Europe & Africa Market Update 10 Oct 2024

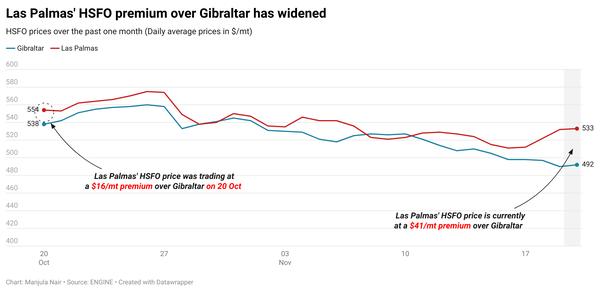

Regional bunker benchmarks have shown mixed market directions, and prompt HSFO continues to be tight in Las Palmas.

Changes on the day to 09.00 GMT today:

- VLSFO prices up in Gibraltar and Durban ($1/mt), and down in Rotterdam ($6/mt)

- LSMGO prices up in Gibraltar ($20/mt), and down in Rotterdam ($9/mt) and Durban ($6/mt)

- HSFO prices up in Rotterdam ($5/mt), and down in Gibraltar ($2/mt)

- Rotterdam’s B30-VLSFO was indicated at a $234/mt premium over its VLSFO

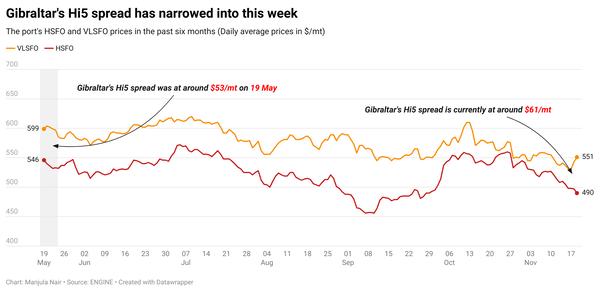

Rotterdam’s HSFO price has increased for the second consecutive day, while its VLSFO price has fallen. As a result, the port’s Hi5 spread has narrowed to $25/mt, which is much narrower compared to $63/mt a week ago.

Prompt HSFO supply tightness has contributed to push the grade's price higher in Rotterdam. HSFO price has risen by a significant $53/mt over the past week. Some bunker barges continue to face delays in loading the product in terminals.

