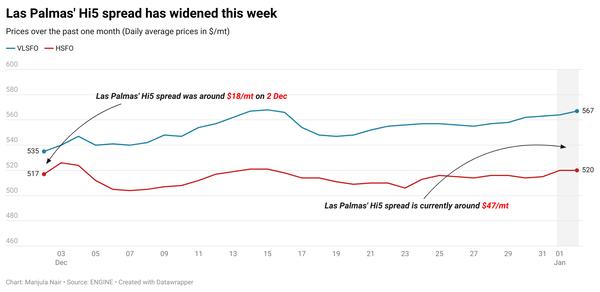

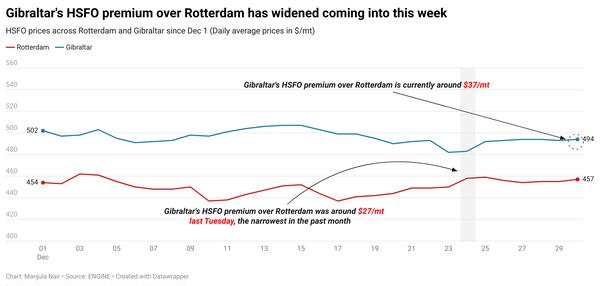

Rotterdam’s HSFO price drop has outpaced its VLSFO price decline over the weekend. As a result, the port’s Hi5 spread has narrowed moderately from $36/mt on Friday to $39/mt now, but remains wider than $18/mt last week.

Gibraltar’s VLSFO price has countered Brent’s downward pull and registered a moderate $4/mt gain over the weekend. A significantly higher-priced VLSFO stem booked in Gibraltar for $621/mt for 150-500 mt has supported this upward movement over the weekend.

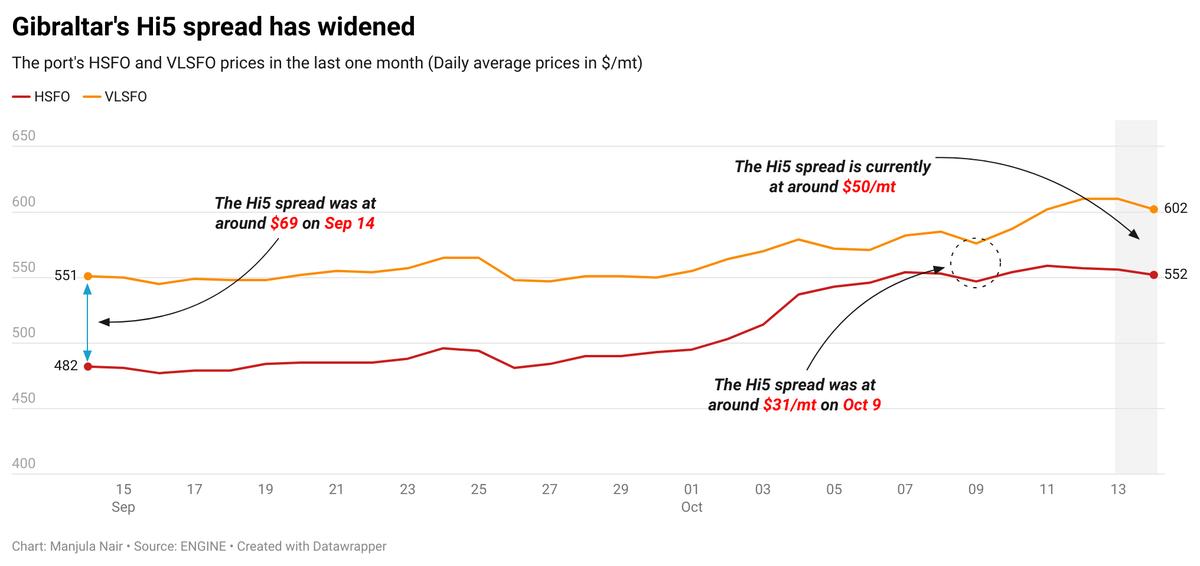

In contrast, Gibraltar’s HSFO price has held steady. The port’s Hi5 spread has widened from $36/mt on Friday to $40/mt now. Availability across all grades is normal in Gibraltar with suppliers able to offer prompt delivery dates. Lead times of 3–4 days are recommended across all grades, a trader said.

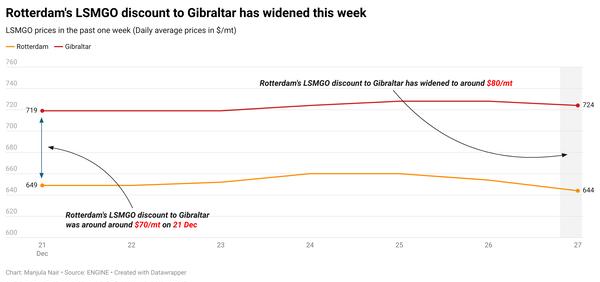

Meanwhile, a lower-priced non-prompt LSMGO stem fixed off Malta on Friday at $714/mt for 0-50 mt has pulled the benchmark down by $7/mt. Its discount to Gibraltar's LSMGO has narrowed by $6/mt to $33/mt. Prompt bunker availability is good off Malta with lead times of 3–4 days advised for all grades.

Brent

The front-month ICE Brent contract has moved $0.76/bbl lower on the day from Friday, to trade at $77.71/bbl at 09.00 GMT.

Upward pressure:

Brent crude’s price found some upward pressure over escalating tensions in the Middle East. Global oil market traders and analysts are factoring in Israel’s retaliatory move against Tehran’s missile attack on 1 October.

“Israel’s government has yet to decide how to retaliate against Iran for a missile attack,” ANZ Bank’s senior commodity strategist Daniel Hynes remarked. “The lingering possibility of Iran’s oil output being disrupted has left the market on edge,” he added.

On the calendar today is the release of OPEC’s monthly oil market report. Analysts expect an optimistic oil demand growth figure from the oil producers’ group will provide some boost to prices.

The report is also expected to show better supply compliance from members including Iraq, Kazakhstan, and Russia. Earlier this month, the Saudi Arabia-led group advised the members to “fully implement” output cuts pledged earlier this year.

“Members that have been over-producing are expected to cut deeper than current quotas to make up for the extra barrels they produced,” Hynes said.

Downward pressure:

Brent’s price started the week on a softer note as China’s latest economic briefing over the weekend “lacked any concrete new measures to support struggling oil demand in the country,” two analysts from ING Bank remarked.

In a press conference, Chinese Finance Minister Lan Foan announced new measures, stating that Beijing would help local governments tackle debt and offer subsidies to people with low incomes, without mentioning the size of the fiscal stimulus, Reuters reported.

“A highly anticipated briefing by China’s finance minister on Saturday disappointed investors that were hoping for a concrete fiscal stimulus figure,” VANDA Insights’ founder and analyst Vandana Hari said.

By Manjula Nair and Aparupa Mazumder

Please get in touch with comments or additional info to news@engine.online

Contact our Experts

With 50+ traders in 12 offices around the world, our team is available 24/7 to support you in your energy procurement needs.