East of Suez Market Update 16 Sep 2024

Prices in East of Suez ports have moved down, and bunkering has been suspended in Zhoushan since yesterday due to Typhoon Bebinca-induced bad weather.

Changes on the day from Friday, to 17.00 SGT (09.00 GMT) today:

- VLSFO prices down in Zhoushan ($10/mt), Fujairah ($5/mt) and Singapore ($2/mt)

- LSMGO prices down in Fujairah ($15/mt), Singapore ($8/mt) and Zhoushan ($4/mt)

- HSFO prices down in Fujairah, Zhoushan ($12/mt) and Singapore ($3/mt)

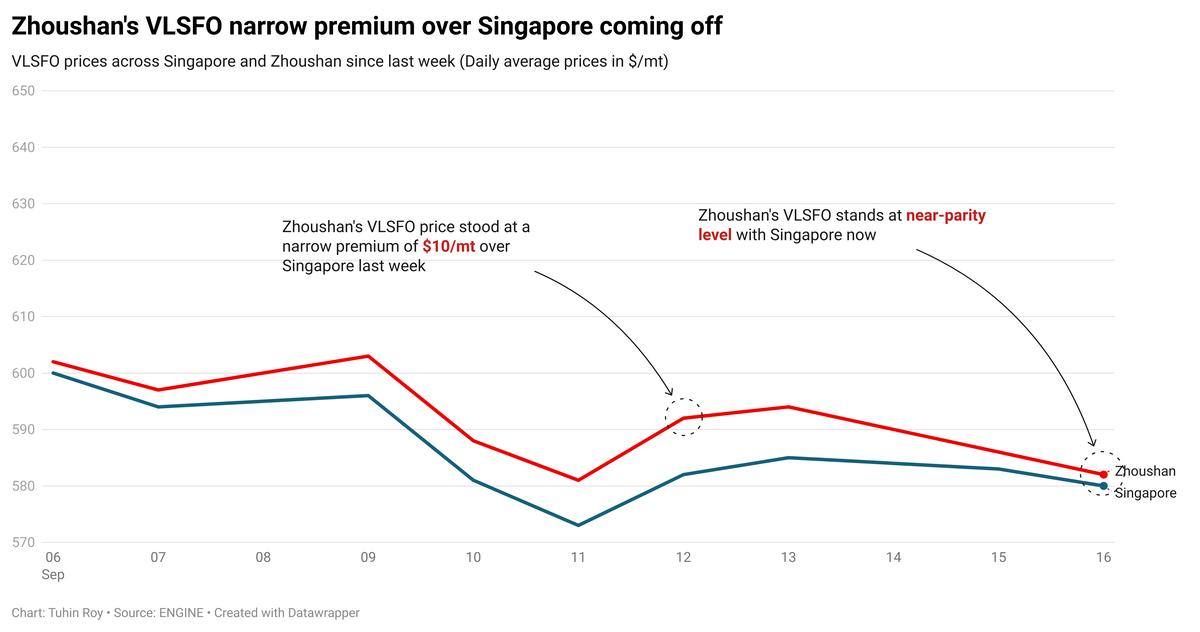

Most bunker benchmarks in East of Suez ports have followed Brent’s decline over the weekend. Zhoushan’s VLSFO price has dropped by $10/mt, while Fujairah and Singapore’s prices have remained steady. This has erased Zhoushan’s VLSFO premium over Singapore, which now stands at near parity level. Zhoushan’s VLSFO premium over Fujairah is $17/mt.

Prompt VLSFO availability is tight in Zhoushan, with some suppliers running low on stocks. Lead times for VLSFO remain at 5-7 days, consistent with last week. In contrast, HSFO and LSMGO grades are more readily available in Zhoushan, with shorter lead times of 3-5 days.

Bunker operations in Zhoushan have been suspended since yesterday due to bad weather conditions induced by Typhoon Bebinca. Bunkering is likely to resume tomorrow or the following day when calmer weather conditions are forecast, a source says.

In Taiwan, VLSFO and LSMGO supplies in Hualien, Kaohsiung and Keelung ports are stable with lead times of about 2-3 days, similar to last week. Deliveries in Taichung require slightly longer lead times of 3-4 days for both grades.

Brent

The front-month ICE Brent contract has shed $0.18/bbl on the day from Friday, to trade at $72.33/bbl at 17.00 SGT (09.00 GMT).

Upward pressure:

Brent’s price felt some upward pressure ahead of the US Federal Reserve’s (Fed) two-day Federal Open Market Committee (FOMC) meeting. A cut in key US interest rate is widely expected this week, according to market analysts.

Lower US interest rates make dollar-denominated commodities like oil more affordable for holders of other currencies, thereby supporting demand growth in the world’s largest oil consuming nation.

“This week's Fed meeting is setting up to be one of the most eagerly awaited in recent memory,” SPI Asset Management’s managing partner Stephen Innes remarked.

The global oil market’s focus remains on Fed chairman Jerome Powell’s decision to whether cut interest rates by 25 or 50 basis points, as the latter can raise concerns of a possible recession, according to analysts. An aggressive rate cut could indicate underlying fears of an economic recession in the US, they said.

“While a cut is priced in, the uncertainty is whether we get a 25bp or 50bp [25 or 50 basis points] cut,” two analysts from ING Bank said. “A 50bp [basis points] cut could be slightly bearish for oil [prices] as it may raise recession fears,” they added.

Downward pressure:

Oil production in the US Gulf of Mexico is gradually resuming, following last week’s temporary closures due to Hurricane Francine, according to reports. This news has added some downward pressure on Brent’s price today.

“[Brent] crude oil edged lower… as operations in the Gulf of Mexico restarted as the impact of Hurricane Francine started to ease,” ANZ Bank’s senior commodity strategist Daniel Hynes said.

On Friday, oil giant Shell announced the resumption of oil production in five offshore platforms, as the impact of the hurricane eased, according to a Reuters report. US-based oil major Chevron has deployed its staff to three offshore platforms in the US Gulf of Mexico, the report adds.

Meanwhile, demand growth concerns from China continue to drive Brent’s price lower, according to analysts. The country imported 11.56 million b/d of crude oil in August, down from 12.43 million b/d imported during the same time a year ago.

“Chinese data continues to point towards weaker domestic oil demand,” ING Bank’s analysts said.

By Tuhin Roy and Aparupa Mazumder

Please get in touch with comments or additional info to news@engine.online

Contact our Experts

With 50+ traders in 12 offices around the world, our team is available 24/7 to support you in your energy procurement needs.