Europe & Africa Market Update 2 Oct 2024

Regional bunker benchmarks have gained with Brent values, and prompt LSMGO supply remains tight in Rotterdam.

PHOTO: Oil storage tanks in the Port of Amsterdam, Netherlands. Getty Images

PHOTO: Oil storage tanks in the Port of Amsterdam, Netherlands. Getty Images

Changes on the day to 09.00 GMT today:

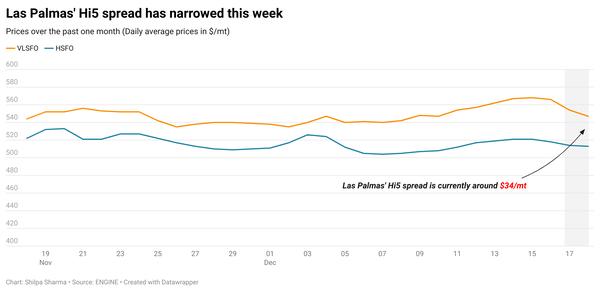

- VLSFO prices up in Durban ($49/mt), Gibraltar ($25/mt) and Rotterdam ($24/mt)

- LSMGO prices up Durban ($67/mt), Rotterdam ($44/mt) and Gibraltar ($34/mt)

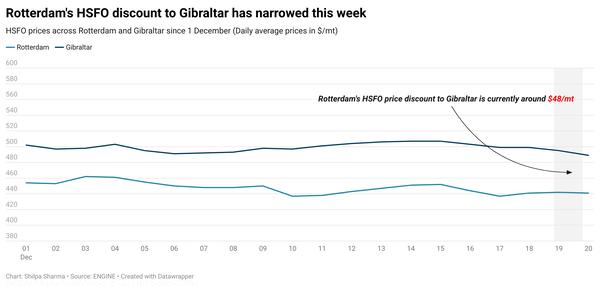

- HSFO prices up in Rotterdam ($36/mt) and Gibraltar ($20/mt)

Rotterdam’s LSMGO price has increased sharply in the past day. Prompt supply of the grade is currently tight in Rotterdam and in the wider ARA hub as some suppliers are facing barge loading delays at terminals. Lead times of around seven days are generally recommended for the grade.

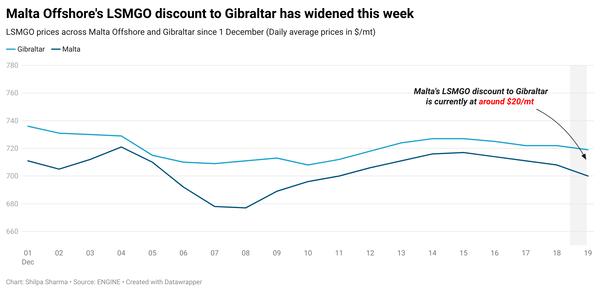

Bunker prices across all grades have increased in Gibraltar in the past day. Prompt availability of all grades is good in the port, requiring lead times of 3–5 days for broad coverage from suppliers. Gibraltar’s LSMGO premium over Rotterdam has narrowed by $10/mt to $69/mt now.

In South Africa’s Durban, VLSFO and LSMGO prices have increased in the past day. Prompt supply of the two grades remains tight in Durban. Recommended lead times for LSMGO stretch up to two weeks, while lead times of 7–10 days are advised for VLSFO deliveries, according to a trader.

Brent

The front-month ICE Brent contract has moved $4.87/bbl higher on the day, to trade at $75.17/bbl at 09.00 GMT.

Upward pressure:

Brent’s price surpassed $75/bbl on oil supply disruption fears, following reports that Iran launched over 180 ballistic missiles towards Israel on Tuesday.

In a significant escalation of tensions in the Middle East, the Israel Defense Forces (IDF) confirmed that Tehran is now directly involved in the regional conflict, putting the second-largest OPEC producer’s production capabilities under direct threat.

“Crude oil prices surged higher after Iran launched a missile attack on Israel,” ANZ Bank’s senior commodity strategist Daniel Hynes said.

The attack comes in retaliation to Israel’s military actions in Beirut last week, which killed Hezbollah leader Hassan Nasrallah and other prominent leaders of the Iran-aligned militant group.

Meanwhile, Israel has vowed to strike back against yesterday’s attack, sparking further tensions in the wider Middle Eastern region.

“Attention is now fully on how Israel will respond to this latest attack,” two analysts from ING Bank remarked. “The more Iran gets directly involved in this conflict the greater the risk of oil supply disruptions,” they added.

Downward pressure:

Brent’s price gains were marginally capped by concerns about production hikes from the OPEC+ members.

“The [oil] market was spooked by reports that Saudi Arabia is willing to forge ahead with production hikes in December,” Hynes said.

OPEC+ will hold its Joint Ministerial Monitoring Committee (JMMC) meeting later today. The Saudi Arabia-led coalition, which is expected to gradually start unwinding production cuts from 1 December, “is not expected to recommend any changes to production policy,” VANDA Insights’ founder and analyst Vandana Hari said.

Demand growth concerns coming in from China, the world’s second-largest oil consumer, have also put some downward pressure on Brent.

China’s latest economic stimulus measures may not be enough to sustain economic growth in the country, market analysts said.

By Shilpa Sharma and Aparupa Mazumder

Please get in touch with comments or additional info to news@engine.online

Contact our Experts

With 50+ traders in 12 offices around the world, our team is available 24/7 to support you in your energy procurement needs.