East of Suez Market Update 19 Sep 2024

Most prices in East of Suez ports have moved up, and bunker operations have been suspended in Zhoushan since yesterday due to Typhoon Pulasan.

Changes on the day to 17.00 SGT (09.00 GMT) today:

- VLSFO prices up in Zhoushan ($11/mt) and Singapore ($8/mt), and down in Fujairah ($3/mt)

- LSMGO prices up in Singapore, Fujairah ($14/mt) and Zhoushan ($6/mt)

- HSFO prices up in Zhoushan ($10/mt) and Fujairah ($8/mt), and down in Singapore ($5/mt)

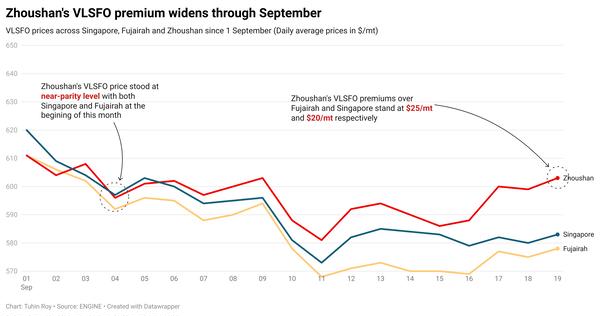

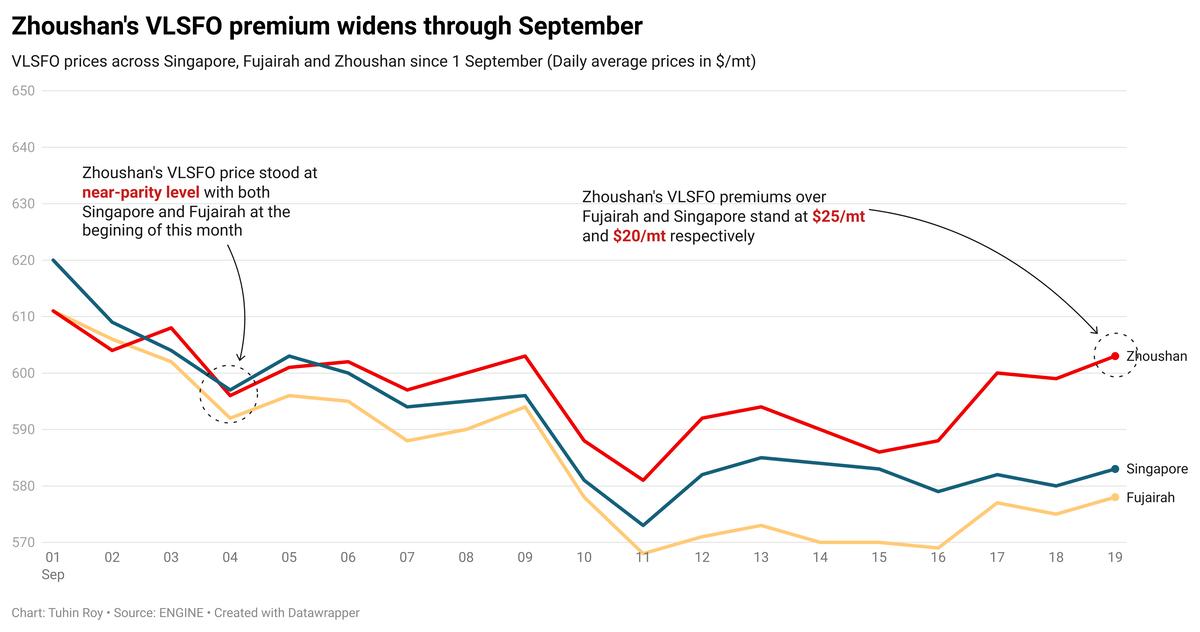

Most bunker benchmarks in East of Suez ports have followed Brent’s upward movement, posting gains over the past day. VLSFO prices in Zhoushan and Singapore have increased by $11/mt and $8/mt, respectively, while Fujairah’s price has held steady. Zhoushan’s VLSFO premiums over Fujairah and Singapore have widened since the beginning of this month.

VLSFO availability has improved in Zhoushan. Lead times have reduced from 5-7 days earlier in the week to around 3-5 days now. Lead times for LSMGO remain unchanged at 3-5 days. However, HSFO lead times have increased from 3-5 days to 5-7 days now.

Bunker operations in Zhoushan have been suspended since yesterday due to Typhoon Pulasan, which is expected to make landfall between Xiangshan in Zhejiang and Pudong district in Shanghai on Thursday.

China's National Meteorological Center issued an alert for Typhoon Pulasan, located over the East China Sea, about 320 km southeast of Xiangshan County in Ningbo as of this morning.

Full bunkering operations are expected to resume by tomorrow or the day after, when calmer weather is forecast, according to a source.

In Taiwan, VLSFO and LSMGO supplies are stable in the ports of Hualien, Kaohsiung and Keelung, with lead times of 2-3 days. Taichung deliveries require slightly longer lead times of 3-4 days for both grades.

Brent

The front-month ICE Brent contract has gained $1.66/bbl on the day, to trade at $74.45/bbl at 17.00 SGT (09.00 GMT).

Upward pressure:

Brent’s price moved higher after the US Federal Reserve (Fed) cut its key interest rate by a massive 50 basis points for the first time since 2020, bringing the central bank’s benchmark rate to a range between 4.75% and 5.00%.

Lower interest rates in the US can boost demand growth for dollar-denominated commodities like oil as it makes the greenback weaker against other currencies. Brent’s price moved into a “positive territory,” after the US Fed announced its rate cut, ANZ Bank’s senior commodity strategist Daniel Hynes said.

Meanwhile, a drop in US crude stocks also supported the oil demand growth expectations in the world’s largest oil consuming nation. Commercial crude oil inventories in the US dropped by 1.63 million bbls to touch 418 million bbls on 13 September, according to the US Energy Information Administration (EIA).

Oil market traders are also closely monitoring geopolitical developments in the Middle East. Walkie-talkies and other hand-held pager devices used by Iran-aligned Hezbollah armed group detonated yesterday across southern Lebanon, Reuters reported.

The news of devices exploding has raised concerns of a wider Israel-Lebanon conflict in the oil-rich region, with the latter blaming the Israel Defense Forces (IDF) for the blasts.

“Tensions remain high after Iran-backed Hezbollah accused Israel of orchestrating an attack that killed several people,” Hynes added.

Downward pressure:

Brent’s price remains under some downward pressure due to concerns over slowing demand growth in China.

Chinese refiners processed about 59.07 million mt (13.91 million b/d) of crude oil in August, down 6.2% from the same period a year ago, market intelligence provider JLC reported citing data from China’s National Bureau of Statistics (NBS).

Additionally, the country’s oil imports also remain tepid. China imported 11.56 million b/d of crude oil last month, down from 12.43 million b/d imported in August 2023.

“China has obviously been the key concern when it comes to demand,” two analysts from ING Bank said.

By Tuhin Roy and Aparupa Mazumder

Please get in touch with comments or additional info to news@engine.online

Contact our Experts

With 50+ traders in 12 offices around the world, our team is available 24/7 to support you in your energy procurement needs.