Americas Market Update 4 Sep 2024

Most bunker prices in the Americas have come down with Brent, and bunker operations have resumed in GOLA.

Changes on the day, to 08.00 CDT (13.00 GMT) today:

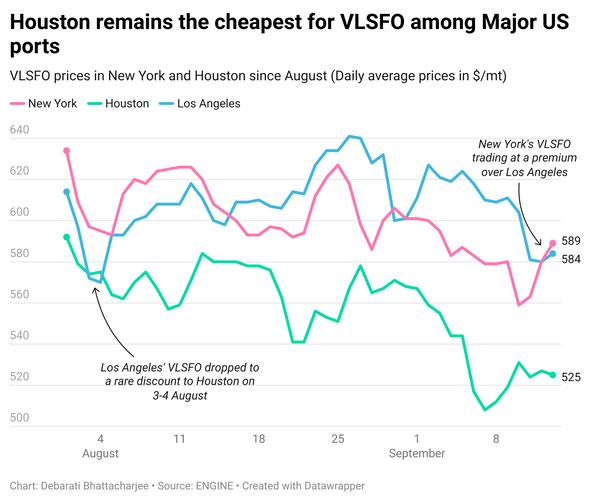

- VLSFO prices up in Los Angeles ($9/mt), unchanged in New York, and down in Balboa ($10/mt) and Houston ($9/mt)

- LSMGO prices up in Los Angeles ($10/mt), unchanged in Balboa, and down in New York ($28/mt) and Houston ($1/mt)

- HSFO prices up in Los Angeles ($6/mt) and New York ($3/mt), and down in Houston ($16/mt) and Balboa ($2/mt)

