Europe & Africa Market Update 9 Sep 2024

Regional bunker benchmarks have declined with Brent, and rough weather may impact bunkering in Gibraltar today.

Changes on the day, from Friday to 09.00 GMT today:

- VLSFO prices up in Durban ($3/mt), and down in Rotterdam ($8/mt) and Gibraltar ($7/mt)

- LSMGO prices up in Durban ($6/mt), and down in Gibraltar ($14/mt) and Rotterdam ($8/mt)

- HSFO prices down in Rotterdam ($8/mt) and Gibraltar ($5/mt)

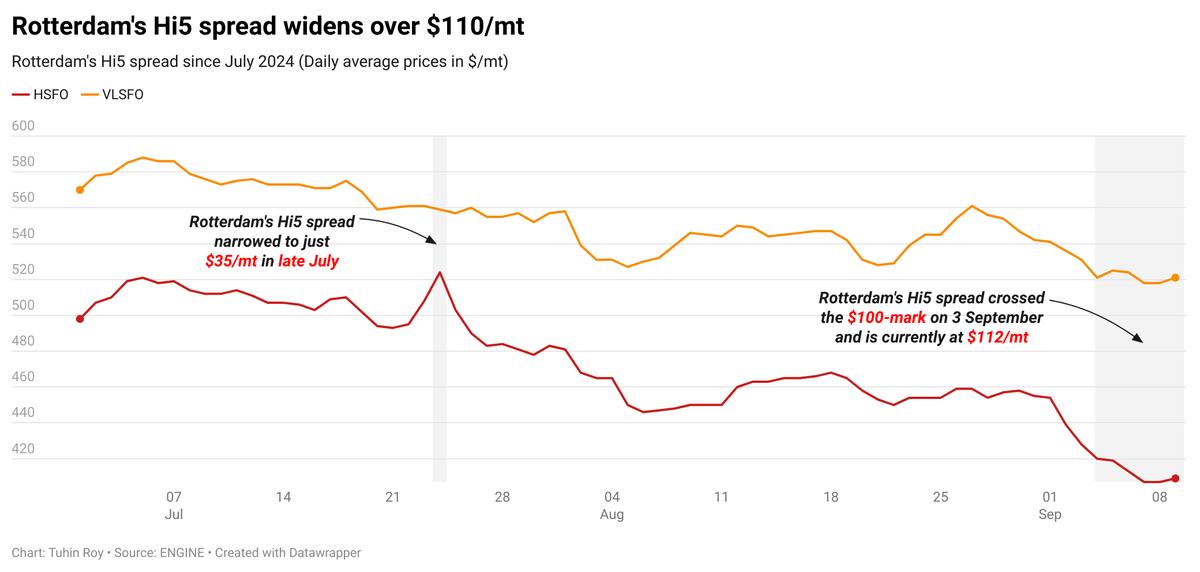

Rotterdam’s HSFO and VLSFO prices have shown a similar decrease over the weekend. The port’s Hi5 spread has remained consistent from Friday and is currently at $110/mt. Rotterdam’s Hi5 spread has mostly been above the $100/mt mark in September so far.

Gibraltar’s LSMGO price drop has outpaced Rotterdam’s LSMGO price fall over the weekend. These price movements have narrowed Gibraltar's LSMGO price premium over Rotterdam's by $6/mt to $88/mt now.

Bunkering may be hit by adverse weather in the Gibraltar port area today with wind gusts of up to 21 knots forecast. One vessel is waiting for bunkers in Gibraltar today, unchanged from Friday, according to a source. In nearby Ceuta, 12 vessels are due to arrive for bunkers today, up from seven yesterday, said shipping agent Jose Salama & Co.

Two lower-priced prompt stems were booked earlier today off Malta. Of these, a significantly lower-priced HSFO stem booked at $467/mt for 500-1500 mt has dragged the benchmark down by $17/mt. This price drop has narrowed Gibraltar’s discount to Malta by $12/mt to $24/mt now.

Brent

The front-month ICE Brent contract has lost $1.00/bbl on the day from Friday, to trade at $71.74/bbl at 09.00 GMT.

Upward pressure:

Brent’s price found some support following OPEC’s latest announcement to extend the ongoing 2.2 million b/d oil production cuts for two months.

Last week, eight members of the Organization of the Petroleum Exporting Countries (OPEC) and its allies collectively decided to postpone the gradual easing of production cuts that were planned to begin in October.

Oil’s selloff was “briefly halted by the announcement that OPEC would postpone its production hikes by two months,” ANZ Bank’s senior commodity strategist Daniel Hynes said.

In eastern Europe, supply disruption concerns have continued over the weekend, adding some upward pressure on Brent’s price. A series of fires broke out at a fuel depot in Volokonovsky district in Russia's Belgorod region yesterday, its Governor Vyacheslav Gladkov confirmed.

The fire was caused by falling drone debris launched by the Ukrainian armed forces, Gladkov claimed.

Downward pressure:

Brent’s price trailed lower as economic activity in the US continued to show signs of weakness, market analysts said.

Concerns about sluggish economic growth in the US grew after the country's Bureau of Labor Statistics (BLS) published a weaker-than-expected US jobs report on Friday. US employers added 142,000 jobs in August, according to the report.

Oil market analysts were expecting the report to show a much larger growth of 161,000 additional US jobs, according to SPI Asset Management’s managing partner Stephen Innes.

This news has raised demand growth concerns in the US and put downward pressure on Brent’s price. “Demand weakness and a soft oil balance in 2025 are still clearly a concern,” two analysts from ING Bank said.

By Manjula Nair and Aparupa Mazumder

Please get in touch with comments or additional info to news@engine.online

Contact our Experts

With 50+ traders in 12 offices around the world, our team is available 24/7 to support you in your energy procurement needs.