Europe & Africa Market Update 5 Sep 2024

Bunker benchmarks in most European and African ports have moved in mixed directions, and prompt LSMGO availability is good in Gibraltar.

Changes on the day to 09.00 GMT today:

- VLSFO prices up in Gibraltar ($20/mt), Durban ($10/mt) and Rotterdam ($7/mt)

- LSMGO prices up in Gibraltar ($18/mt) and Durban ($5/mt), and down in Rotterdam ($8/mt)

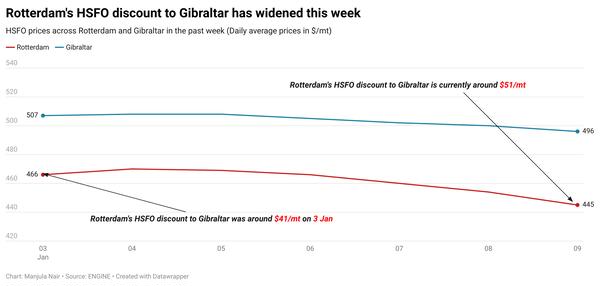

- HSFO prices down in Gibraltar ($6/mt) and Rotterdam ($4/mt)

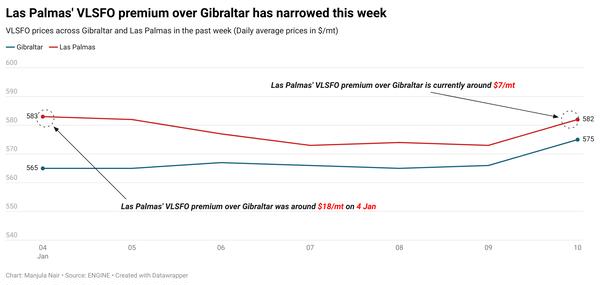

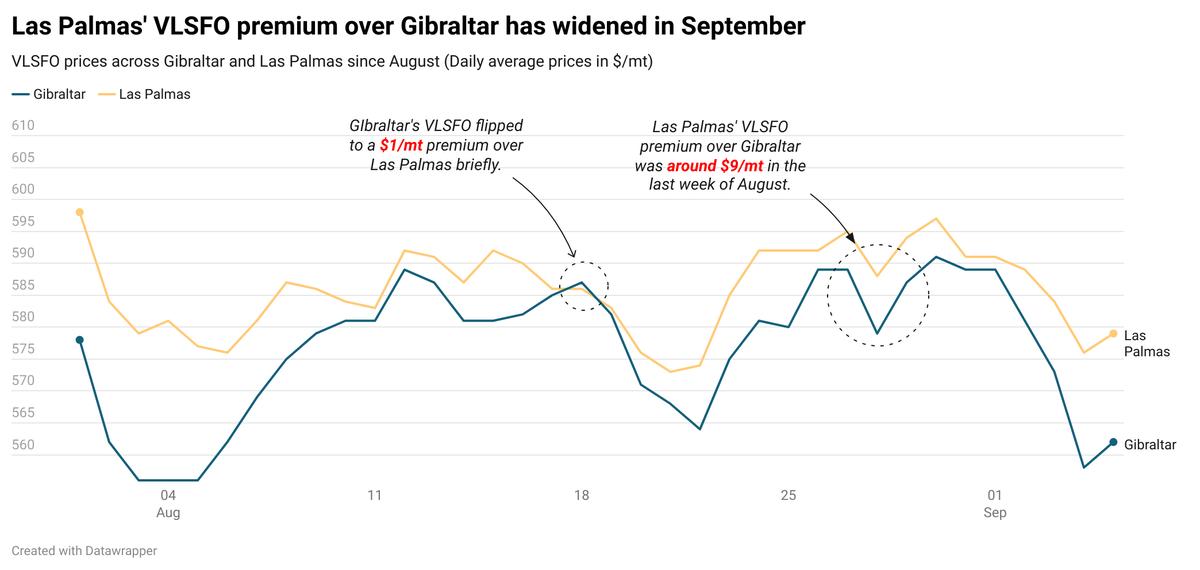

Las Palmas' VLSFO premium over Gibraltar has widened coming into September. A higher-priced non-prompt VLSFO stem was booked in Las Palmas yesterday. The stem has contributed to push the benchmark up by $17/mt in the past day.