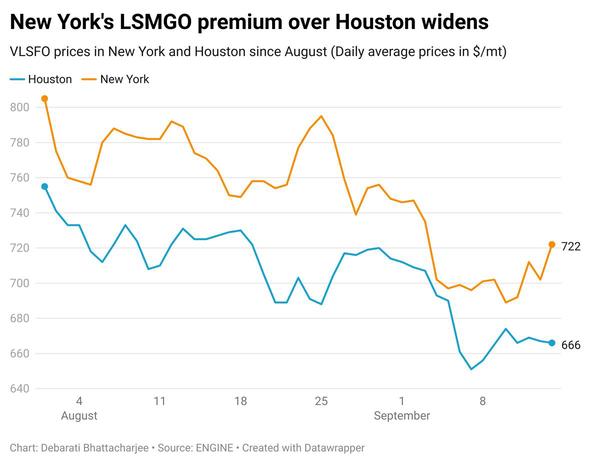

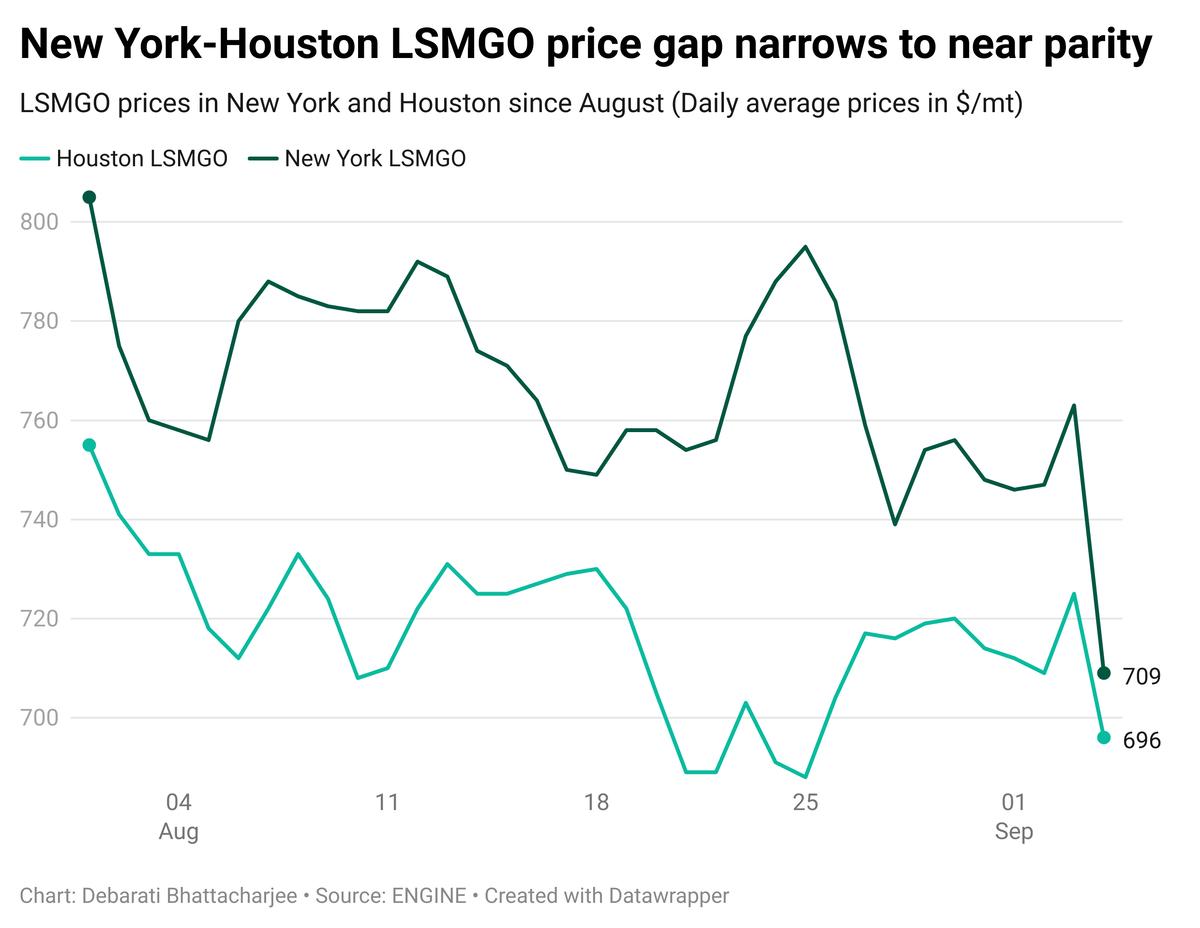

New York’s LSMGO price has dropped by $28/mt in the past day with pressure from two lower-priced firm offers. Meanwhile, Houston’s LSMGO price has fallen marginally. This has narrowed New York’s LSMGO price premium over Houston, from $40/mt yesterday, to $13/mt now.

Demand for LSMGO at the New Orleans Outer Anchorage (NOLA) has increased due to its lower price compared to Houston's. NOLA's LSMGO is priced about $17/mt lower than Houston's LSMGO.

San Francisco’s LSMGO price has dropped by $23/mt in the past day, while Los Angeles’ LSMGO price has gained by $10/mt. This has narrowed its LSMGO discount to San Francisco’s LSMGO from $132/mt, to $99/mt.

Bunkering resumed in the Galveston Offshore Lightering Area (GOLA) this morning after being suspended since Monday evening due to rough weather conditions. Suppliers are working to clear bunker backlogs caused by recent bad weather. Currently, 2–3 vessels are waiting to bunker at the anchorage.

Brent

The front-month ICE Brent contract has plummeted by $1.47/bbl on the day, to trade at $73.69/bbl at 08.00 CDT (13.00 GMT) today.

Upward pressure:

Libya's crude oil production and exports have drastically dropped this week amid the ongoing conflict in the country over the leadership of its central bank. This news has continued to put some upward pressure on Brent’s price.

Earlier this week, the country’s state-owned National Oil Corporation (NOC) declared force majeure on the El Feel oilfield, stating that the prevailing situation with oil production and export in the country is “out of its control and cannot be prevented.”

In the Middle East, hopes of a ceasefire subsided as Iran-backed Houthi armed groups continued targeting commercial vessels and oil tankers transiting the Red Sea.

In August, the Yemeni militant group hit MV DELTA SOUNION, a Greek-owned oil tanker, with a missile, causing a fire onboard. The vessel is currently stranded in the Red Sea.

Downward pressure:

Brent’s price plunged lower than the $75/bbl mark as fresh economic data from the world’s top oil consumers, China and the US, disappointed the global oil market.

Manufacturing Purchasing Managers' Index (PMI) readings in China and the US came in at 49.1% and 47.2% in August, respectively. These figures fell short of market expectations, prompting concerns of a slowdown in factory activity, analysts remarked.

“Concerns over global economic growth—amplified by disappointing Chinese manufacturing data—are fueling doubts about future oil demand,” SPI Asset Management’s managing partner Stephen Innes said.

A PMI reading below 50 typically indicates weak economic health and a contraction in the manufacturing sector, which includes production, inventory levels, new orders, etc. It also highlights demand growth concerns, ultimately weighing down on prices of commodities like oil.

“The crude oil market sentiment remains under pressure as China's economic slowdown shows little sign of improvement, following data showing a further contraction in factory activity,” Saxo Bank’s head of commodity strategy Ole Hansen said.

By Debarati Bhattacharjee and Aparupa Mazumder

Please get in touch with comments or additional info to news@engine.online

Contact our Experts

With 50+ traders in 12 offices around the world, our team is available 24/7 to support you in your energy procurement needs.