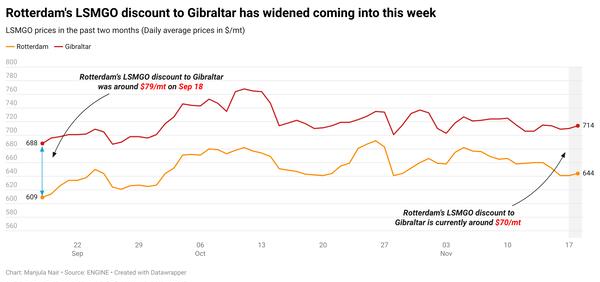

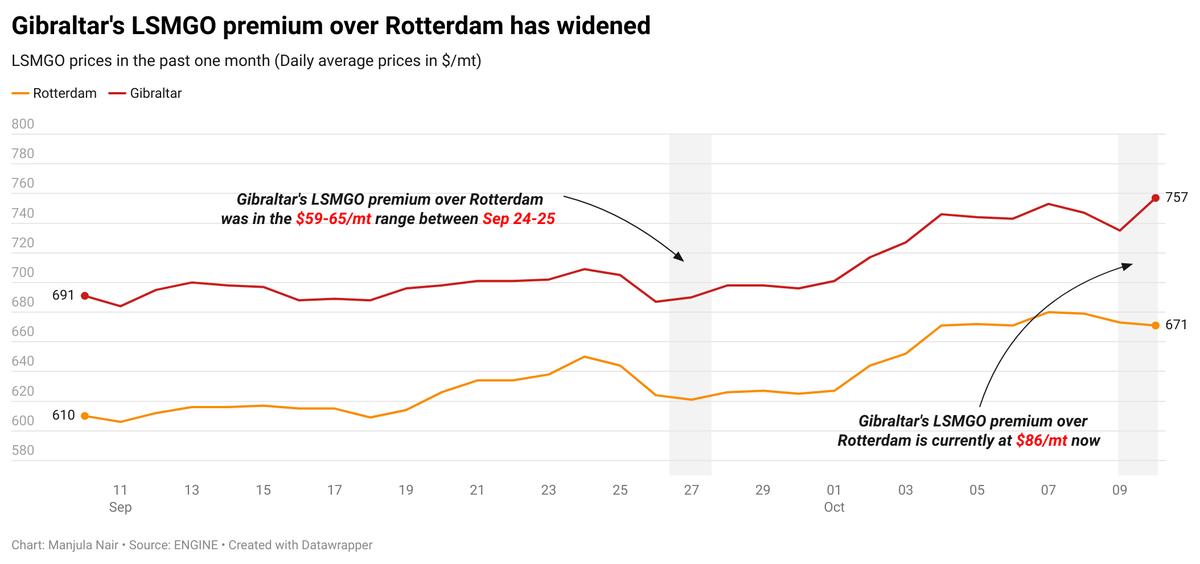

Gibraltar’s LSMGO price has countered Brent’s downward pull and gained by a steep $20/mt in the past day. This upward movement was due to a significantly higher-priced prompt stem fixed at $758/mt for 50-150 mt in the past day. On the other hand, Rotterdam’s LSMGO has come down in the past day. These diverging price moves have widened Gibraltar’s LSMGO premium over Rotterdam to $86/mt today.

Prompt HSFO availability remains very tight in the Canary Islands’ port of Las Palmas, according to a trader. Lead times of 5–7 days are advised by traders. HSFO is currently tight in the port as suppliers await replenishment cargoes. The last HSFO cargo received in Las Palmas was nearly a month ago, according to Vortexa data. The cargo arrived from Portugal, where a supplier restarted HSFO supply in August.

Brent

The front-month ICE Brent contract has declined by $0.42/bbl on the day, to trade at $77.21/bbl at 09.00 GMT.

Upward pressure:

Brent crude’s price felt some upward pressure from elevated tensions in the Middle East. Oil market analysts remain concerned about potential Israeli retaliation on Iran, which could disrupt oil production in the Middle East region.

“The latest reports indicate that Iran is prepared to launch thousands of missiles at Israel and target economic sites if its attacked,” ANZ Bank’s senior commodity strategist Daniel Hynes remarked.

Although US President Joe Biden, in a recent press brief, discouraged the Israel Defense Forces (IDF) from targeting Tehran’s oil facilities, “there is growing concern that Israel’s allies [like the US] have little influence on its strategy,” Hynes said.

Oil prices also found support as Hurricane Milton made landfall on Florida’s west coast, with major US oil companies including Chevron and Kinder Morgan closing fuel-importing terminals at the port of Tampa, Reuters reported.

“[Oil] prices recovered some of the losses this morning amid uncertainty in the Middle East and concerns over supply disruptions due to Hurricane Milton,” two analysts from ING Bank said.

Downward pressure:

Brent’s price trailed lower after the US Energy Information Administration (EIA) reported a build in US crude stocks, sparking demand growth concerns.

Commercial crude oil inventories in the US increased by 5.81 million bbls to touch 423 million bbls on 4 October, according to data from EIA.

An increase in US crude stocks indicates lacklustre oil demand growth, which can put downward pressure on Brent’s price. “The Energy Information Administration’s (EIA) inventory report was bearish for the oil market yesterday,” ING Bank’s analysts said.

However, the weekly US crude stock build was much smaller compared to the 10.9 million bbls build predicted by the American Petroleum Institute (API).

Meanwhile, China’s National Development and Reforms Commission (NDRC), in a recent press conference, failed to announce any new supportive measures for the country’s economic growth.

This news coming from the world’s second-largest crude oil consumer has put further downward pressure on Brent. “[Brent] crude oil prices were under pressure… as the disappointment over a lack of new stimulus measures in China weighed on sentiment,” Hynes added.

By Manjula Nair and Aparupa Mazumder

Please get in touch with comments or additional info to news@engine.online

Contact our Experts

With 50+ traders in 12 offices around the world, our team is available 24/7 to support you in your energy procurement needs.