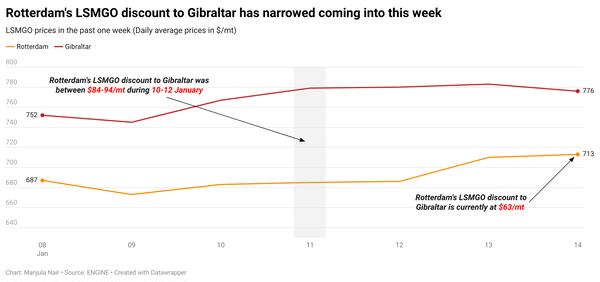

Rotterdam’s LSMGO price has come down in the past day. A lower-priced non-prompt LSMGO stem fixed in the port at $628/mt for 50-150 mt has triggered the fall in the benchmark. In contrast, a higher-priced prompt delivery LSMGO stem was booked in Gibraltar yesterday. The stem has contributed to push the grade's price up in Gibraltar. These diverging price moves have widened Gibraltar’s LSMGO premium over Rotterdam by $26/mt to $95/mt now. LSMGO supply is good for prompt delivery in Gibraltar and in the ARA hub.

Bunkering is proceeding normally in Gibraltar amid calm weather conditions. Three vessels are waiting for bunkers today, down from four yesterday, according to a source. Bunker operations are running smoothly in Ceuta as well, where nine vessels are due to arrive for bunkers today, down from ten yesterday, said shipping agent Jose Salama & Co.

Brent

The front-month ICE Brent contract has inched $0.20/bbl lower on the day, to trade at $73.32/bbl at 09.00 GMT.

Upward pressure:

Brent’s price found some support after the American Petroleum Institute (API) reported a sizeable draw in US crude stocks, easing some demand growth fears in the world’s largest oil-consuming nation.

Crude oil inventories in the US declined by about 7.4 million bbls in the week that ended 30 August, the API reported. The drop in crude stocks was “constructive”, two analysts from ING Bank remarked.

Brent futures gained additional support following a news report which stated that OPEC+ is planning to extend the ongoing production cuts, analysts said. “The report brought some relief to [oil] markets,” ANZ Bank’s senior commodity strategist Daniel Hynes said.

Four sources told Reuters that the Saudi Arabia-led coalition is discussing delaying the gradual oil output increase scheduled to commence in October, after Brent’s price plunged lower than the $75/bbl mark.

“The oil balance is in surplus through 2025 (assuming OPEC+ increases supply) and so continuing cuts into 2025 might make sense,” ING Bank’s analysts said.

Downward pressure:

Oil prices have been under pressure this week due to demand concerns from the US and China.

Manufacturing Purchasing Managers' Index (PMI) readings in China and the US came in at 49.1% and 47.2% in August, respectively. These figures fell short of market expectations, prompting concerns of a slowdown in factory activity, analysts remarked.

“Concerns over weaker demand returned to drive [oil] prices lower on the close,” Hynes said, “These concerns were triggered earlier this week by further weak economic data [from China and the US],” he added.

A PMI reading below 50 typically indicates weak economic health and a contraction in the manufacturing sector, which includes production, inventory levels, new orders, etc. It also highlights demand growth concerns, ultimately weighing down on prices of commodities like oil.

“Weak demand remains the key concern for the oil market,” ING Bank’s analysts remarked.

By Manjula Nair and Aparupa Mazumder

Please get in touch with comments or additional info to news@engine.online

Contact our Experts

With 50+ traders in 12 offices around the world, our team is available 24/7 to support you in your energy procurement needs.